Profit and Loss Statement: What It Is, Importance & Example

As a business owner, it’s important to consider several areas of your business when it comes to financial performance. You need to worry about cash flow, operating income, income taxes, and your company’s revenues. Plus, there will be a need to increase cash flow to help balance any expenses incurred.

But is it mandatory to do all of this or is there a simple way to find this information? What If you want to learn more about a company’s assets? The simple answer is yes, and these details can be found in the profit and loss (P&L) statement. Read on to learn everything you need to know about P&L statements. We’ll dive into what it is, its structure, how it works, its importance, and much more!

Table of Contents

What Is a Profit and Loss Statement (P&L)?

Profit and Loss Statement Structure

How Profit and Loss Statements Work

Profit and Loss Statement Types

Importance of Profit and Loss Statement

Profit and Loss Statement Example

What Is a Profit and Loss Statement (P&L)?

A profit and loss statement (P&L) is a type of financial report that businesses put together. It includes expenses, revenues, profits and losses over a specific period of time. The P&L statement can also commonly get referred to as a statement of operations or an income statement.

Essentially, it breaks down and shows how well your business is able to generate sales. As well, it provides insights into your overall ability to create more profits and manage all of your expenses.

The P&L statement differs compared to the cash flow statement. This is because it includes general accounting principles, such as matching, accruals, and revenue recognition. Yet, businesses put together the P&L statement along with the cash flow statement and the balance sheet to learn more about operating income.

A few other ways the P&L statement gets referred to include the statement of operations, the earnings statement, the expense statement, or the statement of financial results.

Profit and Loss Statement Structure

A month, quarter, or fiscal year is typically used to illustrate the company’s statement of profit and loss.

The P&L’s principal categories and structure are as follows:

- Net income

- Interest expenses

- Taxes

- Marketing and advertising

- Cost of goods sold, or the cost of sales

- Revenue

- Selling, general, and administrative expenses

Creating a P&L statement is typically included in the majority of accounting software. Whenever you require the information, you can run a report that includes your P&L. But regardless of whether the final figure is positive or negative, it is still important to comprehend the methodology used to arrive at it.

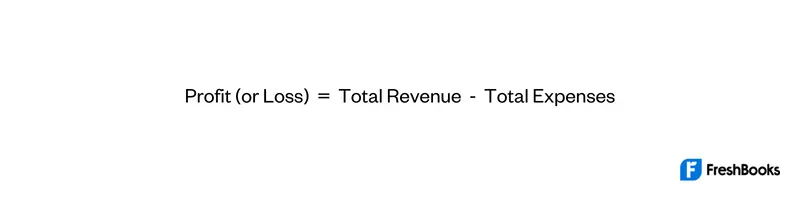

The most straightforward formula to calculate P&L is:

Your turnover information serves as the foundation for the P&L calculations. In a trading year, that is the money made from the sale of goods or services. You will need to have information and documentation for:

- Sales invoices

- Sales receipts

- Credit notes and additional sales records

Sales and expenses are normally taken into account when calculating profit, rather than when they are actually paid. Therefore, even credit sales and purchases that haven’t yet been paid for are included in profits for the period.

The total of direct costs, such as labour and materials, and indirect costs are subtracted from sales, typically over a 12-month period, to determine gross profit. The term overhead also applies to indirect costs. By dividing the gross profit by the turnover of your business, you can determine the gross profit margin as well as the net profit margin. This makes it clear how much money you’re ultimately making.

How Profit and Loss Statements Work

This is outlined in the heading above.

Profit and Loss Statement Types

There are two primary ways to prepare a profit and loss statement. These are the accrual method and the cash method. Let’s take a closer look at how both of these work.

Accrual Method

Revenue is recorded using the accrual accounting method as it is earned. This indicates that a business using the accrual method records the amount of money it anticipates receiving in the future. For instance, even though it hasn’t yet received payment, delivering a product to a customer will still see the revenue included on the P&L statement. Similar to assets, liabilities are recorded even if no expenses have been paid by the business.

Cash Method

Only when cash enters and exits the business is the cash method used. It’s also known as the cash accounting method. This is a very straightforward method that only tracks money that has been paid or received. When money is received in a transaction, it is recorded as revenue; when it is spent on obligations, it is recorded as a liability. Smaller businesses and people who want to manage their personal finances frequently employ this technique.

Importance of a Profit and Loss Statement

A profit and loss statement illustrates how your business has performed over a specific time period, such as a month, quarter, or year. This is in contrast to a balance sheet, which presents a snapshot of your current financial situation at a particular point in time.

It’s one of the most crucial financial records you’ll require for managing and expanding a prosperous company. It enables you to maintain compliance, assists you in submitting accurate accounts at the conclusion of the trading year, and enables you to comprehend how purchases and sales affect trading. This subsequently enables you to grow your company, draw in more funding, or add new employees to your staff.

The P&L statement shows the top and bottom lines of a company. The top line is where any of the costs of doing business get subtracted. These costs include:

- Operating expenses

- The cost of goods sold

- Interest expenses

- Tax expenses

One of the three types of financial statements created by companies is a P&L statement. The other two types of financial statements include the balance sheet and the cash flow statement. The main goal is to highlight the expenses and the earnings of a company for a specific period of time. This is usually one fiscal year.

By combining this data with insights from the other two financial statements, investors and analysts can use this information to evaluate the profitability of the business. To determine a company’s return on equity (ROE), an investor could, for instance, compare its net income to the amount of shareholder equity. The shareholder equity is shown on the balance sheet.

Profit and Loss Statement Example

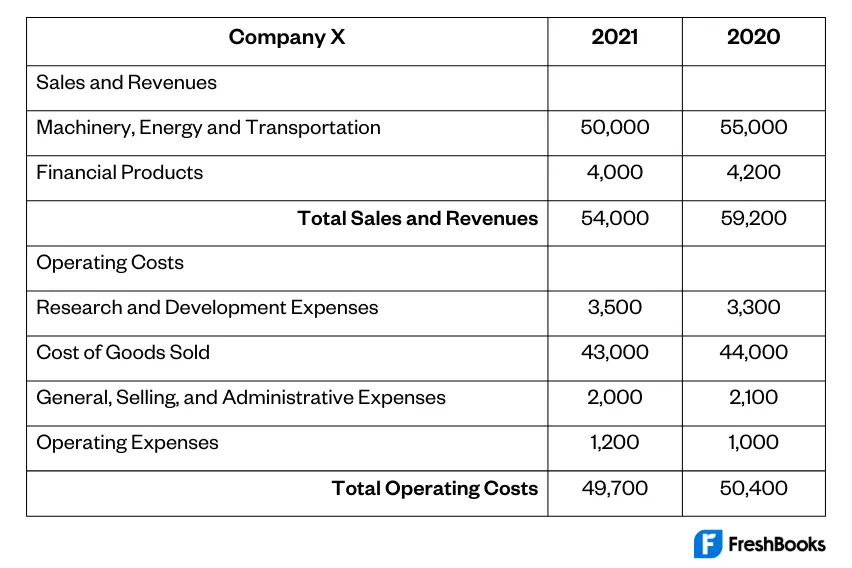

As an example of a profit and loss statement, let’s look at Company X. Here is what the P&L statement looked like for 2020 and 2021.

Using the details included in the P&L statement, you can gain insights into several areas of your business. These can include the net profit margins, the operating ratio, the operating profit margin, and the gross profit margin. Plus, when you combine the P&L statement with the cash flow statement and balance sheet, you’re going to gain even more insights.

Ultimately, all of these details are going to paint a much clearer picture of the financial performance of your business. You can gain additional information about a company’s revenues and overall financial strength for a given period.

Key Takeaways

The revenues, costs, and expenses of a business over a given time period are compiled in a P&L statement. The balance sheet and the cash flow statement are the other two financial statements that companies typically release on an annual or quarterly basis. Financial statements are used by analysts and investors to evaluate a company’s financial standing and potential for expansion.

FAQs on the Profit and Loss Statement

Is P&L the Same As an Income Statement?

A P&L statement, also known as the income statement, is a financial statement that lists all of the receipts, payments, and outlays made over a given time period, typically a fiscal year or quarter.

Where Can I Get a Profit and Loss Statement?

The P&L or income statement is one of the financial statements that public companies are required by law to issue to shareholders and can be found on a company’s website. For a more accurate picture of a company’s financial health, the cash flow statement and the P&Ls for various periods should be compared.

Who Prepares a P&L Statement?

More often than not, an accountant is going to prepare a P&L statement. You can either have your own accountant do this or outsource it to an accountancy company. Or, you can use accounting software to help do everything for your accounting periods.

Is It Compulsory to Prepare a Profit and Loss Statement?

A profit and loss statement for each fiscal year must be produced by law if your business is incorporated. If your company does not operate as a limited company, you are not required to produce one, but the data you provide to HMRC to determine your tax liability will still amount to the same thing.

What Is the Difference Between P&L Statements and Balance Sheets?

A P&L statement is going to provide a summary and overview of all the revenues, costs, and expenses of a company. And this is specific to a period of time. The balance sheet shows areas such as shareholder equity, liabilities, and assets.

RELATED ARTICLES

Types of Budgets: 6 Common Budgeting Methods for Business

Types of Budgets: 6 Common Budgeting Methods for Business Retained Earnings: Definition, Formula & Example

Retained Earnings: Definition, Formula & Example Feasibility Study: Meaning, Types & Process

Feasibility Study: Meaning, Types & Process What Is Direct Debit Guarantee & Direct Debit Rules?

What Is Direct Debit Guarantee & Direct Debit Rules? What Is a Risk-Free Rate of Return? Definition & Example

What Is a Risk-Free Rate of Return? Definition & Example What Is a Control Account?

What Is a Control Account?