Self-Employed Invoice Templates

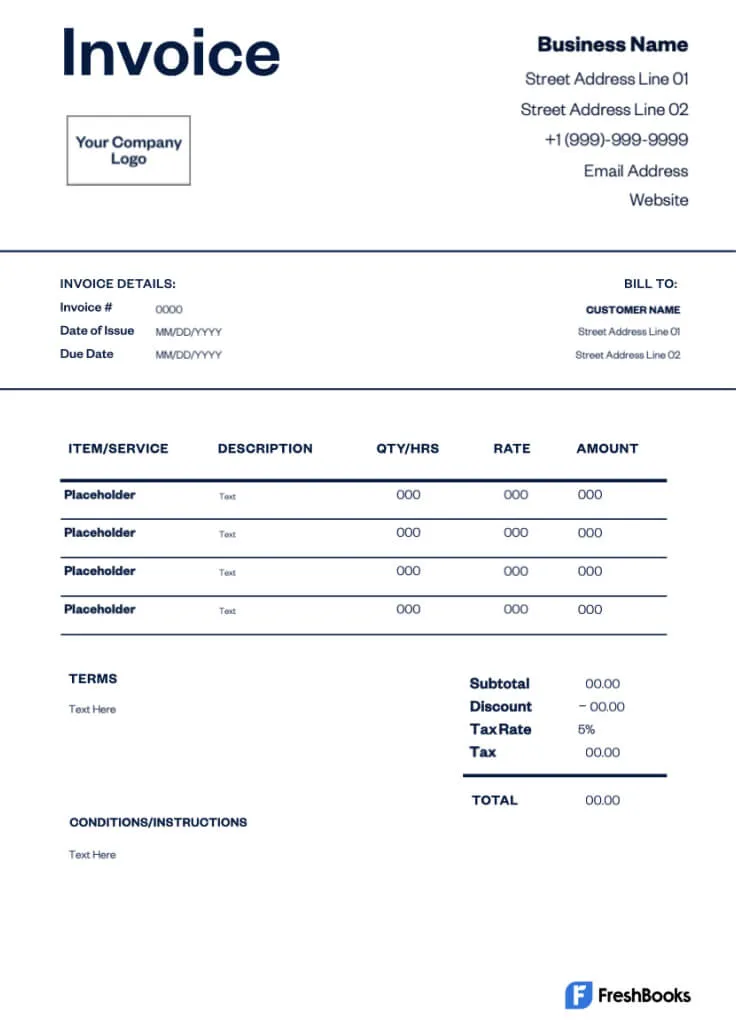

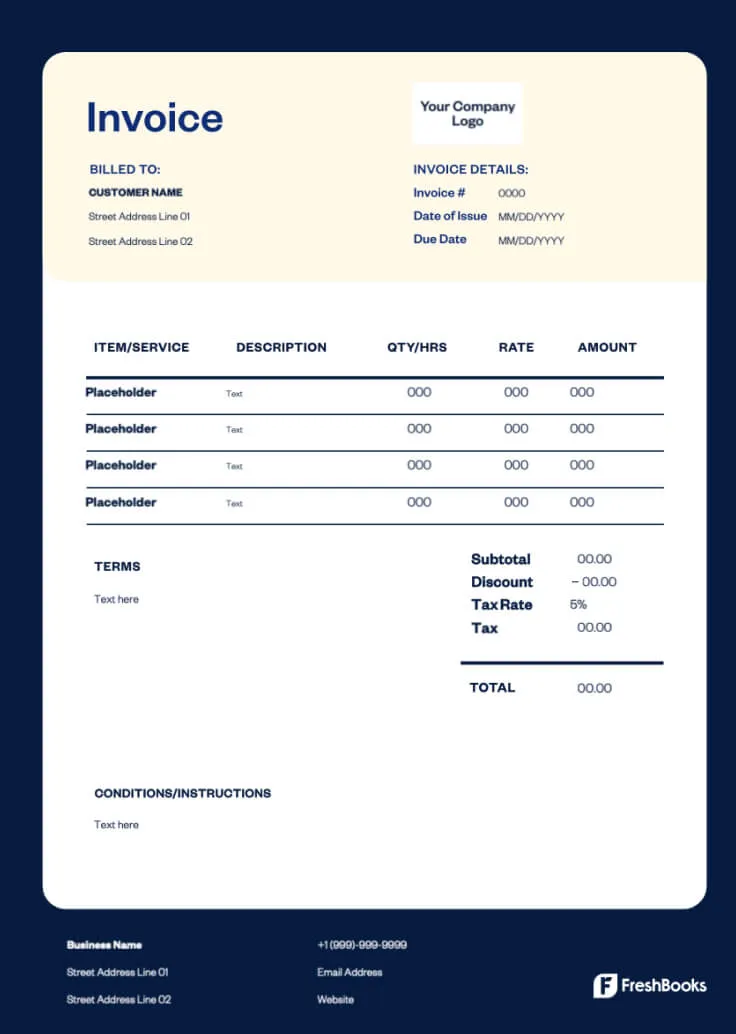

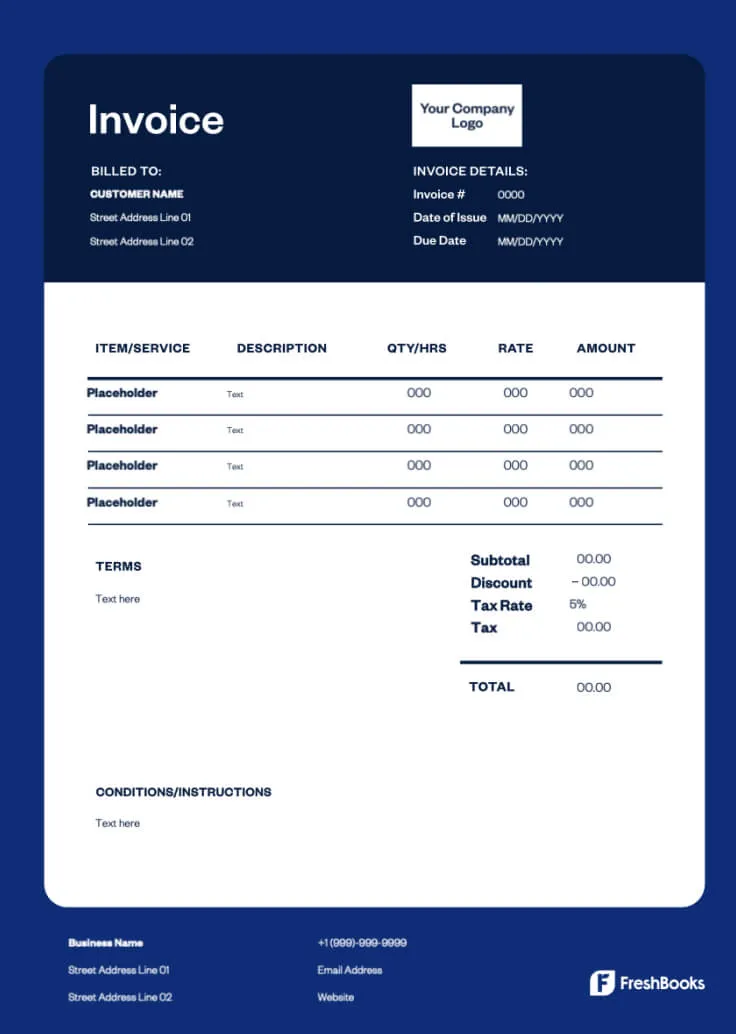

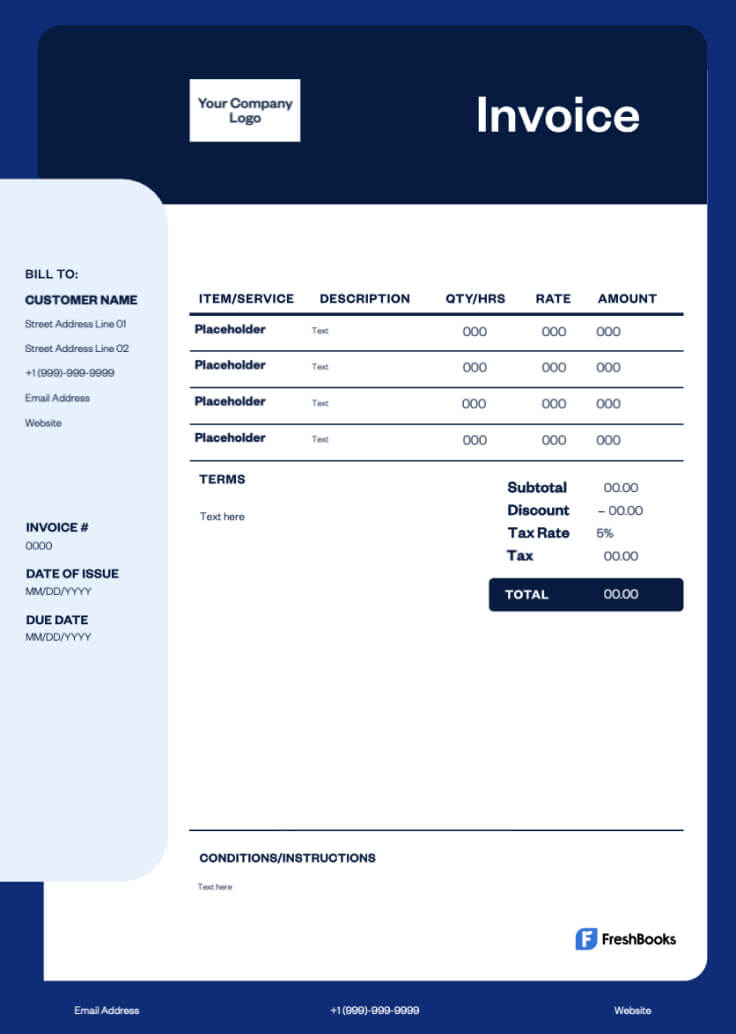

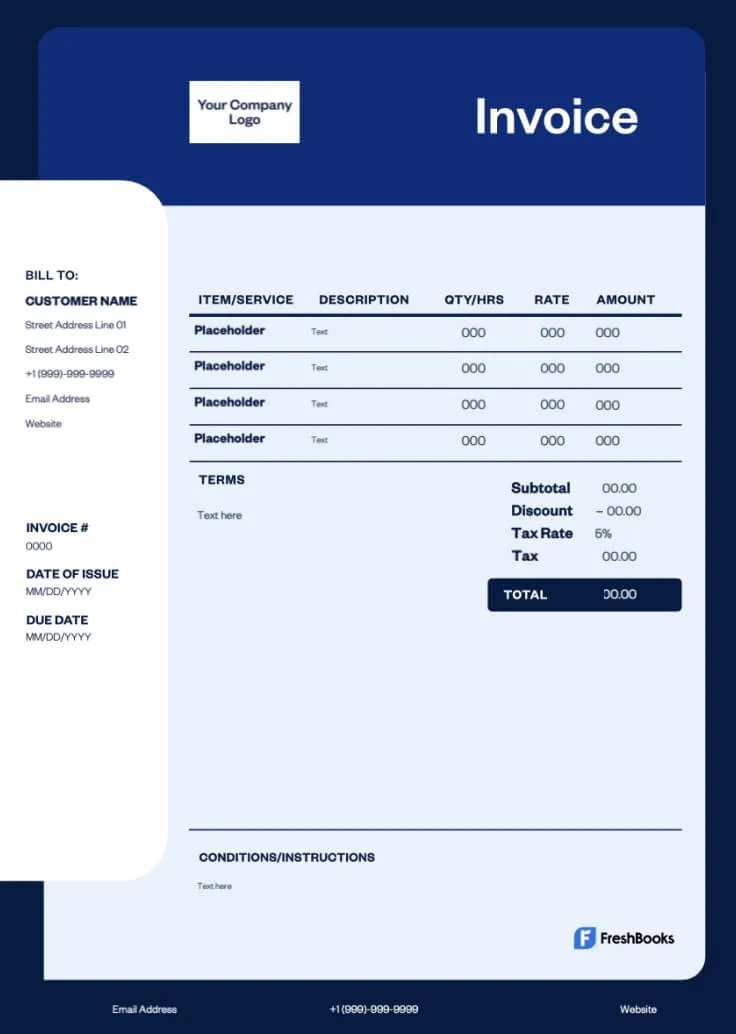

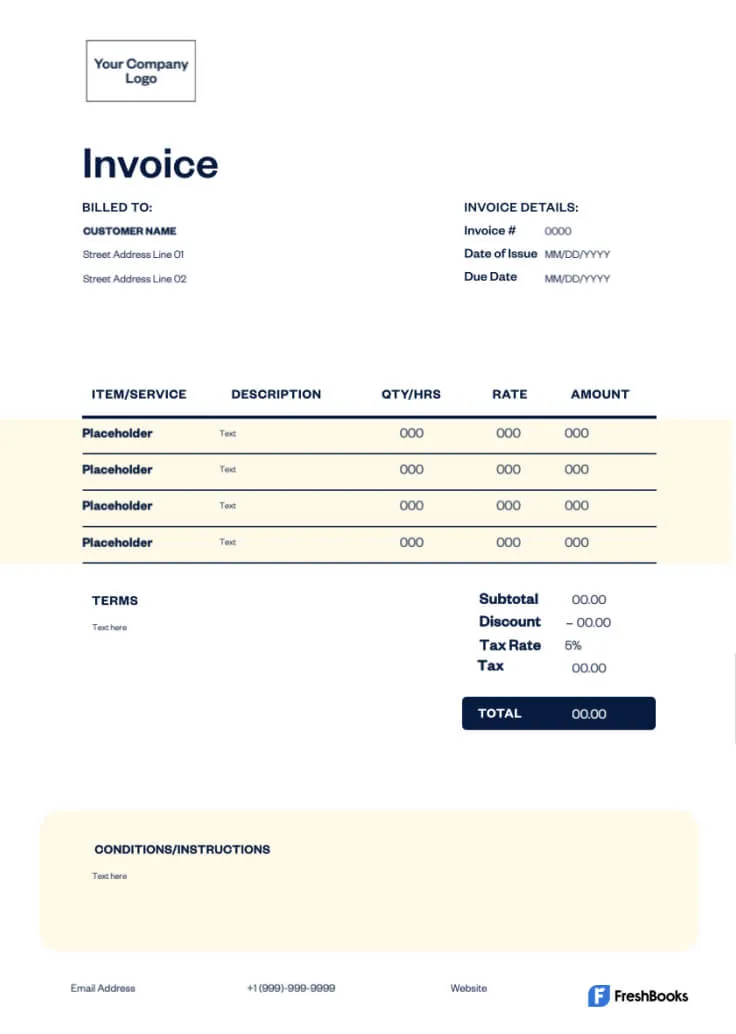

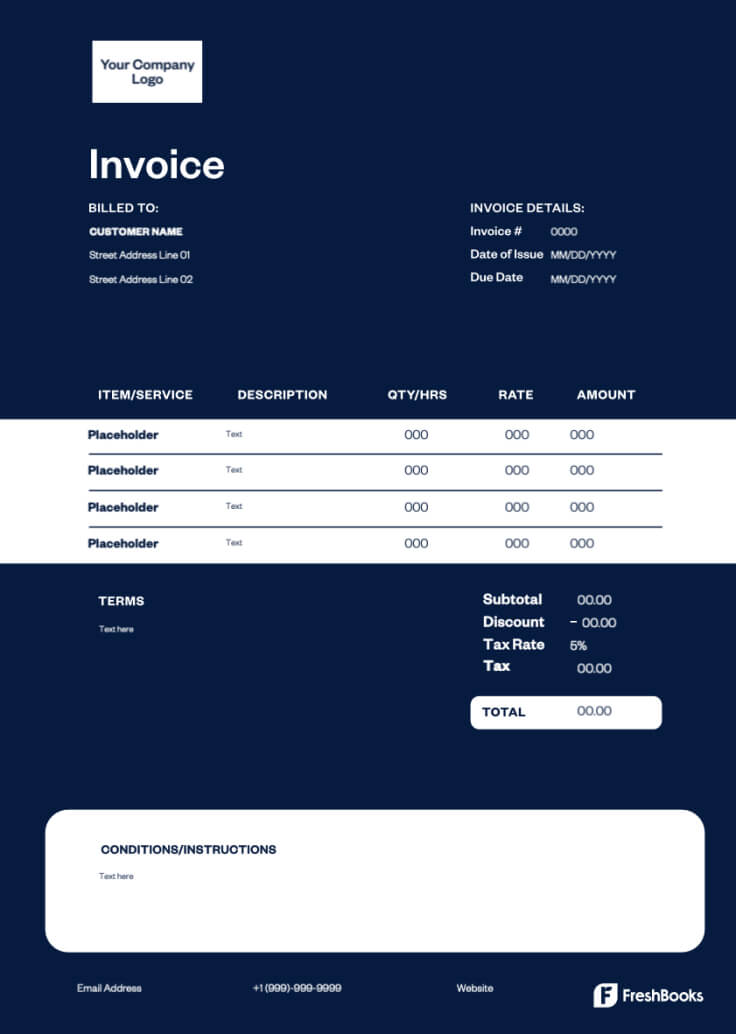

You’re the boss of your business — keep things moving smoothly with the self-employed invoice template by FreshBooks, which helps you customise and create professional invoices in minutes.

Download Self-Employed Invoice Template

Being self-employed means you’ve got a lot on your plate. Save time on accounting and administrative tasks with a free self-employed invoice template that helps streamline your invoicing process and increases efficiency.

Choose a template

Free Invoice Generator

Create your own personalised self-employed invoice online with the free invoice generator by Freshbooks. With an easy-to-use platform and intuitive design, you can generate customised invoices that are ready to send to your clients in a matter of minutes.

More Invoice Templates by Industry

No matter your trade, hard-working entrepreneurs rely on efficient invoicing to keep money flowing. Discover a variety of industry-specific templates below that make it easy to create invoices and bill clients.

Still on the hunt for the perfect invoice? Check out the invoice template gallery by FreshBooks for a curated collection of thoughtfully designed templates customised to your business needs.

Construction Invoice Template

As a construction worker, you need to bill clients for building and repairing structures, speciality tools, or tool rentals. Get paid quickly with a construction invoice template that includes areas for labour, materials, costs, and payment terms.

Plumbing Invoice Template

Plumbers have the important job of installing, repairing, and maintaining plumbing systems in buildings. Simplify your billing process with a plumbing invoice template that includes services, details of the work performed, materials used, costs, and other business details.

HVAC Invoice Template

Heating, ventilation, and air conditioning professionals need to invoice clients for the services provided. Use an HVAC invoice template and outline costs for installation, repairs, maintenance, or equipment sales.

Roofing Invoice Template

With sections for labour costs and materials like shingles and tiles, roofing invoice templates make it easy to generate a professional roofing invoice in minutes.

Painting Invoice Template

Cut down on the time you spend billing for paint, brushes, and other equipment with professional-looking painting invoice templates that include breakdowns of labour and painting equipment costs.

Landscaping Invoice Template

Find customizable landscaping invoices for lawn prep, leaf removal, and hedge trimming with landscaping invoice templates that you can tailor to any job.

Lawn Care Invoice Template

If you work in lawn care, you know there’s more that goes into making a beautiful landscape than meets the eye. From work like mowing and trimming to weed control and soil testing, free lawn care invoice templates make billing simple.

Handyman Invoice Template

Good handymen are hard to find, and you deserve to be compensated for each odd job and hour worked. Get paid for repairs, installations, and any other services you provide with a professional handyman invoice template.

House Cleaning Invoice Template

House cleaners provide a range of services to residential clients, like dusting, mopping, and deep-cleaning each nook and cranny. Optimise your invoicing process with a house cleaning invoice template that details the services provided, hours worked, and your rates.

Real Estate Invoice Template

You help people buy, sell, or rent properties — bill for your services with a real estate invoice template that includes customisable areas for property details, client information, bank details, taxes, and any additional information that’s relevant to the transaction.

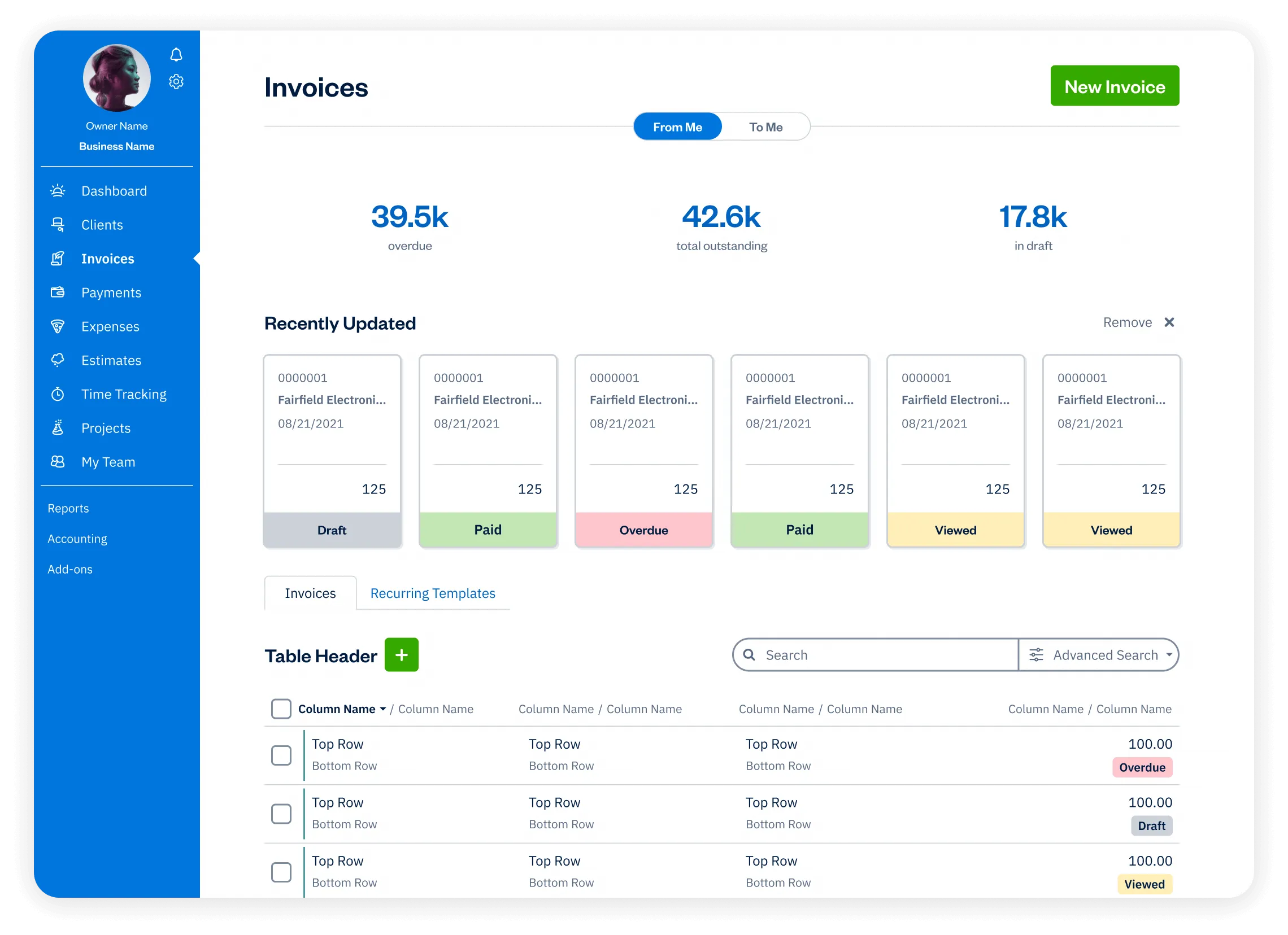

Self-Employed Invoice Template vs. FreshBooks

Free self-employed invoice templates are great for one-off billing, but you can take your company to the next level with FreshBooks invoicing software. Accept payments, schedule invoices, and more with features that put your invoicing on auto-pilot.

Self-Employed Invoice Template

VS

FreshBooks

Features

Self-Employed Invoice Template

Flexible invoice templates

Printable formats

Email invoices at no cost

Accept payments on invoices

Schedule invoices

Automate payment reminders and late fees

Manage paid and outstanding invoices

Set up deposits for projects

Add discounts and credits to invoices

Automate recurring subscription invoices

Create and send invoices via mobile devices

Access your invoices FOREVER on the cloud 🔥

Sign up for a free FreshBooks trial today

Try It Free for 30 Days. No credit card required.

Cancel anytime.

Self-Employed Invoicing 101: Helpful Resource for Your Business

Unlock your business potential with our collection of resources designed to take you to the next level. Discover smart strategies for claiming deductions, learn the ins and outs of self-employment, get ahead of tax season, and learn how self-employment taxes really work. Prepare yourself with the knowledge to grow your profits and streamline your processes.

Business Deductions for the Self-Employed: 12 Overlooked Tax Deduction Tips

How the Self-Employed Can Prepare for Tax Season All Year Long

How to Calculate Self-Employment Tax

Frequently Asked Questions

Yes, your self-employed invoice can be customised to include terms and conditions. Providing clear terms gives clarity to both parties and helps avoid any disputes. Within your terms and conditions, consider adding acceptable payment methods, late fees, payment due dates, and the currency you deal in.

After sending your client an invoice, you can accept payments online through credit card, debit card, services such as PayPal, or money transfer. FreshBooks invoicing software accepts online payments directly on invoices with a variety of options, along with other advanced features, including invoice scheduling, mobile invoice creation, and more.

Yes, late payment fees can be added to self-employed invoices. Customise the payment terms to include these details. Clearly state the payment details, including the total amount of the fee, the invoice date, the due date, and any grace periods. FreshBooks invoicing software makes this simple by allowing you to automate payment reminders and charge late fees.

It’s recommended to keep copies of your self-employed invoices for at least six years. This aligns with HMRC guidelines for record-keeping to ensure you have the necessary information on hand for tax purposes and potential audits. FreshBooks invoicing software ensures you always have these files on hand by keeping all your invoices together on the cloud forever.

Yes, on your self-employed invoice, be sure to include a breakdown of your services or products. This is one of the most important elements of the invoice and gives your client a clear breakdown of their charges to offer transparency between both parties. It can also help in tax and accounting purposes to have a clear understanding of the transaction.