Common Size Financial Statement: Definition, Overview & Formula

A financial statement or balance sheet that expresses itself as a percentage of the basic number of sales or assets is considered to be of a common size. Common-size analysis, also known as vertical analysis, is the process of constructing a financial statement of a common size.

Owner equity, assets, and liabilities are shown in the financial statement as a percentage of total assets. This type of financial statement makes it simpler for analysts to evaluate the profitability of a company over time.

With this in mind, read on as we take a look at exactly what a common size financial statement is. As well as lay out the formula for you, describe the different types, and show you the limitations of common size analysis.

Table of Contents

KEY TAKEAWAYS

- A common size financial statement lists any entries as a percentage of a base figure. This differs compared to traditional financial statements that would use absolute numerical figures.

- Common size financial statements include cash flow statements, balance sheets, and income statements.

- Common size financial statements provide analysts the opportunity to compare companies based on different variables. These can include companies that are in different industries or that are of different sizes.

What Is a Common Size Financial Statement?

A common size financial statement is a specific type of statement that outlines and presents items as a percentage of a common base figure. The process of creating a common size financial statement is often referred to as a vertical analysis or a common-size analysis.

It outlines and reports everything from liabilities, assets, and owner equity as a percentage of the sales or assets. Creating this type of financial statement makes for easier analysis between companies. Or between different periods for the same company.

Essentially, it helps evaluate financial statements by expressing the line items as a percentage of the amount. It helps break down the impact that each item on the financial statement has, as well as its overall contribution.

It’s worth noting that if two companies are using different accounting methods the comparisons might not be accurate.

Common Size Analysis Formula

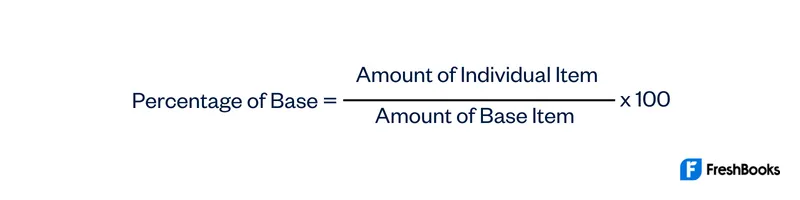

Conducting a common size analysis is relatively straightforward to do. All you need to have is the percentage of the base amount, the total amount of an individual item, and the amount of the base item.

From here, you can plug the various figures into the formula. The accounting equation for common size analysis would look like this:

Types of Common Size Analysis

Before breaking down the different types of common size analysis, it’s worth understanding that it can be conducted in two ways. By either using horizontal analysis or vertical analysis.

Horizontal analysis relates to specific line items and then compares them to a similar item that was included in the previous financial period. Vertical analysis relates to analyzing specific line items against the base item, and this is from the same financial period.

For example, you could determine the proportion of inventory using the balance sheet by using total assets as your base item. You would divide the inventory line by the base item.

Even though common size analysis doesn’t provide as much detail, it can still be effective in analyzing financial statements.

Let’s take a closer look at the types of common size analysis.

Income Statement Common Size Analysis

Also known as the profit and loss statement, the income statement is an overview. It includes business net income, sales, and expenses over a reporting period. To find net income using the income statement equation, you simply minus sales from expenses.

Balance Sheet Common Size Analysis

The balance sheet of a company gives an overview of shareholders’ equity, assets, and liabilities for a reporting period. A common size balance sheet analysis gets created with the same rationality as the common size income statement. You can use the balance sheet equation, which is assets equals liabilities, plus any stockholders equity.

The balance sheet is a representation of the assets of a company. There’s also a separate version of the common size balance sheet where any current asset line items are listed as a percentage of the total assets. It would work the same with liabilities listed as a percentage of total liabilities. It also includes stockholders equity being listed as a percentage of total stockholders equity.

Cash Flow Common Size Analysis

A company’s cash flow statement breaks down all of the uses and sources of its cash. It will typically get divided based on where the cash flow comes from. For example, it could be cash flows from financing, cash flows from operations, and cash flows from investing.

Within each section, there will be additional information that outlines the business activity for each source and use. One of the most common versions of the common size cash flow statement will express any and all line items as a percentage of total cash flow.

However, a more popular version breaks down cash flow in a different way and expresses line items in terms of cash flows from operations. It will also include total financing cash flows and total investing cash flows for both of those activities.

Why Is Common Size Analysis Important?

There can be many important aspects of common size analysis. One of the biggest benefits is that it provides investors with information to see changes in the financial statement of a company.

Typically, this applies over a two or three-year period for financials. Any significant movements can not only provide investors insights into whether or not an investment would be a good idea, but also provide the company’s management team a better view of its financial performance trend. As well, using common size analysis can play a big role in comparing companies that are in the same industry but of varying sizes, as well as comparing companies that are in completely different industries.

Exploring the financial data can break down and reveal strategies. It can also highlight the expense items that provide a company a competitive advantage over another. For example, a company might choose to gain more market share by sacrificing operating margins.

This would come at the expense of good profit margins but would increase revenues. Companies use this strategy to see faster growth. It can be seen as a better investment opportunity for investors.

Limitations of Common Size Financial Statements

Common size financial statements can have a range of limitations. However, it’s important to recognize that some of these limitations come due to various interpretations of the data being observed.

Here are some of the most common limitations of common size financial statements:

- Not all companies use the same accounting practices or policies when creating their financial statements. This means that analysts or investors might need to adjust data to make sure any comparisons are accurate.

- Some businesses might be seasonal, so comparing one company’s profitable season to another company’s not-so-profitable season might not be valuable.

- Common size financial statements aren’t always going to provide accurate or concrete information that’s actionable. This is because different financial components can fluctuate depending on specific circumstances.

- When evaluating the performance of a business, common size financial statements might not be useful if there are inconsistencies when preparing them.

Example of Common Size Financial Statement

One of the best examples of a common size financial statement is to take a look at the sales revenue on an income statement. Here, the common size percentages get calculated for each line item, and they’re listed as a percentage of the standard revenue or figure.

It’s worth noting that calculating a company’s margins and the common size calculation are the same. To find the net profit margin, you simply divide net income by sales revenue. This works the same way for gross margin and operating margin.

Let’s say that you’re looking into the line items on an income statement for a company. The items include selling and general administrative expenses, taxes, revenue, cost of goods sold, and net income.

To calculate net income, you subtract the cost of goods sold, selling and general administrative expenses, and taxes from total revenue. After some calculations, you determine the revenue for the company to be $100,000.

On this income statement, the common size divides each line item by the total revenue. For example, if the cost of goods sold was $50,000 then you would divide it by $100,000 to equal 50%. This would mean the gross margin would be 50%.

You would do this for each of the other line items to determine the common size income statement figures.

How Common Size Financial Statement Differs from Regular Financial Statements

With regular financial statements, you would have line items listed as their total amounts. When it comes to common size financial statements, each line item gets expressed as a specific percentage of revenue or sales.

Using common size percentages allows you to gain a different perspective of each line item. Or, they can also help show how each item affects the overall financial position of a company.

Summary

A common size statement analysis lists items as a percentage of a common base figure. Creating financial statements in this way can make it much easier when it comes to comparing companies, or even comparing periods for the same company.

The most frequent common size financial statements include the likes of the cash flow statement, the income statement, and the balance sheet. Essentially, it allows data entries to be listed as a percentage of a common base figure. This is instead of a traditional financial statement that would list items as absolute numerical figures.

FAQs About Common Size Financial Statement

A common size financial statement is used to analyze any changes in individual items when it comes to profit and loss. They’re also used to analyze trends in items of expenses and revenues and determine a company’s efficiency.

Common size financial statements compare the performance of a company over periods of time. The information can be compared to competitors to see how well it is performing.

The main difference is that a common size balance sheet lists line items as a percentage of total assets, liability, and equity, which is different from the normal numerical value.

Common size financial statements are vertical analysis.

Share: