Best Tax Software For 2025

Managing your taxes for the HMRC can be complex without the best tools involved. Skip the hassle this year and find the best UK tax return software to make filing your taxes quick, straightforward, and safe.

We’ll explore four of the most popular tax software in the UK and walk you through the pros, cons, and pricing schemes of each. Discover the best UK tax software for individuals and small businesses and narrow down the features that will be most helpful for your needs. There’s something for everyone, so we hope you’ll find the best fit for you!

Key Takeaways

- The right tax software can save you time and help you stay HMRC Recognised.

- FreshBooks, Xero, QuickBooks, and GoSimple are four popular tax return software.

- When choosing the best tax software, consider your accounting needs, existing software, user experience, and how many users you’ll have.

- FreshBooks is one of the best overall tax return software for accounting and filing.

Here’s What We’ll Cover:

- FreshBooks

- Xero

- QuickBooks

- GoSimple Tax

- How to Pick the Right Software for You

- Conclusion

- Frequently Asked Questions

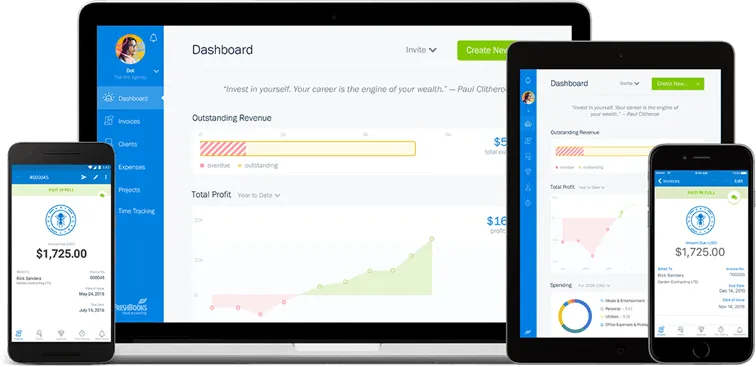

FreshBooks – Best Overall

FreshBooks’ simplicity and versatility makes it one of the best overall tax and accounting software for small businesses. It’s HMRC-recognised and compliant with MTD, which makes it quick and easy to file your taxes digitally. It’s also simple to use, so those with less accounting experience need not face a learning curve during tax season.

As a tax software, the automatic expense system makes it easy to track your expense claims so the software can calculate your standard tax deductions. It also identifies your taxable income and includes features like a VAT calculator so you can input your amounts and find the totals without needing to hunt down tax formulas.

Beyond the tax capabilities, the MTD-compliant software is an all-in-one solution for customer management, billing, and filing. Send unlimited estimates and invoices, track all your expenses, and accept payments—all in one simple software. Client collaboration tools come standard for all packages, and integration partnerships with Google Suite, Shopify, and Squarespace make it easy to sync with other systems.

FreshBooks’ subscriptions work for your business needs with no hidden costs. The Lite package is perfect for freelancers, while the Plus package offers additional support for growing small businesses. When you’re looking to mix and match features, the custom package lets you pick and choose what you need at a price that works. Sign up to discover how FreshBooks accounting can help grow your small business.

Pros:

- Easy to use

- Making Tax Digital compliant

- Fully comprehensive accounting made simple

- Works for many business sizes and structures

Pricing:

- Lite: £15.00/month

- Plus: £25.00/month

- Premium: £35.00/month

- Custom: Talk to a specialist to create a custom plan that fits your needs and budget

Xero – Best for eCommerce

Xero is a cloud accounting system that works amazingly for online stores and eCommerce businesses. This is because it has various features that lend themselves well to eCommerce business structures. For example, it has inventory management and VAT tax filing.

Xero is also MTD-compliant and offers an excellent user experience. It works on desktop and mobile apps relatively seamlessly for tax filing wherever you are. There are no complicated returns here or exorbitant filing fees.

The one drawback of Xero is the fee structure. The basic package is quite limited – it allows you to send up to 20 invoices and track 5 bills to pay. You’ll likely want to upgrade to the Standard or Premium plans for full functionality. You also have optional add-ons such as payroll and expense-claiming capabilities that raise costs. You can check out Xero Vs. FreshBooks comparison for a detailed comparison.

Pros:

- Making Tax Digital compliant

- Inventory management as standard

- Easy interface to use

- Good for small to medium businesses

Cons:

- Can get pricey with all the add-ons

Pricing:

- Starter: £15/month

- Standard: £30/month

- Premium: £42/month

- Ultimate: £55/month

QuickBooks – Best for Comprehensive Accounting

QuickBooks is great for those who already have a handle on tax filing and accounting. It’s a dense system with powerful features for the advanced business owner or accountant.

Quickbooks has an automatic tax calculating system that is very accurate and useful, but there is a learning curve. However, when you learn to use the multiple features it has to offer, Quickbooks is a good option for various professionals.

It can handle your self-assessment as a non-resident or freelancer. It can equally handle your VAT return as an eCommerce vendor. It will calculate standard deductions and create a complex return for you. Whatever the size or function of your business, Quickbooks has a flexible enough interface to cover them. This is a popular product to consider if you have a complicated tax situation. You just need to take the time to learn how to use it properly!

As for pricing, the Simple Start package will cover most sole traders and small business owners without teams. With teams, you’ll want the Essentials or Plus packages.

Pros:

- Very in-depth accounting system

- Payroll capabilities

- Making Tax Digital compliant

- Works with many business structures

Cons:

- Can be a learning curve to use

Pricing:

- Self-employed: £10/month

- Simple start: £14/month

- Essentials: £24/month

- Plus: £34/month

- Advanced: £70/month

GoSimple Tax – Best for Solely Tax-Filing

Lastly, let’s talk about the best system for solely tax filing. So far, all of the options we’ve mentioned have accounting capabilities like payroll, expense reporting, and financial health checks. GoSimple Tax is for you if you simply want assistance filing taxes and nothing else.

It’s pretty much the expert because GoSimple Tax focuses solely on self-assessments and various income tax returns. They have different tax models you can file with them directly to HMRC annually. Therefore, their plans require a small annual fee to help you get the help you need during self-assessment and filing.

As for the tax filing options, you can file:

- Property income tax

- Foreign income tax

- Self-employment income tax/freelance income tax (simple return)

- Partnership tax

- Capital gains tax

And much more. All the hard stuff is done for you, instantly making the filing process less hassle. They have great one-to-one support come tax time, too.

It’s relatively good value for money, given that you only pay once a year. The software aims to be like a tax accountant. A tax accountant could cost you hundreds around tax season. But this software is under £100.

Best of all, it syncs with FreshBooks! If you do your main accounting with us but want GoSimple Tax to handle the filing side and tax affairs of things, you can easily have both.

Pros:

- Making Tax Digital compliant

- Integrates with FreshBooks

- Makes various tax forms incredibly simple

- Very seamless tax filing experience

Cons:

- Just for taxes – has no other accounting capabilities

Pricing:

- Individual: £54.99/tax year

- Partnership: £77.99/tax year

- Friends & Family: £83.99/tax year

How to Pick The Right Software For You?

There are several excellent tax software on the market—finding the right one depends on your business needs and user base. Here are a few factors to consider when you start shopping:

1. What will you be using it for?

Some software is just for tax season, while others can handle accounting tasks as well. If all you need is filing assistance, basic tax software can help you file your returns. If you’re looking for full accounting support for personal or small business needs, try software that comes with expense tracking and account record capability.

2. Does it integrate with your existing software?

Some tax software offers full accounting capability, while others integrate with your existing software to help you digitise your current records. If you already have accounting software you like and are looking for a tax add-on, look for a compatible tax solution so you don’t have to input your bank accounts manually.

3. Who will be using the software?

Are you a sole trader, or will you have friends, family, or business partners filing too? Remember to consider everyone’s experience level as well as the client volume each software can accommodate so you can find user-friendly software packages that work for everyone.

4. How big is your business?

Some software plans are just for individuals and small businesses and may limit the number of features they offer. Choose a software that fits your information volume, whether you’re filing for one individual or a larger company.

Conclusion

The right tax software can make filing your tax returns quicker, safer, and more accurate. When searching for the right tax software, consider the size of your business, what integration options the software offers and user-friendly qualities.

There are several HMRC Recognised tax filing software on the market, but FreshBooks is the most effective for overall ease and versatility. It’s MTD-compatible, so you can easily file your taxes online, and it offers plenty of other accounting features like expense tracking and record-keeping so you can stay HMRC Recognised. Browse more accounting software features to learn how FreshBooks can support your business through tax season and beyond.

For more UK tax guides, head to our resource hub.

FAQs on Best Tax Software

Is it safe to use tax software for filing my taxes in the UK?

Yes, most HMRC-recognised tax software like FreshBooks is considered to be a safe way to file your taxes in the UK. Filing digitally also eliminates the concern for things like mail fraud, so you can feel confident knowing your FreshBooks taxes are going straight to their destination.

How can I determine if UK tax software is HMRC Recognised?

The HMRC recognises a number of UK tax software, so you can always double-check that your software is HMRC Recognised. FreshBooks is HMRC Recognised and compatible with Making Tax Digital, so you can quickly and easily submit your tax information through the online portal.

Can tax software generate tax reports and statements required for tax audits?

Tax software like FreshBooks can help you keep accurate tax reports, statements, and records that are required in case you get audited. The HMRC requires that you keep your records for at least five years, so having an accounting system like FreshBooks store and organise your accounting data is helpful.

Is it important for tax software to provide error-checking and validation features?

Yes, it’s important for tax software to offer error checking and validations because any mistakes on your taxes could put you at risk of fines or audits. FreshBooks checks your taxes as you go and helps you flag any errors so that you can ensure your taxes are HMRC Recognised.

Can tax software help with tax calculations for foreign income or international tax obligations?

Some tax software may help you calculate foreign income and international tax obligations. It’s important to declare all income on your taxes, including those from foreign sources. FreshBooks allows you to include data from multiple income sources so that you can provide a comprehensive tax declaration.

Reviewed by

Levon Kokhlikyan is a Finance Manager and accountant with 18 years of experience in managerial accounting and consolidations. He has a proven track record of success in cost accounting, analyzing financial data, and implementing effective processes. He holds an ACCA accreditation and a bachelor’s degree in social science from Yerevan State University.

RELATED ARTICLES

VAT vs Sales Tax: What’s the Difference?

VAT vs Sales Tax: What’s the Difference? UK Payroll Tax: What It Is & How Does It Work?

UK Payroll Tax: What It Is & How Does It Work? What Is a Furloughed Worker? Coronavirus Furlough Guide

What Is a Furloughed Worker? Coronavirus Furlough Guide What Are CIS Deductions? Meaning & Calculation

What Are CIS Deductions? Meaning & Calculation What Is VAT Liability? A Beginner’s Guide

What Is VAT Liability? A Beginner’s Guide What Is the VAT Flat Rate Scheme for Small Businesses?

What Is the VAT Flat Rate Scheme for Small Businesses?