Days Payable Outstanding (DPO): Definition, Formula & Calculation

When it comes to different debts and bills you have to pay, there can be different methods for calculating how long it can take to pay them off. It can sometimes depend on the specific bill, but knowing how long it will take can allow you to make better business decisions.

One of the most effective ways a company can do this is by using the days payable outstanding formula. Keep reading to learn everything you need to know, including the definition, formula, limitations, and more.

Table of Contents

KEY TAKEAWAYS

- Days payable outstanding (DPO) represents the average number of days it takes for a company to make a payment to suppliers.

- Having a high DPO may mean that available cash gets invested in short-term opportunities. It also represents strong working capital and company cash flow.

- DPO that is too high indicates a business is struggling to meet its obligations or has a cash shortfall.

Definition of Days Payable Outstanding

Days payable outstanding (DPO) is a formula used for calculating the average number of days a company takes to pay bills. This may include items like:

- Trade creditors

- Suppliers

- Vendors

- Financiers

Companies usually calculate the DPO quarterly, semi-annually, or annually. DPO helps to understand how a company is managing its cash flow.

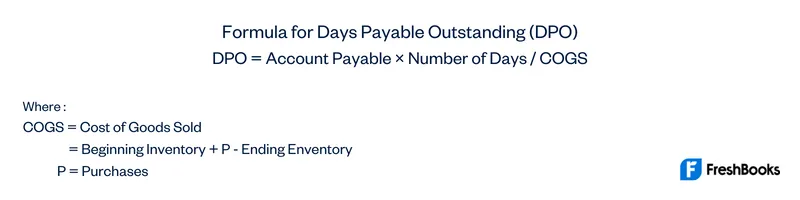

Days Payable Outstanding Formula

You can calculate days outstanding using the following data:

- Cost of goods sold (COGS)

- Purchases

- Accounts payable

- Number of days

To determine the cost of goods sold, you add the beginning inventory to the purchases, then subtract the ending inventory.

Understanding the DPO Calculation

Companies must invest in materials and equipment to create products. The term ‘accounts payable’ means the amount of money a company owes to its vendors and suppliers. These debts may be in the form of loans, credit cards, or outstanding invoices.

Most companies also take utilities, rent, storage, and employee wages into consideration. It is important to factor these expenses into the cost of goods sold. Together these expenses represent the cash flow going out to pay for products your company intends to sell.

The number of days in a formula depends on the amount of time represented by expenses. If you calculate quarterly, you might use 90 days. If you calculate annually, you use 365 days. Calculating expenses this way offers a daily cost average.

Example of Days Payable Outstanding

Let’s say a company has $10 million in accounts payable with a COGS of $53 million. Since these numbers are for a fiscal year, we use 365 days for the calculation. So, the formula is: ($10 million * 365) / $53 million = 68.87 days.

How to Interpret Days Payable Outstanding

DPO doesn’t translate from industry to industry. For example, you can’t compare the retail industry to a company that manufactures construction equipment. Each company has a different industry background, and payment terms may vary greatly. The comparison won’t offer insight into either type of industry. It is best practice to compare DPO within industry sectors.

This allows you to look at an industry average and see how a company measures up to the broader industry.

DPO Limitations

DPO is a great way to compare companies to one another. However, there is no expert opinion on what a healthy DPO figure is. There are a variety of ways to manage money. Some companies have great relations with suppliers. They can pay credit accounts after they reach a particular threshold. Instead, you should also look at additional factors. Examples include:

- Product days in inventory

- Average per day cost

- Cash cycle analysis

- Cash outflows

- Cost of sales

- Cost of debt

Others pay on an accounting period that is monthly, bi-monthly, or quarterly. Large companies often have more bargaining power and thus better DPO calculations. This is because they achieve more favorable credit terms with suppliers. DPO is best used along with other financial ratios to get a company’s bigger financial picture.

Factors that can influence DPO include:

- Economy

- Region

- Sector

- Seasonal impacts

Pros and Cons of a High DPO

If a company has a high DPO, it takes longer to pay bills. This is a good thing because funds stay available for a longer period of time. The company may be able to maximize the benefit of those funds in the interim, offering competitive positioning. However, a high DPO may also indicate a struggle to manage funds properly if bills are consistently late.

Pros and Cons of a Low DPO

If a company has a low DPO, it may not be utilizing credit periods. This means they are paying vendor invoices sooner than they have to. This may indicate a company is paying bills on time. But, it can also indicate that a business owner has shorter payments periods negotiated or worse credit terms. In many cases, a low DPO is a bigger red flag than a high DPO. If your business is consistently paying bills quickly, that means profits are coming in and leaving with a quick turnaround.

Summary

Many leaders use DPO to measure cash flow within a business. A low DPO means that you’re paying invoices too frequently, impeding cash flow. A slightly higher DPO shows that a business has strong working capital.

Frequently Asked Questions About DPO

A high DPO is usually good, while a low DPO is concerning. If DPO gets too high, it’s a sign that invoices aren’t being paid in a timely manner.

Usually, a low DPO is not good. Having a low DPO indicates that you’re paying debts and bills quickly. This may mean you have worse credit terms with vendors and billers.

An outstanding payable is an amount you owe to a lender. You have credit with a company or vendor and this is your balanced owed that is due for payment.

It is better to have higher days payable. This is because a higher DPO indicates stronger credit terms. It also means you have better cash flow in your business.

DSO stands for days sales outstanding. While DPO represents cash flow going out, DSO represents cash flow coming in for sales. A high DSO indicates that consumers take longer to pay for sales that occur on credit with the company.

Share: