Amortization: Definition, Formula & Calculation

There can be several moving parts to being a small business owner. Generating revenue is important, but does this happen right away? What if you take out a loan or incur certain debts along the way?

Accounting is one of the most important elements of any size of business. There can be a lot to know and understand but certain techniques can help along the way. Amortization is one of these techniques that can come in handy.

So how does amortization work and what exactly do you need to know? Don’t worry, we put together this guide to explain everything about amortization. Keep reading to find out how it works, the formula, and a few calculations.

Table of Contents

KEY TAKEAWAYS

- Amortization is a process to spread out certain loans into fixed payments. You pay these amounts off monthly until the end of the payment schedule.

- Using an amortization table can be a helpful way to understand how all your payments get applied. It helps to pay off debt over time.

- Some of the most common types of amortizing loans can include home loans, auto loans, and personal loans.

- A portion of each payment goes towards the principal balance and a portion goes towards interest costs.

What Is Amortization?

Amortization is a certain technique used in accounting to reduce the book value of money owed, like a loan for example. It can also get used to lower the book value of intangible assets over a period of time.

When it comes to handling loans, you would use amortization to help spread out the debt principal over a period of time. It’s the process of paying off those debts through pre-determined and scheduled installments.

For assets, it works in a similar way to depreciation. Essentially, it’s a way to help determine the reduced value of an asset. This can be to any number of things, such as overall use, wear and tear, or if it has become obsolete.

How Does Amortization Work?

An amortization table might be one of the easiest ways to understand how everything works. For example, if you take out a mortgage then there would typically be a table included in the loan documents.

Essentially, the table breaks down the schedule for any monthly loan payments. It will also outline how much of each payment goes to the principal and to interest. There can be different types of amortization tables, but most will include similar information:

- Your scheduled payments — These are the monthly payments you are required to make. They will usually be organized by month and listed individually for the entire length of the loan.

- Your principal loan repayments — First, the relevant interest charges get applied. Then, anything that’s left will go towards paying off the total debt.

- Your interest expenses — When you make a scheduled payment, a certain amount goes toward your interest month by month. This ends up getting calculated by multiplying your monthly interest rate by the remaining loan balance.

What Is the Formula to Calculate Amortization?

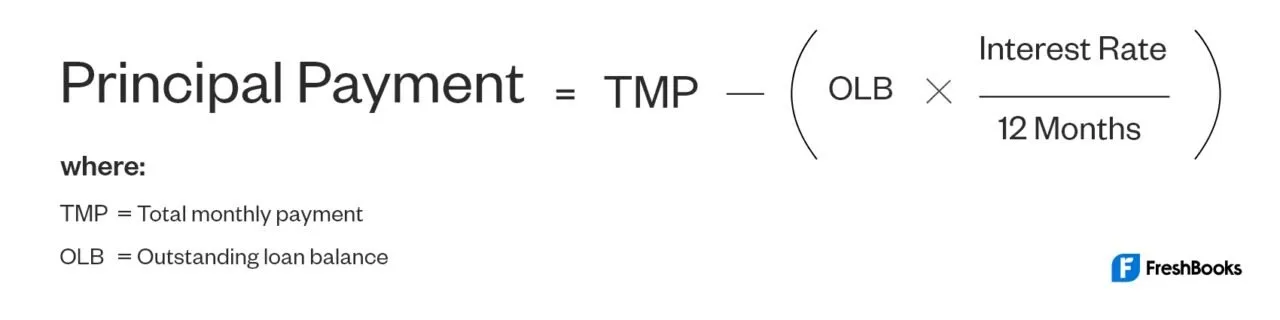

If you’re looking to calculate the monthly principal you can use a formula to determine how much is due. Here is the formula to calculate the amortization any money owed:

One of the most common ways to pay off something such as a loan is through monthly payments. These details are usually outlined as soon as you take out the principal. When this happens it can be fairly easy to calculate exactly what you need.

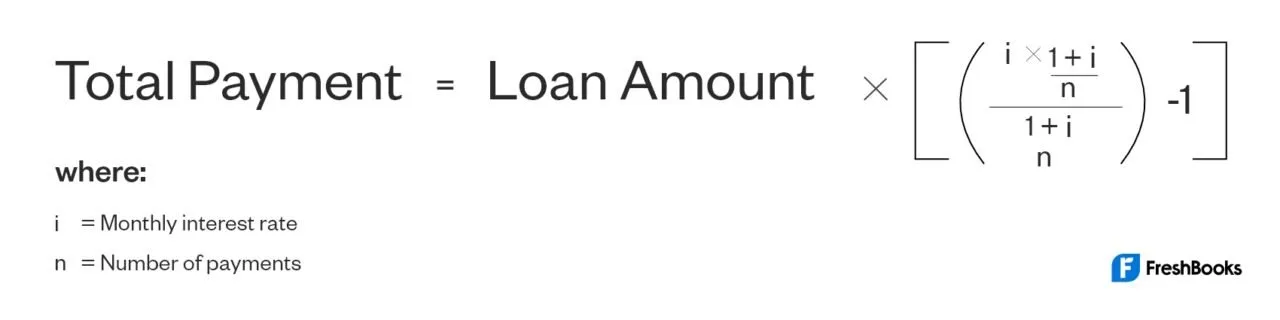

But sometimes you might need to compare or estimate a monthly payment. You can do this by understanding certain factors, like the interest rate and total loan amount. As well, there can often be a need to calculate your monthly repayment.

If you wanted to calculate how much your total monthly payment might be, you can use this formula:

Amortization Example

It’s important to recognize that when calculating amortization, you’re going to need to divide your annual interest rate by 12.

If your annual interest rate ends up being around 3 percent, you can divide this by 12. In this case, your monthly interest rate would be 0.25 percent.

You are also going to need to multiply the total number of years in your loan term by 12. So, if you had a five-year car loan then you can multiply this by 12. You would end up with a total of 60 loan payments.

For example, let’s say you take out a four-year, $30,000 loan that has 3% interest. Using the formula outlined above, you can plug in the total loan amount, monthly interest rate, and the number of payments.

Since it’s a four-year loan, there would be a total of 48 payments. As well, with a 3% interest rate, you would have a monthly interest rate of 0.25%.

After the calculations, you would end up with a monthly payment of around $664. A portion of that monthly payment is going to go directly to interest and the remaining will go directly towards the principal. This then stays the same for each month. However, the amount that goes towards principal will increase as the amount of interest decreases.

Why Is Amortization Important to Know and Understand?

Like any type of accounting technique, amortization can provide valuable insights. It can help you as a business owner have a better understanding of certain costs over time. As well, investors can use it to forecast costs over time.

But perhaps one of the primary benefits comes through clarifying your loan repayments or other amounts owed. Amortization helps to outline how much of a loan payment will consist of principal or interest. This information will come in handy when it comes to deducting interest payments for certain tax purposes.

There can be a few different types of loan amortization, as well. These can include:

- Auto loans

- Home loans

- Personal loans

Summary

Every accounting process is important for business operations. And amortization of loans can come in especially handy for any repayments. It’s a technique used to help reduce the book value of any loans you have.

You can also use amortization to help reduce the book value of some of your intangible assets. This works by spreading out payments over a period of time.

Use our guide to help understand how amortization works. You can also use the formulas we included to help with accurate calculations. You’ll have a better sense of how a regular payment gets applied to help pay off your entire loan or other debt.

FAQs on Amortization

Yes, you can. Use your amortization schedule to help send regular monthly payments. You can also include the principal portion for your next payment to help cut your repayment length down. Paying additional payments or extra payments can help speed things up.

It can depend on the type of business. Some common assets that can get amortized include organizational costs and franchise agreements. It can also include trademarks, patents and copyrights.

Having longer-term amortization means you will typically have smaller monthly payments. However, you might also incur brighter total interest costs over the total lifespan of the loan.

Amortization can be an excellent tool to understand how borrowing works. It can also help you budget for larger debts, such as car loans or mortgages. This way, you know your outstanding balance for the types of loans you have.

Share: