Online Tax Return: Guide to File Self Assessment Tax Return

If you’re running a small business, it’s important to have a good understanding of taxes. A large part of that is understanding how to file taxes online. HM Revenue and Customs (HMRC) authority make online tax preparation easy. The use of these online services for filing self-assessment tax returns can be unclear in some cases, however. You shouldn’t have to be a tax professional to file your own taxes. That’s where we come in. Check out our guide regarding self-assessment tax return preparation below!

Here’s What We’ll Cover:

How is Self Assessment Completed?

Who Needs to Complete Self Assessment?

Steps for Filing Your Tax Return

What is Self Assessment?

While income taxes are normally deducted automatically from wages, it isn’t deducted from businesses. It is the responsibility of the business owner to report to the HMRC whether or not they owe any taxes. This is the entire point of self-assessment. Any business that believes they may owe taxes is required to file a current-year tax return.

How is Self Assessment Completed?

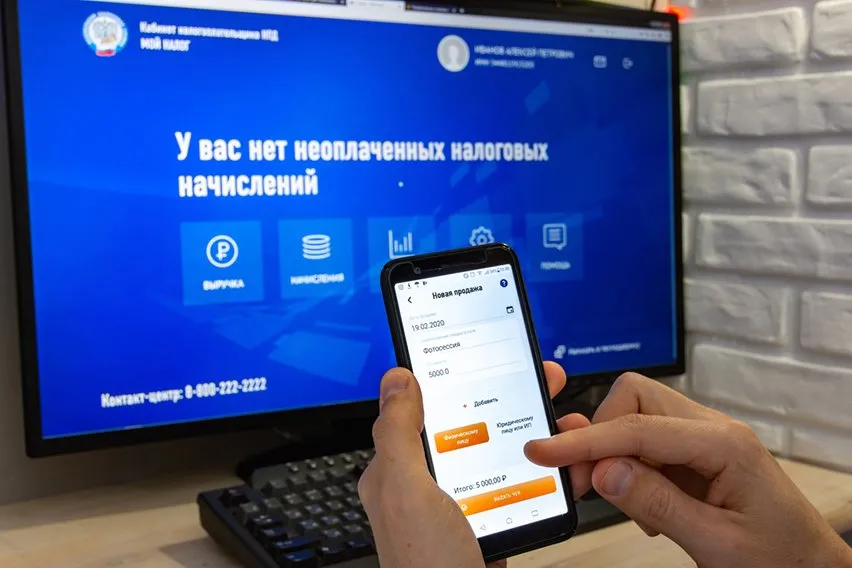

Self-assessment tax forms can be filed either by paper or online, depending on your needs. Using online business services or online tax preparation software, you can estimate how much you’ll owe. However, the only party that can determine how much your business will owe in taxes is HMRC.

Who Needs to Complete Self Assessment?

The majority of people in the UK do not need to complete self-assessment tax forms. If they are employed, they are able to utilise Pay As You Earn (PAYE). This prevents them from needing to file a tax return annually. If one or more of the following apply to you, you’ll have to file a self-assessment tax return:

- You work for yourself, also known as being self-employed

- You are a partner in a partnership business

- You are a minister of any faith or denomination

- You are the executor of an estate or a trustee

In all of these instances, it will be required for you to file a self-assessment tax return. It’s also possible that in some of the next instances that you’ll have to file a form, as well.

- You have income other than your job, such as rental income

- You receive money from a trust or settlement

- You have foreign income

- You have investment income that totals over £10,000 or more before tax

Tax on rental income and investment income are commonly not taxed before being received. As such, it has to be reported and reviewed through self-assessment. Thankfully, you don’t need to be a tax expert to file a self-assessment form.

Steps for Filing Your Tax Return

HMRC makes filing the proper paperwork convenient and easy. The process can be done online or via paper.

Step 1: Register for Self Assessment

The first step to turning in self-assessment tax returns is registering for self-assessment. You can do so online at the HMRC website, where you can find detailed instructions on how to do a self-assessment online. The process is slightly different, depending on your status. The statuses are self-employed, registering a partnership, or not self-employed.

Step 2: Set Up a Government Gateway Account

After you’ve registered online, you’ll receive a Unique Taxpayer Reference (UTR) number. You’ll use this number to begin the setup required for a Government Gateway account. Once the process has started, you’ll receive an activation code in the post. Once received, you’ll be able to start the self-assessment process online.

Step 3: Gather All Necessary Information

To complete the self-assessment tax return, you’ll need quite a bit of information. Make sure that you have all of the following, when applicable:

- Your UTR number

- Your National Insurance number

- Records of self-employment expenses

- Full details of any income earned

- A total of any rent income received

- A total of any investment income received

- Records or receipts of taxes paid so far

Step 4: Fill in the Applicable Sections

Fill out any information in the tax return forms that applies to you. This is entirely dependent on your situation. Be sure to double-check all fields.

Step 5: Submit Your Tax Return and Keep a Copy

Once everything has been filled out, and all the information has been attached, you can file your tax return. It is in the best interest of the business owner or self-employed individual to keep a copy of the return as well. Records should be kept for up to 5 years and ten months, depending on your income source.

Key Takeaways

Self-assessment tax returns are a requirement of any business owner or self-employed individual. They tell HMRC how much money should be paid in taxes for the year that the form is filed. Be sure to register and file your taxes to avoid any penalties!

Did this article help you? If so, be sure to check out our resource hub for more like it! We’ve got plenty of information to help you out.

RELATED ARTICLES

How to Register as Self-Employed in the UK? A Step-by-Step Guide

How to Register as Self-Employed in the UK? A Step-by-Step Guide What Is IR35? A Guide to Its Rule & Changes

What Is IR35? A Guide to Its Rule & Changes What Is the Emergency Tax Code? A Tax Code Guide

What Is the Emergency Tax Code? A Tax Code Guide 3 Best IR35 Calculator to Calculate IR35 Cost

3 Best IR35 Calculator to Calculate IR35 Cost Can Employers Claim Back Statutory Sick Pay From HMRC?

Can Employers Claim Back Statutory Sick Pay From HMRC? How Do I Claim My Mileage Back From HMRC?

How Do I Claim My Mileage Back From HMRC?