Book-to-Market Ratio: Definition, Formula & Examples

Have you been looking for a way to find out the overall value of your business? Whether it’s you, an investor, or an analyst, understanding the value of a company can provide several different benefits. Sometimes you can use earnings multiples, a discounted cash-flow analysis, or base it on revenue.

Yet, there can often be times when going beyond a traditional financial formula is helpful. The book-to-market ratio is a great alternative that gives accurate insights. Continue reading to learn all about the book-to-market ratio, including the formula to calculate it, how to use it effectively, and more.

Table of Contents

KEY TAKEAWAYS

- Using the book-to-market ratio can provide investors with information about the value of a company. It’s done by comparing the book value of the company with its market value.

- The ratio does not take into account other factors that may affect the value of a company, such as earnings, cash flow, and growth potential.

- A company with a high book-to-market ratio can indicate that the market values the equity cheaper compared to the book value of the company.

What Is the Book-to-Market Ratio?

The book-to-market ratio is an effective way to determine the value of a company. It works by comparing a company’s book value to its market value.

With book value, this relates to the accounting value or historical cost of the company. But the market value looks into the number of shares the company has outstanding and its price in the stock market. Essentially, the market value is market capitalization.

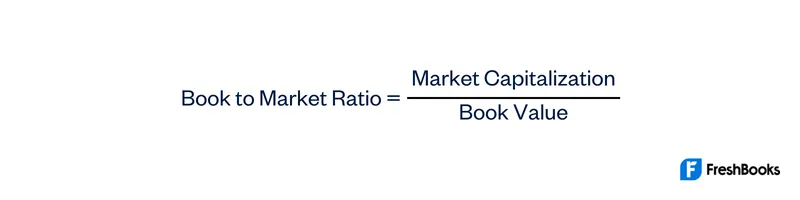

Book-to-Market Ratio – Formula

The book-to-market ratio formula involves taking the common shareholders’ equity and dividing it by the market cap. The formula would look like this:

What does the Book-to-Market Ratio Convey?

The book-to-market ratio can provide insights into a few different valuable areas. If a company’s market value is trading at a higher rate compared to its book value per share, it can indicate it to be overvalued.

If the book value ends up being higher compared to the market value, this often means the company’s undervalued. Using the book-to-market ratio will allow you to compare the net asset value, or book value, of a company against its current or market value.

Essentially, the book value of a company is the accounting value that’s calculated using information from its balance sheet. You can do this by subtracting intangible assets, total liabilities, and preferred shares from a company’s total assets. What you’re left with will represent what the company would have if it went out of business.

It can also be common for analysts to recognize the total shareholders’ equity as the book value on the balance sheet. This data is essential in determining the true value of an investment. And that’s why the ratio is so widely used throughout industries with investments.

By calculating the market capitalization of a company, you can determine the market value of a publicly-traded company. To do this, you simply need to take the total number of shares outstanding and multiply it by the current share price.

You’re going to end up with the market value, which is the price that investors would pay to either buy or sell the stock on a secondary market. If it’s a good buy, it will likely turn a profit. Or you can sell the purchase to make an investment.

Using the Book-to-Market Ratio Effectively

Using the book-to-market ratio can help identify any overvalued or undervalued securities. You do this by dividing the market value by the book value of a company. The ratio ends up determining whether or not the market value is relative to the actual worth of the company.

Investors and analysts use the ratio to see if the true value of a publicly-traded company is in line with investor speculation.

Usually, a book-to-market ratio that’s above 1 indicates undervalued stock. A high ratio can show insights into if the stock price of a company is trading for less than what its assets are worth. Value managers prefer higher ratios.

If the ratio is less than 1, the stock’s overvalued. This can imply that investors might be willing to pay more for a company compared to what its net assets are worth. A lot of times, this also forecasts that a company is bound to have healthy future profit projections. In this case, investors are usually going to be more than open to paying a premium.

Companies that don’t have lots of physical assets, such as technology companies, may have lower book-to-market ratios.

Difference between Book-to-Market ratio and Market-to-Book Ratio

The market-to-book ratio, which is also known as the price-to-book ratio, is the opposite of the book-to-market ratio.

That said, it still serves to evaluate undervalued or overvalued stock by comparing market prices. With the market-to-book ratio, a ratio above 1 indicates overvalued stock. Whereas the book-to-market ratio is the opposite.

Book-to-Market Ratio Example

Let’s say that you are considering investing in Company XYZ. You find that the book-to-market ratio is 2. This means that the company’s assets are worth twice as much as the market value of the company.

You decide to investigate further and find that the company has strong earnings, cash flow, and growth potential. You also find that the market-to-book ratio for Company XYZ is 0.5. This indicates undervalued company stock by the market.

You decide to invest in Company XYZ because you believe that the market is not valuing the company properly.

A book-to-market ratio is a useful tool for finding undervalued companies. However, it is important to remember that the ratio does not take into account all of the factors that affect a company’s value. Investors should always consider other indicators before making an investment decision. These include earnings, cash flow, and growth potential.

In doing so, they can see a clearer picture of an investment opportunity. And as such, it will be easier to decide whether an investment is good or bad.

Summary

The book-to-market ratio helps to find out the actual value of a company. You do this by comparing the company’s book value to its market value to come up with a ratio. A book-to-market ratio below 1 indicates undervalued stock. A ratio over 1 indicates overvalued stock in the current market.

Using the book-to-market ratio is great for market analysis and it can even show insights into the implications of market leverage. Plus, investors can avoid overvalued shares or undervalued shares and get more of an explanation of the share price.

Book to Market Ratio FAQs

Having a book-to-market ratio that’s around 1 is a good place to be. Having a ratio that’s 3, for example, might suggest that it can be expensive to invest in a company. However, there would need to be more research and analysis conducted.

To calculate the book-to-market ratio all you need to do is divide the market capitalization of a company by its book value.

A high book-to-market ratio can mean that the market is valuing the equity of a company much cheaper compared to its book value.

Share: