What Is Beta in Finance: Definition, Formula & Calculation

There are usually some dangers involved while investing. The stocks that make up the stock market all move at various rates, but the market as a whole is always rising and falling.

Some may move in a manner that is essentially identical to the market as a whole, while others may have higher highs and lower lows. Predicting it sometimes proves to be challenging.

Investors have perfected a method for telling. It’s known as beta, and it can provide valuable hints about potential market actions.

Read on as we take a closer look at beta and analyze the pros and cons, and show some examples.

Table of Contents

KEY TAKEAWAYS

- Beta (β), which is mostly employed in the capital asset pricing model (CAPM), is a measurement of a security or portfolio’s volatility—or systematic risk—in comparison to the market as a whole.

- The amount of risk that a stock will add to a diversified portfolio can only be roughly predicted using beta data about a specific stock.

- The stock must be tied to the benchmark used in the calculation for the beta to have any significance.

- The beta for the S&P 500 is one.

- The S&P 500 tends to move with greater momentum than equities with betas above 1, while companies with betas below 1 tend to move with less momentum.

What Is Beta in Finance?

Beta (β) is a way to compare a securities or portfolio’s volatility—or systematic risk—against the market as a whole. Typically, this is the S&P 500. Generally speaking, stocks with betas greater than 1.0 are thought to be more volatile than the S&P 500.

The capital asset pricing model (CAPM), which analyses the connection between systematic risk and projected asset returns, employs beta (usually stocks). The CAPM approach is frequently used to value hazardous securities and to predict projected returns of assets while taking into account both the cost of capital and the risk of those assets.

We will delve deeper into these metrics in our guide to beta.

Types of Beta Value

Beta Value Equal to One

If a stock’s beta value is 1.0, then it shows that the activity of the price correlates heavily with the market. While there’s systematic risk in beta 1.0, beta calculation won’t detect unsystematic risk. If you were to add stock with beta 1.0, you wouldn’t add risk to your portfolio. However, it also won’t increase the chances of a larger return.

Beta Value Under One

A beta value less than one means that the stock is less volatile than the market. For example, if the market goes up by 10%, the stock might only go up by 5%. Moreover, this means security is not as volatile as the market. So by adding a stock with this beta value, you are making your portfolio less risky.

Beta Value Over One

This beta value shows security price volatility higher than market. So a beta value of 1.4 would indicate that the volatility of the stock is 40% higher than market. Adding this stock to your portfolio will cause risk to increase. But expected return will increase, as well.

Negative Beta Value

A negative beta value means that the stock tends to move in the opposite direction of the market. For example, if the market is going up, the stock might go down.

So, is a negative beta good or bad?

It depends on your investment goals. If you’re looking for stability, a negative beta might not be what you’re looking for. On the other hand, if you’re looking for a stock that will go up when the market goes down, a negative beta might be right for you.

Steps to Calculate Beta

Beta coefficient measures individual stock volatility. This compares the overall market’s systematic risk. When put into statistical terms, you can see that beta represents a line slope.

This is through the reduction of data points. When it comes to finance, each data point represents individual stock returns. This is against the returns of the overall market.

Beta works to describe activity in a security’s return. And it does so in response to the various market swings.

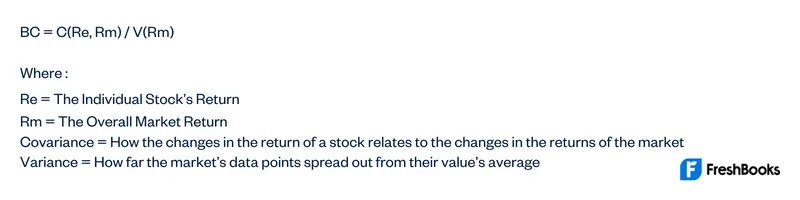

Here’s how you would calculate a security’s beta. You divide the covariance product by variance over a specific period of time.

Here is the calculation for beta:

So, a stock with a beta of 2 will tend to move twice as much as the market, while a stock with a beta of 0.5 will tend to move half as much as the market.

Factors such as the size of the company, the industry it operates in, and the overall market condition affect a stock’s beta.

Beta is just one tool that investors use to evaluate stock. Investment decisions should also consider other factors. For example, an investor might also look at earnings, dividends, and valuation.

Beta is useful for measuring investment risk. But it has its limitations. For example, it doesn’t take into account the size of the movements, just how often they occur. So a stock with beta of 2 could double in value over the course of a year, or it could lose half its value.

In the context of historic beta, the measure only tells us past performance of a stock. It’s possible for stock to have high beta one year and a low beta the next. So, while beta can be helpful in assessing risk, it’s not the only factor you should consider.

Risk Assessment in Beta

Beta is often used as a measure of risk. A high-beta stock is riskier than a low-beta stock.

However, it’s important to remember that beta is only one factor to consider when assessing risk. Other factors, such as the size of the company, the industry it operates in, and overall market conditions, can also affect risk.

When assessing risk, it’s important to consider all of the factors involved and not just beta.

Pros and Cons of Beta

Beta can be a helpful tool for investors, but it’s important to remember that it has its limitations.

Some advantages of beta include:

- It’s a simple measure that can be easily calculated.

- It can compare the risk of different stocks.

- It takes into account the overall market conditions.

Some disadvantages of beta include:

- It’s a historical measure, which means it only tells us how a stock has behaved in the past.

- It doesn’t take into account the size of the movements, just how often they occur.

- It’s just one factor to consider when assessing risk. Other factors, such as the size of the company, the industry it operates in, and overall market conditions can also affect risk.

Examples of Beta

Here are a few examples of beta values:

Alphabet (GOOGL), the parent company of Google, has a 1.13 beta value.

Apple (AAPL) has a 1.19 beta value.

Amazon (AMZN) has a 1.23 beta value.

Facebook (FB) has a 1.39 beta value.

Walt Disney (DIS) has a 1.16 beta value.

As you can see, these stocks have beta values that range from 1.17 to 2.00. Alphabet, Apple, and Facebook are all large companies with stable earnings and a history of consistent growth. These factors tend to lead to lower beta values.

Amazon, on the other hand, has more volatile earnings. This tends to lead to a higher beta value.

Walt Disney is a large company with stable earnings, but it also has a lot of debt. This can lead to a higher beta value as well.

Summary

Beta measures volatility and is used to assess risk. It’s important to remember that beta is only one factor to consider when assessing risk. You need to employ other methods to gain the best picture of a stock.

When assessing risk, it’s important to consider all of the factors involved and not just beta. Beta can be a helpful tool for investors, but it’s important to remember that it has its limitations.

FAQs About Beta

It can be, but it’s important to remember that beta is only one factor to consider when assessing risk. Other factors, such as the size of the company, the industry it operates in, and overall market conditions can also affect risk.

The beta of equity is the measure of a stock’s volatility as it relates to the overall market.

No, beta measures volatility, but it’s not the same thing. Volatility is a measure of how much a stock’s price moves up and down. Beta also measures how much a stock’s price moves as it relates to the overall market.

There is no definitive answer to this question. A “good” beta value depends on your investment goals and tolerance for risk.

Share: