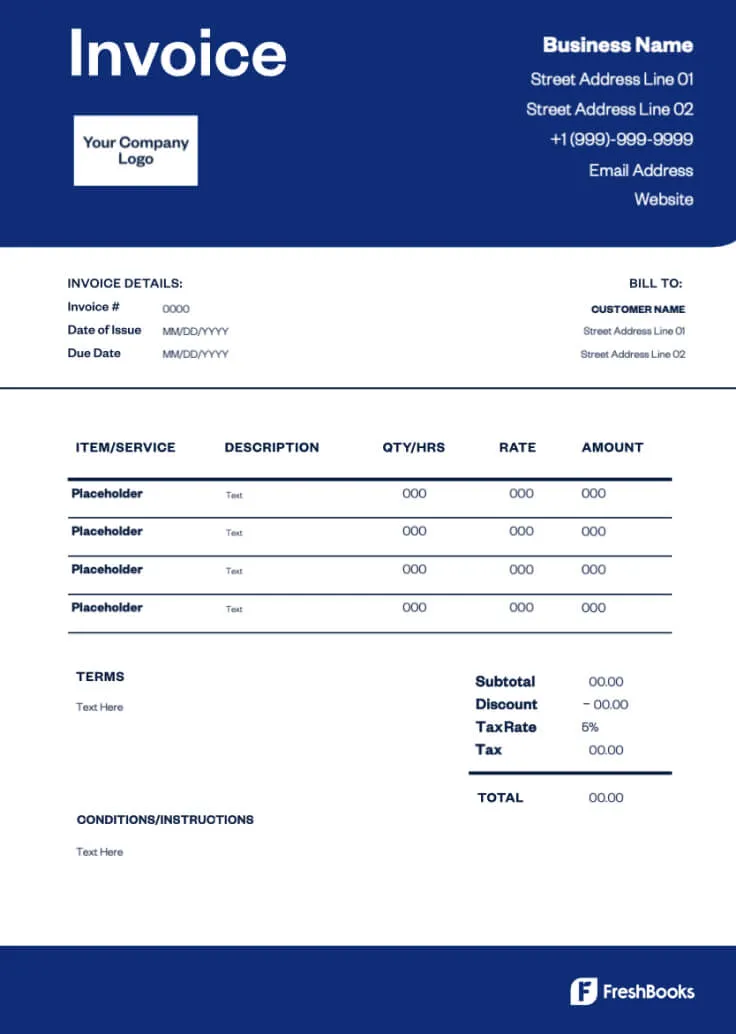

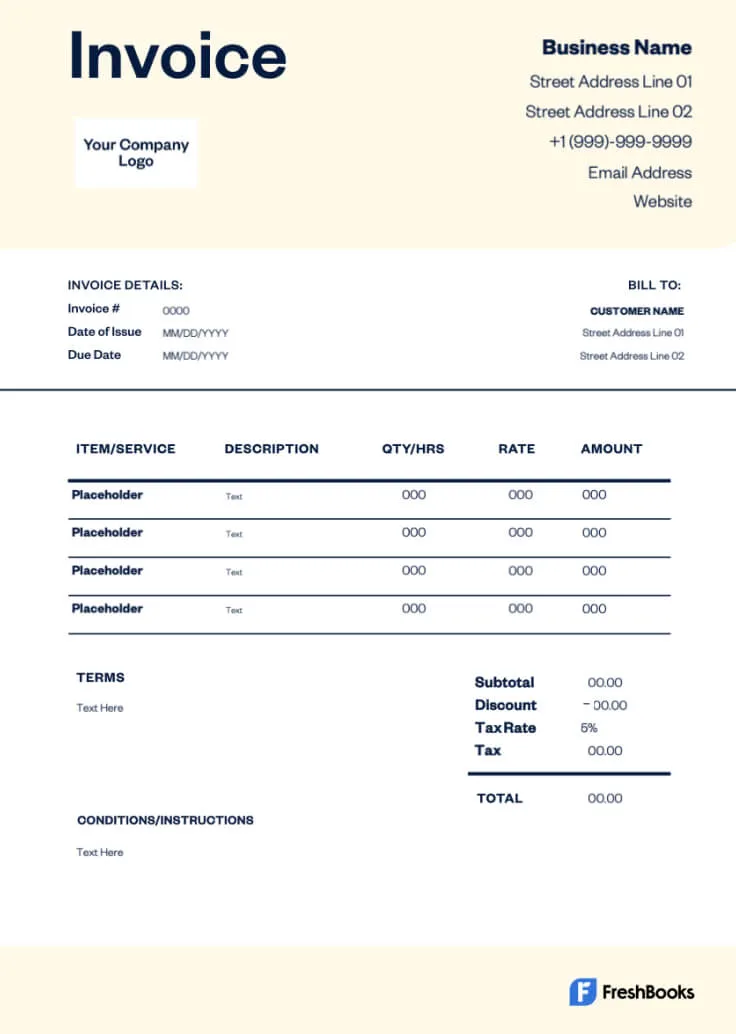

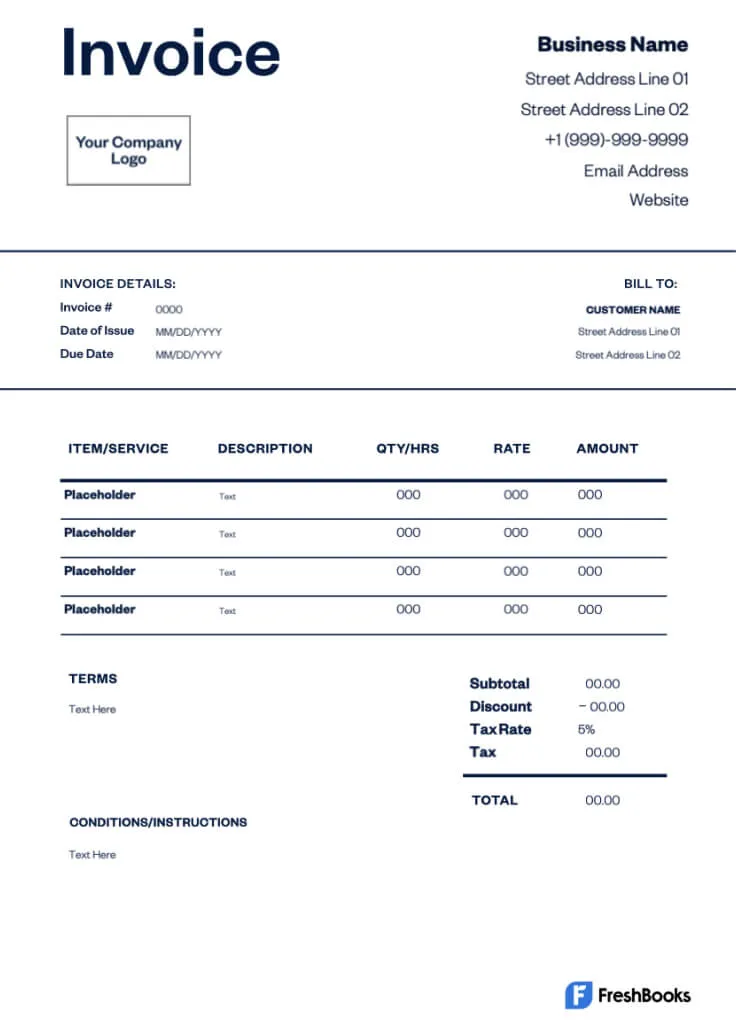

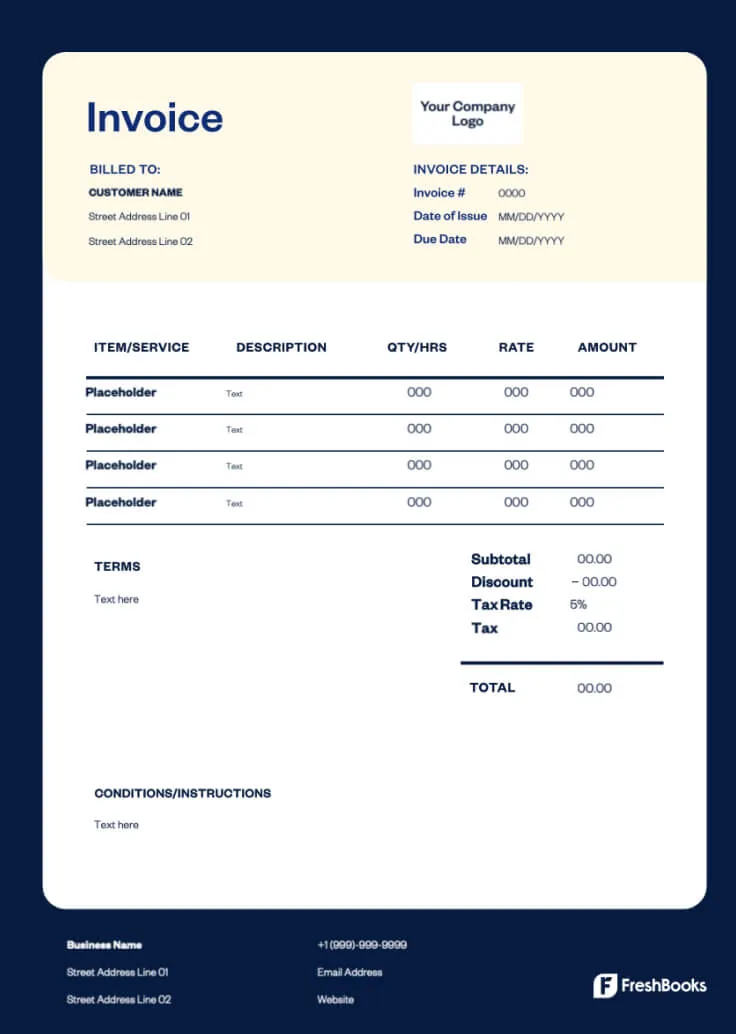

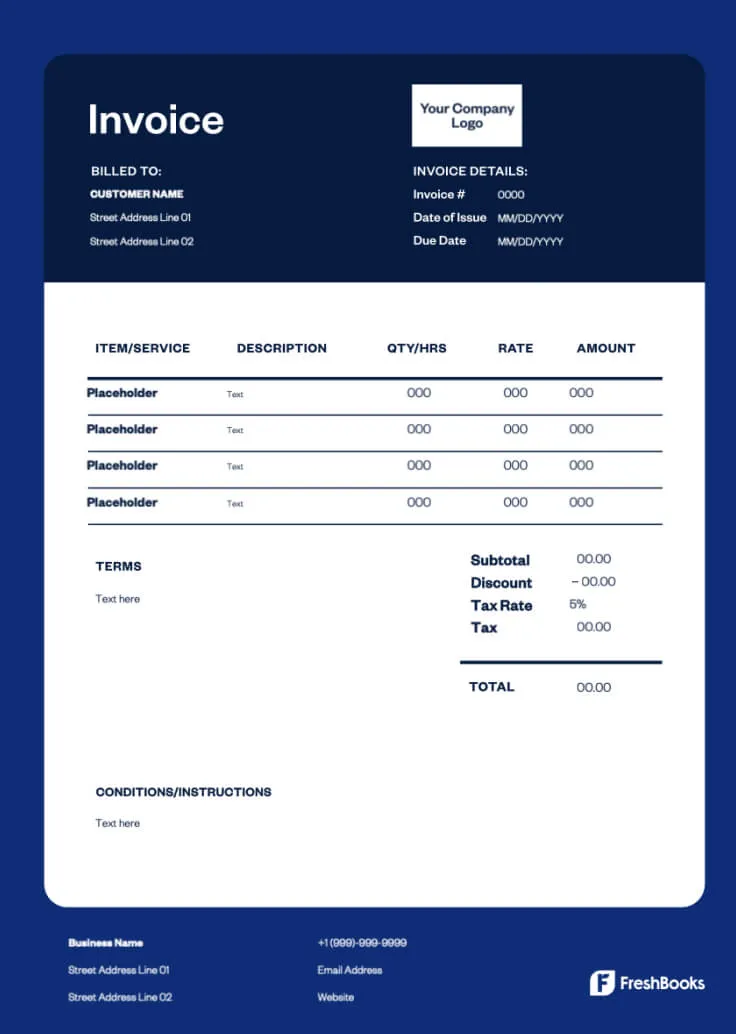

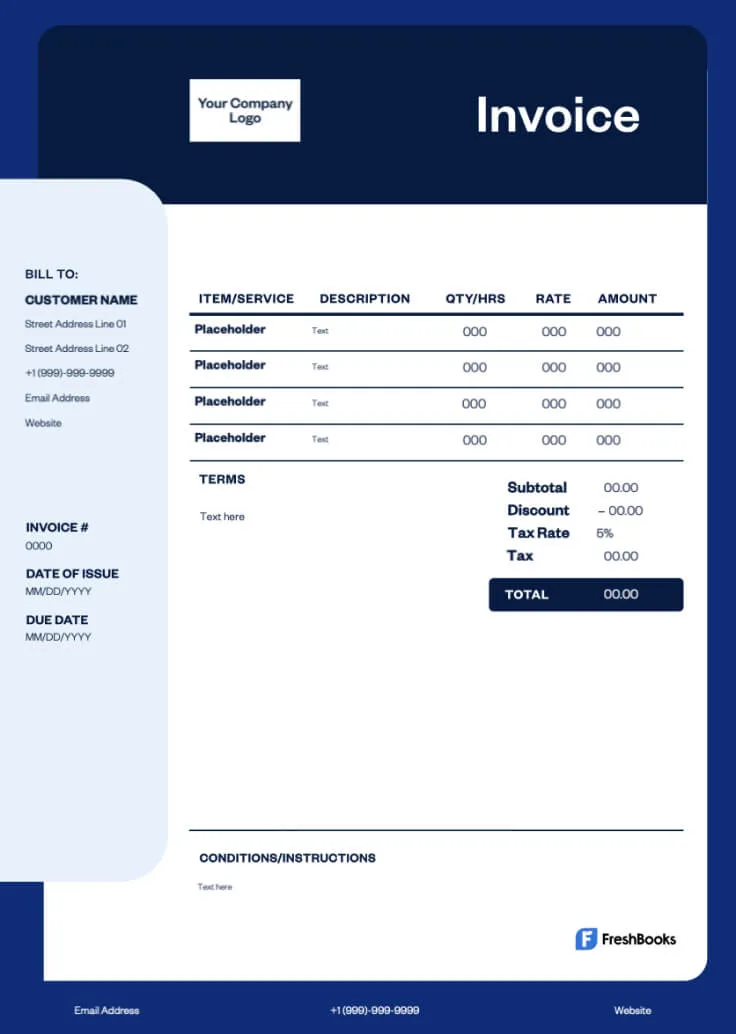

Proforma Invoice Templates

Offer your clients a clear quote for your services with the free proforma invoice template by FreshBooks. Create professional invoices tailored to your services in a matter of minutes.

Download a Proforma Invoice Template

Let clients know what to expect. Send out a preliminary list of costs and keep your services transparent with the proforma invoice template by FreshBooks. Avoid getting bogged down by administrative work with easy-to-use invoice templates that save time and increase efficiency.

Choose a template

Free Invoice Generator

If downloading templates isn’t for you, try the free invoice generator by FreshBooks. Quickly produce personalised invoices online that are ready to send out to clients instantly. Just input the necessary details, click ‘generate,’ and receive a free invoice that is ready to send to your customers.

FreshBooks Invoice Generator

Drag your logo here, or select a file

Bill From:

Bill To:

Invoice Number:

Date:

Amount Due (USD)

$0.00

| Description | Rate | Qty | Line Total |

|---|---|---|---|

| Subtotal | 0.00 |

|---|---|

Discount | |

| 0.00 | |

| Total | 0.00 |

| Amount Due (USD) | $0.00 |

More Invoice Templates by Industry

Business owners work with a variety of companies in other industries. Check out our selection of industry-specific invoice templates below and find a template that perfectly suits your business’s invoicing needs.

If you find you’re still searching for the right invoice to send to a person or company you collaborated with, take a look at our invoice template gallery. It’s jam-packed with plenty of industry-focused templates you can customise for any situation.

Net 30 Invoice Template

Establish a payment term of 30 days for clients to settle their bills with a Net 30 invoice template that helps manage cash flow and maintain smooth financial operations.

Services Rendered Invoice Template

Bill for services provided with a services rendered invoice template. With this customizable template, you can add details such as descriptions of services, service rates, and payment terms to help streamline the invoicing process and get paid quickly.

Standard Invoice Template

A standard invoice template lets you bill for goods or services provided. Customise your template to reflect your business’s branding elements and specific invoicing requirements.

Printable Invoice Templates

From work like painting and repairing furniture to mowing lawns and trimming trees, a free downloadable handyman invoice template is a great way to outline services rendered and make billing simple.

Blank Invoice Template

Blank invoice templates offer a structured layout for sales information, ensuring consistency and professionalism in businesses’ invoicing process. Ideal for client transactions.

Contract Labour Invoice Template

Whether you’re a seasonal worker or you make a living providing financial advice to clients, make sure you’re paid correctly with a professional contract labour invoice template.

Simple Invoice Template

Sometimes, the basics are better. Simple invoice templates provide a straightforward format for billing clients without unnecessary complexities, making them easily accessible for small businesses and freelancers.

Billing Invoice Template

Invoice templates simplify billing by offering a standardised format with crucial details. Record transactions accurately and secure timely payments from clients with a customisable billing invoice template.

Hourly Invoice Template

As a freelancer or service provider, you need to bill clients based on the number of hours you work. Hourly invoice templates include areas for details like your hourly rate so you can get paid for billable hours and facilitate communication of charges to clients.

Retainer Invoice Template

Bill clients for upfront fees to secure your services. Retainer invoice templates include fields for details like the retainer amount, agreed-upon services, the duration of the retainer period, and any unused balance from previous retainers.

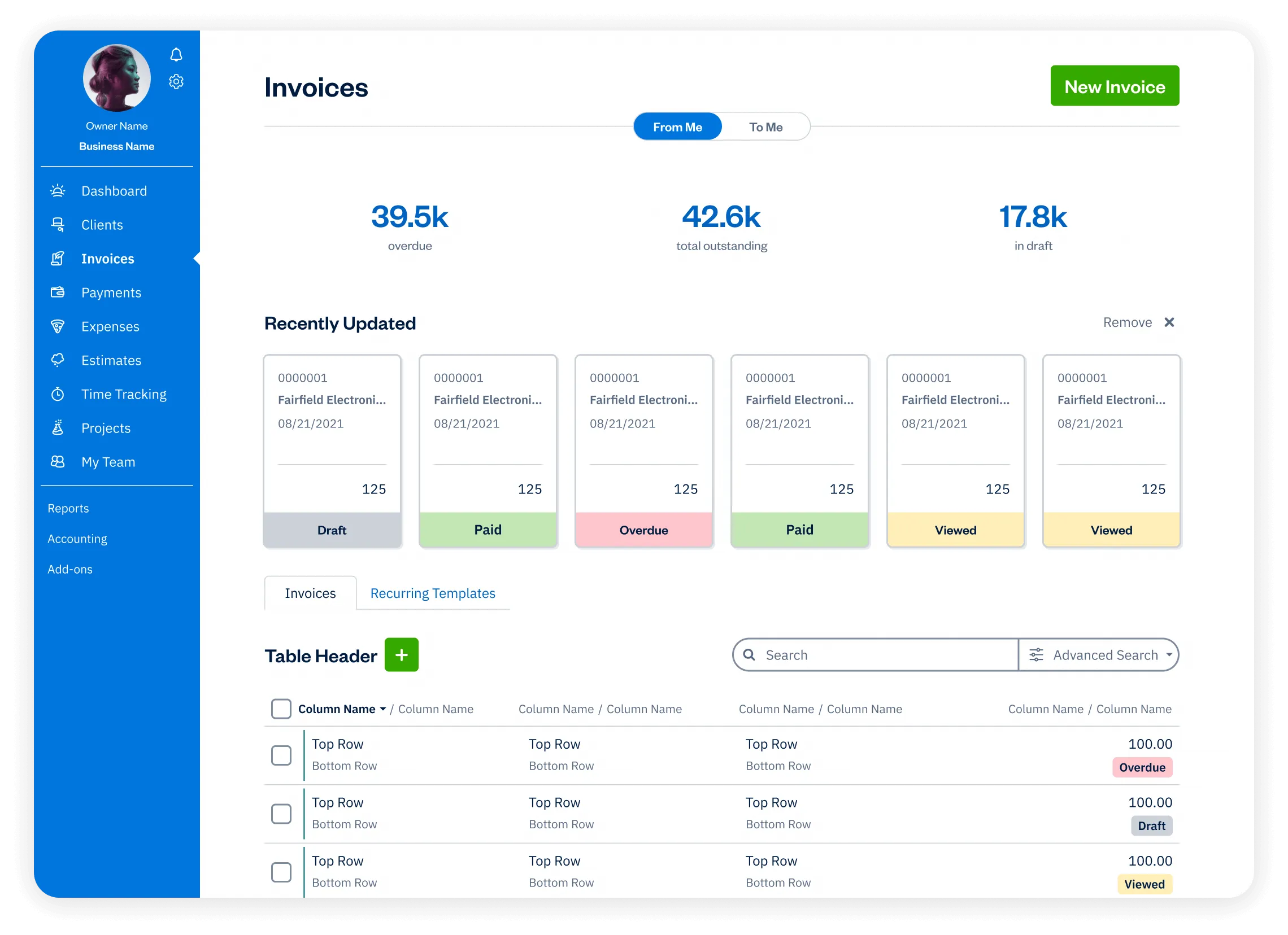

Proforma Invoice Template vs. FreshBooks

While one-off invoice templates are handy, you can streamline your business even further with FreshBooks’ invoicing software. Advanced features, including invoice scheduling, late reminders, and direct payments, put your business on autopilot.

Proforma Invoice Template

VS

FreshBooks

Features

Proforma Invoice Template

Flexible invoice templates

Printable formats

Email invoices at no cost

Accept payments on invoices

Schedule invoices

Automate payment reminders and late fees

Manage paid and outstanding invoices

Set up deposits for projects

Add discounts and credits to invoices

Automate recurring subscription invoices

Create and send invoices via mobile devices

Access your invoices FOREVER on the cloud 🔥

Sign up for a free FreshBooks trial today

Try It Free for 30 Days. No credit card required.

Cancel anytime.

Proforma Invoicing 101: Helpful Resource for Your Business

Take your business up a notch when you explore our collection of resources. Learn the ins and outs of proforma invoices, discover the differences between invoice types, and optimise your business strategy with pro forma financial statements.

What is a Proforma Invoice?

Proforma Invoice vs Commercial Invoice: What’s The Difference?

What are Pro Forma Financial Statements?

Frequently Asked Questions

A proforma invoice is used as a preliminary bill or quote provided by a seller to a buyer. It helps the buyer understand the cost of goods or services they’ll receive in the future and outlines their financial commitment. It often helps in the process of negotiating or committing to a final purchase.

A professional proforma invoice is prepared by the seller of a product or service. It is given to the buyer as a quote or outline of the services or goods of a potential transaction. It typically includes a unique invoice number, the business name, customer information, the goods or services agreed upon, a cost breakdown, a total cost, shipping costs or delivery fees, and payment terms.

The validity of a pro forma invoice depends on the agreement made between the buyer and seller. The seller will often select a specified period, such as 30 days, in which the invoice will be valid. If the seller does not complete the transaction within this period, the proforma invoice may no longer be valid, and the cost is subject to change.

A pro forma invoice does not operate as a request for payment. It is a preliminary estimate for a future transaction and lacks legal or financial obligation. A payment is usually made when the final invoice is issued to the buyer after the goods or services are delivered, and terms are agreed upon.

Pro forma invoices are not a legally binding document. They do not act as a formal request for payment or a finalised agreement. They provide transparency between parties and outline the cost of a potential transaction. Legal obligations are established when the buyer receives the final and agreed-upon invoice.

Sellers use Proforma invoices to provide buyers with a cost estimate for future transactions. Whether you’re selling consulting services, hardware, training services, or even software licences, many businesses can benefit from a free pro forma invoice template. They assist in price quotes, customs documentation, and facilitating negotiations between parties.

Pro forma invoices do not typically need to be signed as they are not a legally binding agreement. They operate as a preliminary estimate or quote for a potential transaction. Parties may choose to sign them to acknowledge or formalise the commitment, but it is not required.

Pro forma invoices can provide several benefits for both the seller and buyer. They help to provide cost estimation, clarity in pricing and payment terms, and assist in budgeting for buyers. They are a helpful tool in negotiations and let sellers showcase their products or services. To tap into all the benefits of invoicing, check out FreshBooks invoicing software to streamline your billing processes.