The Best Invoicing for Accountants

Make billing for your accounting and bookkeeping work painless with FreshBooks invoicing software. Create professional invoices quickly, send them online and get paid 2x faster.

Join 24 million people who have used FreshBooks

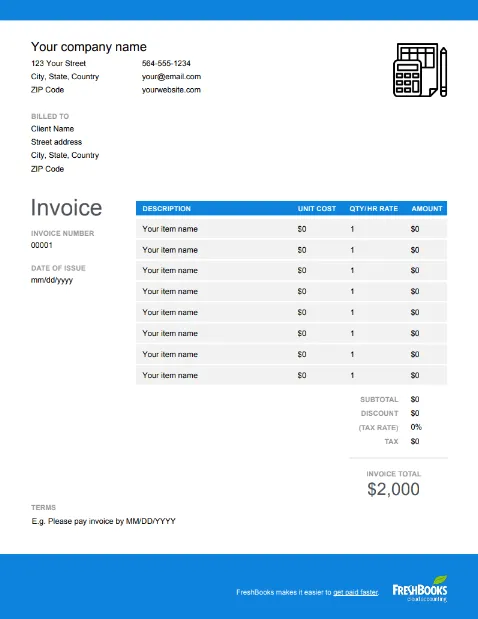

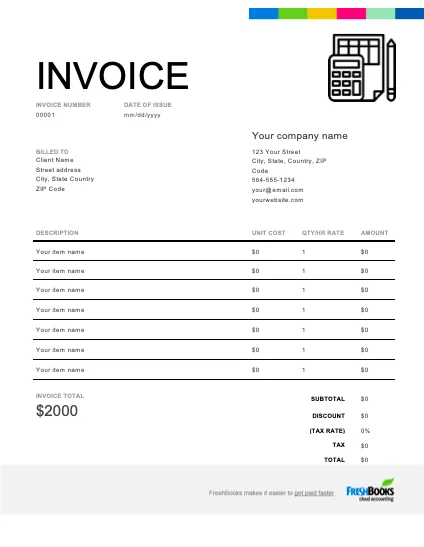

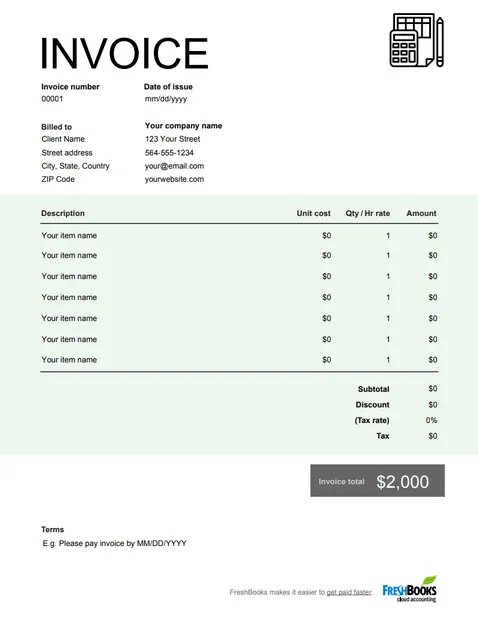

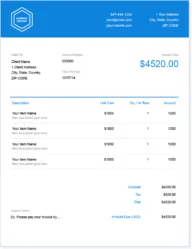

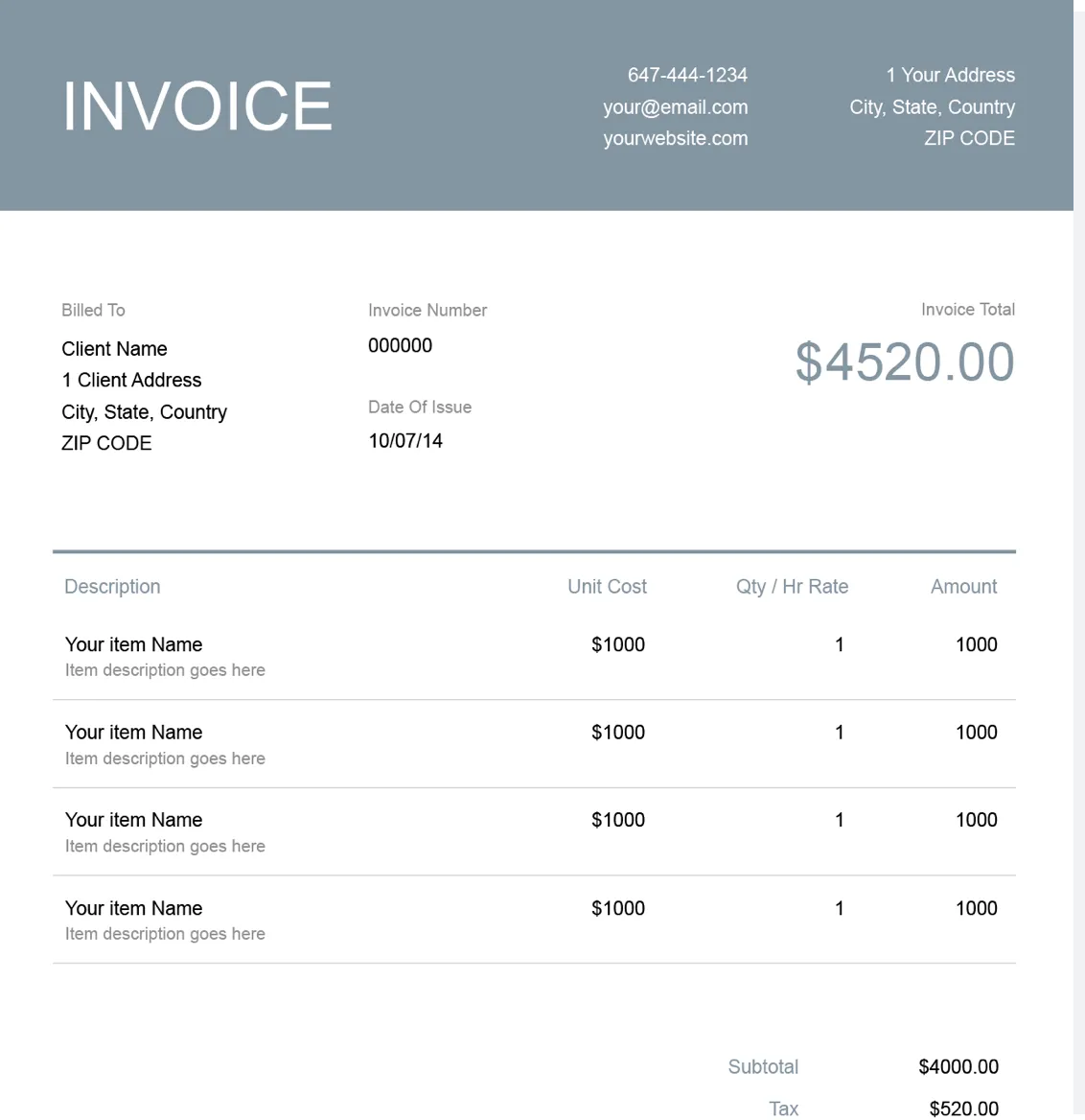

Free Accounting Invoice Template

Don’t search the internet endlessly for a professional invoice template. This free downloadable invoice template delivers exactly what accountants and bookkeepers need to bill for their work.

Get Your Free Accounting Invoice Template

Accountants and bookkeepers need a simple way to bill for their services. This helps them be more efficient and improve cash flow.

Free accounting invoice templates from FreshBooks will help you charge clients for your work, whether you bill by the hour or charge a flat fee for your projects.

Download FreshBooks’ accounting invoice templates in popular formats like .DOC, .XLS, .PDF, Google Docs and Google Sheets. Then, customize them to suit your needs. You can find the free invoice templates gallery here.

Download Accounting Invoice Templates

What Is an Accounting Invoice Used For?

An accounting invoice is used to bill clients for services accountants and bookkeepers provide. It also allows accounting professionals to bill according to standard pricing structures used in the industry.

Accounting invoices can be used by:

- Bookkeepers

- Accountants

- Accounting clerks

Accounting professionals charge their clients by using one of three common pricing structures:

- Fixed fee

- Proposal based

- Hourly rate

Fixed fee pricing is used for tasks like monthly accounting or bookkeeping work, payroll or tax preparation. Proposal-based pricing means an accountant estimates how long a project will take and how much it will cost based on their hourly rate.

Hourly pricing is most common, with rates depending on location, the accountant’s experience level and what services are to be performed.

Accounting invoices help professionals bill for all these pricing structures by letting them itemize their tasks and inserting fixed fees for each.

Or they can plug in their hourly rate and the number of hours of work and calculate the fee for each task. Then sales tax and the total can be calculated.

How to Create an Accounting Invoice

To create your own accounting invoice, use our free downloadable template and then customize it according to the specific project and client. Create an accounting invoice by following these steps:

- Download your free accounting invoice template

- Add your contact information: company name, your name, address, email address etc.

- Insert your company logo at the top

- Fill in your client’s contact information: company name, contact name etc.

- Add an invoice number, invoice date and payment due date

- List the services provided and add a brief description of each

- Add prices for each service, whether it’s a fixed fee or hourly pricing. For hourly pricing, add your rate and the number of hours and calculate the subtotal.

- Add sales tax, if applicable, and calculate the total

- Insert payment terms at the bottom, such as late fees and how you want to be paid

- Send the completed invoice to your client via email. Or print it off and send via regular mail.

A well-designed, detailed and clear invoice tells your client that you’re a professional and helps you get paid on time. It sets you apart from other accounting professionals.

An invoice is also a chance to reinforce your branding. This can be easily done by adding a logo and your company’s colors as well as a personalized message thanking your client for their business.

Invoice Types for Accountants

Your contract with your client will determine what type of invoice you use. Perhaps you’re doing one-off accounting or bookkeeping work or the client isn’t a regular one. Or maybe this is an ongoing contract.

Whatever the case, the type or frequency of the service will tell you what kind of invoice to choose. Selecting the right invoice template will make your invoicing process more efficient and eliminate confusion with the client, helping you get paid faster. Here are the most common invoice types in accounting:

- Standard Invoice: The most common option. This invoice format can be used for all types of projects and pricing structures.

- Automatic Invoice: The best option if you bill your clients the same amount every billing cycle for standard accounting or bookkeeping work. The same invoice can be used and sent.

- Pro Forma Invoice: This type of invoice is closer to an estimate. You estimate the work required and cost involved before the project’s started. Think of it as an appraisal, not a bill.

- Credit Invoice: Used to issue a refund or a discount. You can use a credit invoice to resolve a billing dispute or correct an error.

- Debit Invoice: Used to charge for extra work. You may have already submitted a standard invoice but you had to put in additional hours. Issue a debit invoice to account for this work and revise the total balance owing.

- Mixed Invoice: Can be used to both bill for work and issue a refund or discount at the same time.

- Prepaying Invoice: This invoice is used to charge your client for a deposit or retainer on future work.

Download an Accounting Invoice Template for Free

Simply download the free accounting invoice template and easily create professional invoices for your accounting or bookkeeping business, whether you’re based in the US, Canada, the UK or beyond.

A professional, formal invoicing system is key to tracking who owes you what. It also makes it easier for your clients to send payments.

This improves a business’s all-important cash flow. Having the right invoice template makes it much easier to develop your own professional invoicing system.