Correlation: Definition, Meaning & Formula

Correlation is a term that’s not only used in business and statistics, as it comes up from time to time in our everyday lives.

In statistics, it is often used when there is a relationship between two different variables.

So what exactly is correlation in a business sense? And how can you use it in real life?

Read on as we take you through what correlation is, the formula used to calculate and measure it, and its importance in finance.

Table of Contents

KEY TAKEAWAYS

- Correlation is the statistical measure that describes a relationship between two variables.

- The correlation coefficient is a number between -1 and 1 that measures the strength of the relationship.

- A strong positive correlation will have a coefficient close to 1, while a strong negative correlation will have a coefficient close to -1.

What Is Correlation?

Correlation is the statistic that describes a relationship between two variables. The relationship can be negative or positive. Positive correlation is when a variable increases, there’s an increase in the other one, too. Negative correlation is when a variable decreases, the other increases.

The strength of a relationship between two things gets measured by the correlation coefficient. This number is between -1 and 1. A strong positive correlation will have a coefficient close to 1, while a strong negative correlation will have a coefficient close to -1. A weak correlation has a coefficient close to 0.

There are many ways to calculate the correlation coefficient. The most common way is Pearson’s r. This measures the linear relationship between two variables. To calculate Pearson’s r, you need to know the mean, standard deviation, and sample size of both data sets.

But let’s explore correlation further to understand its purpose and function. We will provide you with some examples and more.

Formula for Correlation

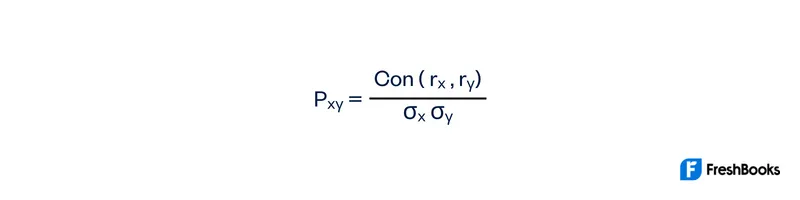

To achieve the correlation calculation, use the following formula:

where:

ρxy is the correlation between variables

Cov(rx, ry) is the covariance return X / covariance return Y

σx is the standard deviation X

σy is the standard deviation Y

Cause and effect are the basis of correlation. The cause is the independent variable, while the effect is the dependent variable. The dependent variable changes in response to the independent variable.

In other words, correlation measures how one thing affects another. However, it’s important to note that correlation does not indicate causation. Just because there’s correlation between two things does not mean that one caused the other.

There are three types of basic correlations: positive, negative, and no correlation. Positive correlation means that as one thing increases, so does the other.

Negative correlation means that as one thing increases, the other decreases. No correlation means that there isn’t a relationship between two variables.

It’s important to maintain accurate correlation in your measures.

How is Correlation Measured?

The correlation coefficient is a measure of the strength of a relationship between two variables. The values range from -1 to 1.

A strong positive correlation will have a coefficient close to 1, while a strong negative correlation will have a coefficient close to -1. A weak correlation has a coefficient close to 0.

Correlations Important in Finance

Correlation is important in finance because it can measure risk. Portfolio managers use correlation to determine how different assets will move in relation to each other.

This information helps construct diversified portfolios that have a lower risk. For example, a portfolio with stocks and bonds would have a lower risk than a portfolio with only stocks.

This is because stocks tend to be more volatile than bonds, and they usually don’t move in the same direction. When one goes up, the other often goes down.

But when one asset becomes more volatile, it doesn’t necessarily mean that the other asset will become more or less volatile. A relationship between two assets can change over time.

This is why portfolio managers must constantly monitor the correlations between different assets.

How Correlation Is Used?

Correlation gets used in statistics, finance, and other disciplines. It’s a way to measure a relationship between two variables. For example, you could measure correlation between college degrees. Or a correlation between hemoglobin levels in patients.

The formula lets you compare correlation between sets. As such, you can review simple relationships or measure the strength of a relationship.

Remember, correlation can be positive, negative, or zero. Positive correlation means when a variable increases, the other does, as well.

Negative correlation is when a variable decreases, the other variable increases. A zero correlation means that there is no relationship between the two variables.

When using correlation in statistics, it’s important to remember that correlation doesn’t imply causation. Keep in mind that two variables correlating does not mean that one variable causes the other to change.

There could be a third variable causing both of the other variables to change. Or you could have a reverse relationship with the second variable causing the first variable to change.

Remember that correlation is only a measure of linear relationships. This means that it can’t measure non-linear relationships.

For example, imagine you want to know if there’s a relationship between hours of sleep and intelligence. You might find no correlation between these two variables.

But this doesn’t mean that there’s no relationship between sleep and intelligence. It could be that the relationship is non-linear.

Remember that correlation only measures the strength of a relationship between two variables. It doesn’t tell you anything about the nature of the relationship.

For example, you might find a stronger relationship between hours of sleep and intelligence. But this doesn’t necessarily mean that sleep causes intelligence.

It could be that intelligent people tend to sleep more. Or it could be that tired people tend to perform worse on intelligence tests.

There are many possible explanations for why these two variables might correlate. So, it’s important to not make any assumptions about the nature of the relationship just based on the correlation coefficient.

When using correlation in finance, it’s important to remember that past performance is not indicative of future results. Just because two assets correlated in the past does not mean that they will correlate in the future.

A relationship between assets can change over time. This is why portfolio managers must constantly monitor the correlations between different assets.

Example of Correlation

To understand correlation, let’s look at an example. Imagine you want to know if there’s a relation between height and weight. You could collect data from a group of people and then calculate the correlation between height and weight.

You might find a positive correlation between height and weight. This means that, on average, taller people tend to weigh more than shorter people.

However, this does not mean that being tall causes you to weigh more. It could be that people who have a genetic disposition to be taller also have a genetic disposition to weigh more.

Or it could be that taller people tend to eat more because they have larger appetites. There are many possible explanations for why height and weight might correlate. correlation doesn’t imply causation.

Another example of correlation is a relationship between study habits and grades.

You might find a positive correlation between studying and grades. This means that, on average, students who study more tend to get better grades than students who don’t study as much.

However, this does not mean that studying causes you to get better grades. It could be that students who are more intelligent tend to both study more and get better grades.

Or it could be that students who are struggling in school are more likely to study more in an attempt to improve their grades.

There are many possible explanations for why studying and grades might correlate. Remember, correlation doesn’t imply causation.

Let’s look at one more example. Imagine you’re a portfolio manager and you’re trying to decide whether to invest in stock A or stock B.

You looked at the historical data and you found that these two stocks have been positively correlated. This means that when one stock goes up, the other stock also goes up.

Based on this information, you might conclude that it’s a good idea to invest in both of these stocks because they tend to move in the same direction.

However, you must remember that just because two assets correlate does not mean that one asset causes the other to change. A relationship between assets can change over time.

Suppose two stocks have been positively correlated in the past. There’s no guarantee that they will be positively correlated in the future.

It’s important to constantly monitor the correlations between different assets. In doing so, you can make informed investment decisions.

Summary

Correlation is the measure of a relationship between two variables. It’s important to remember that correlation doesn’t imply causation.

Just because two variables correlate does not mean that one variable causes the other to change. There could be a third variable causing both of the other variables to change.

It’s also important to remember that correlation is only a measure of linear relationships. This means that it can’t measure non-linear relationships.

And finally, it’s important to remember that past performance is not indicative of future results. And if two assets correlated in the past, it does not mean that they will correlate in the future.

Correlation FAQs

In real life, correlation is the measure of a relationship between two variables. For example, you might want to know if there’s a relationship between hours of sleep and intelligence.

Or you might want to know if there’s a relationship between stock A and stock B.

Correlation is the measure of the strength of a relationship between two variables. It doesn’t tell you anything about the nature of the relationship.

A positive correlation is the measure of a relationship between two variables. So when one variable goes up, the other variable also goes up. This is also known as a perfect correlation.

There are many types of correlation coefficients. But of the correlation types, the most common method is the Karl Pearson correlation coefficient.

You can calculate correlation using the Pearson correlation coefficient. This is a measure of the linear relationship between two variables.

Share: