Accounting Software That Makes Billing Painless

FreshBooks is accounting software that makes running your business easy, fast and secure. And exclusive to Barclaycard business customers, get access to a FREE FreshBooks Plus plan with transaction rates as low as 1%.

Featured In

Why FreshBooks Will Revolutionise

Your Business

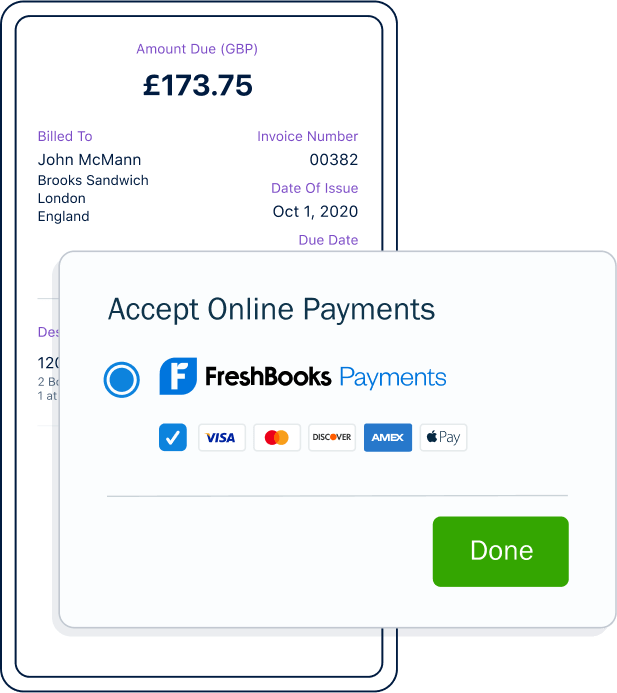

Get Paid (Really) Fast

Barclaycard in FreshBooks gets you paid as fast as next day.** Say hello to automatic deposits, and goodbye to chasing clients for money.

Ridiculously Easy To Use

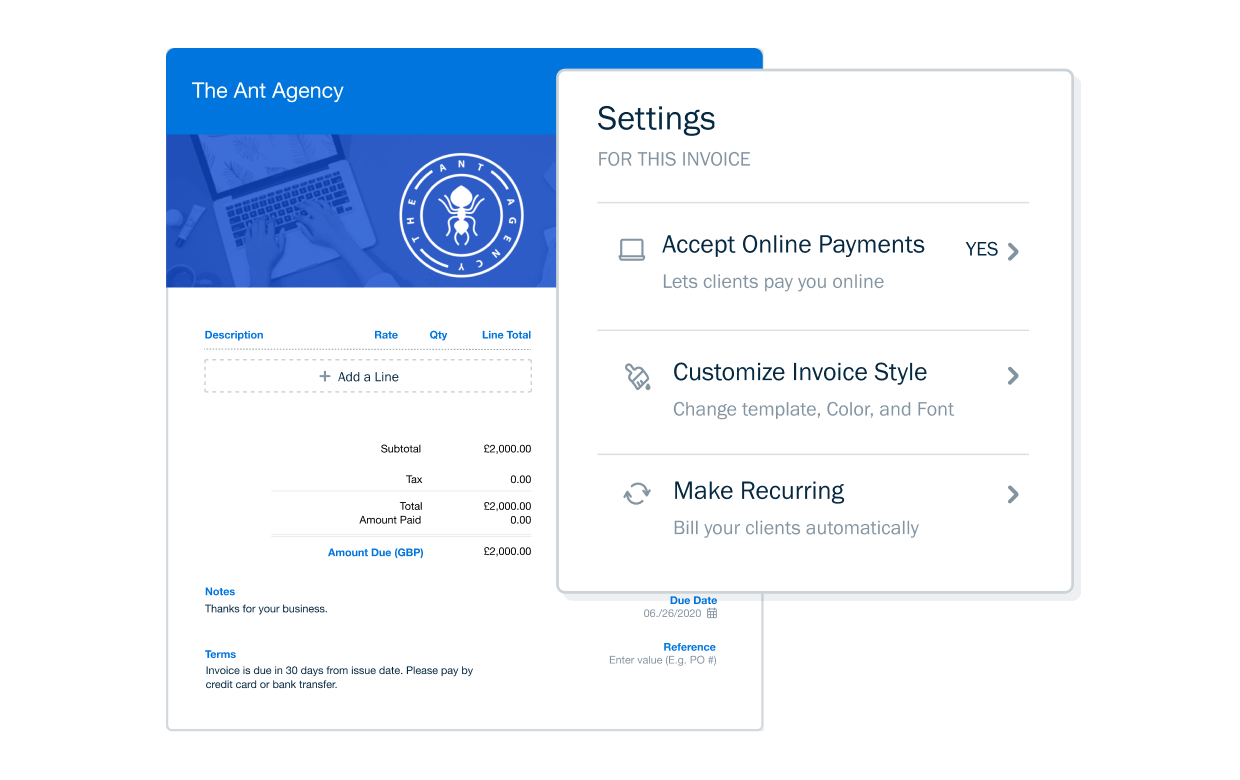

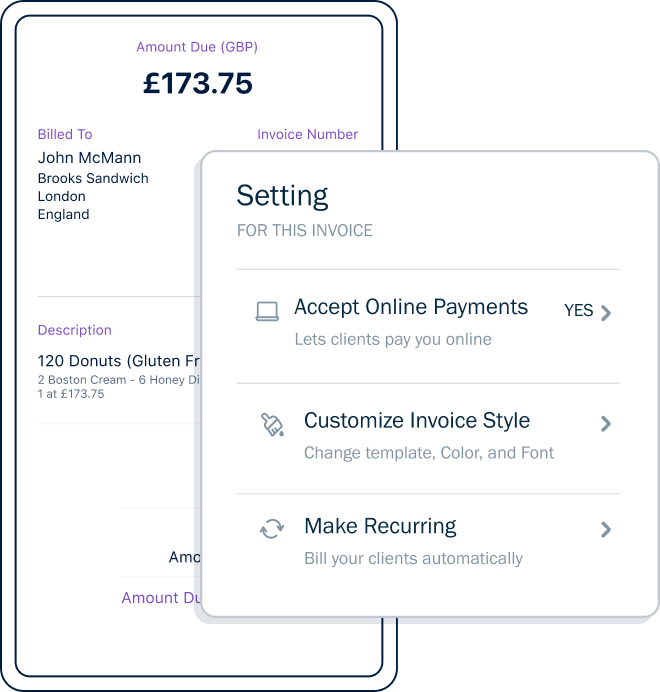

FreshBooks is simple and intuitive, so you’ll spend less time on paperwork and wow your clients with how professional your invoices look.

Powerful Automation

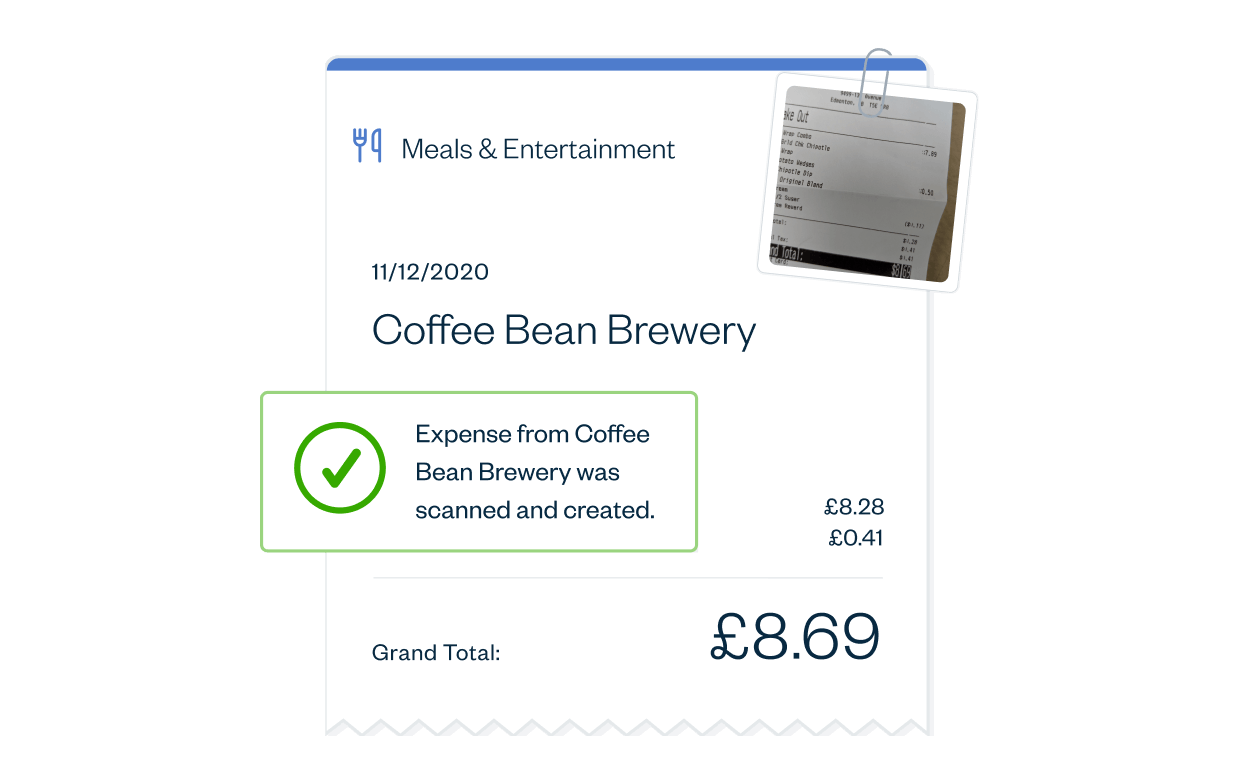

Automate tasks like invoicing, organising expenses, tracking your time, and following up with clients – in just a few clicks.

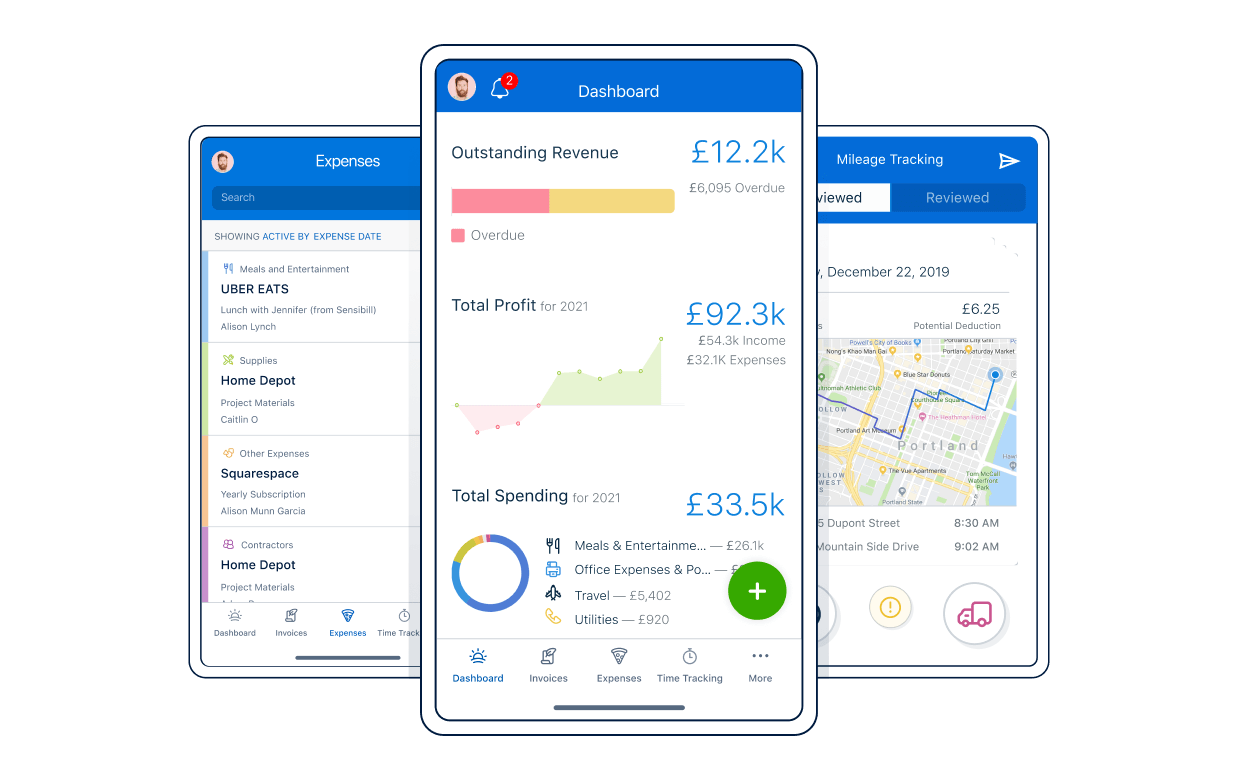

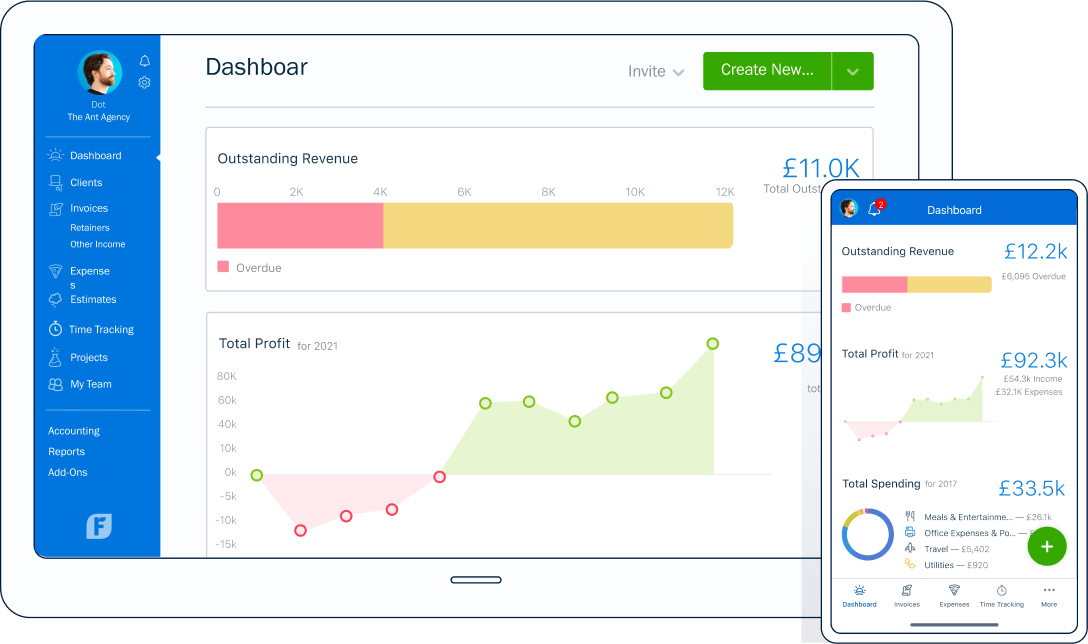

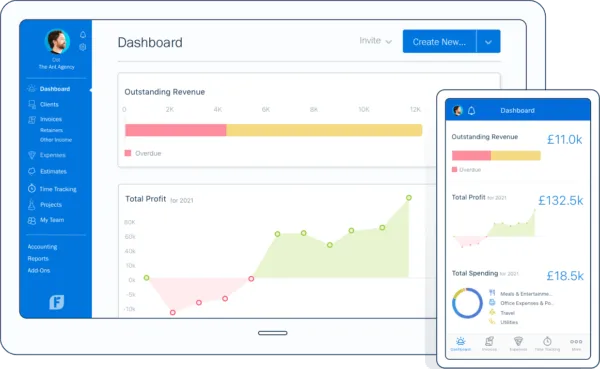

What You Get in the Plus Plan

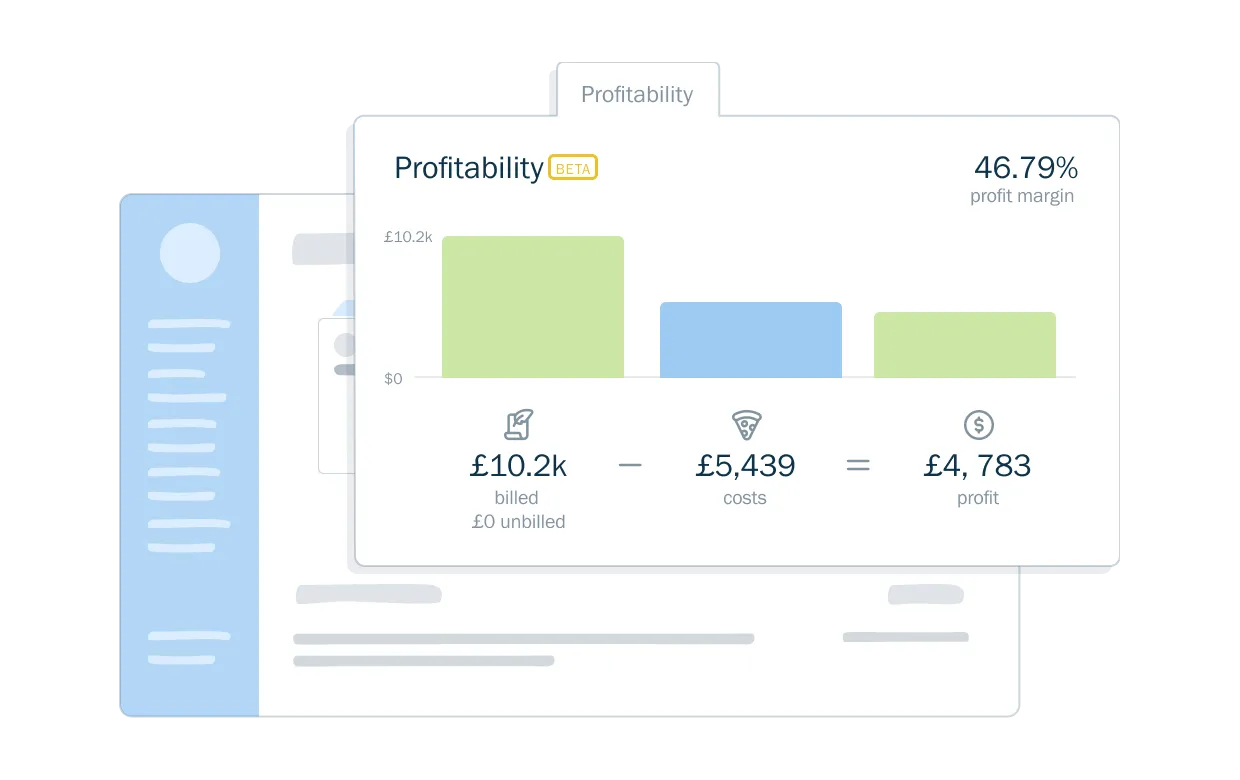

The Plus Plan is built for business owners looking for ways to automate their

business and use insights to make more informed decisions.

Top Features Include:

- Unlimited Invoices

- Automatic Expense Tracking

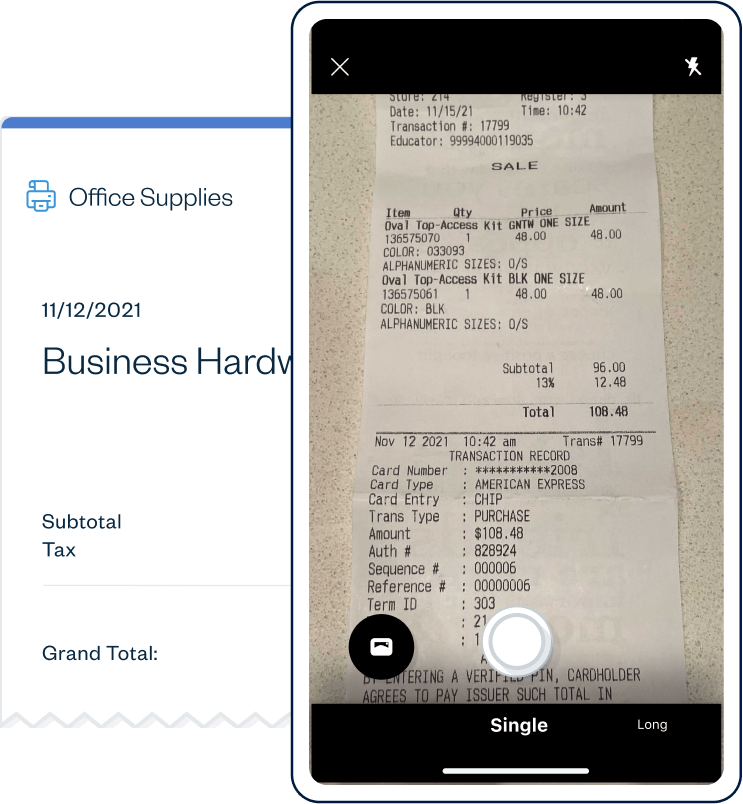

- Automatic Receipt Data Capture

- Unlimited Quotes and Proposals

- Unlimited Credit and Debit Card Payments via Barclaycard

- Recurring Billing and Client Retainers

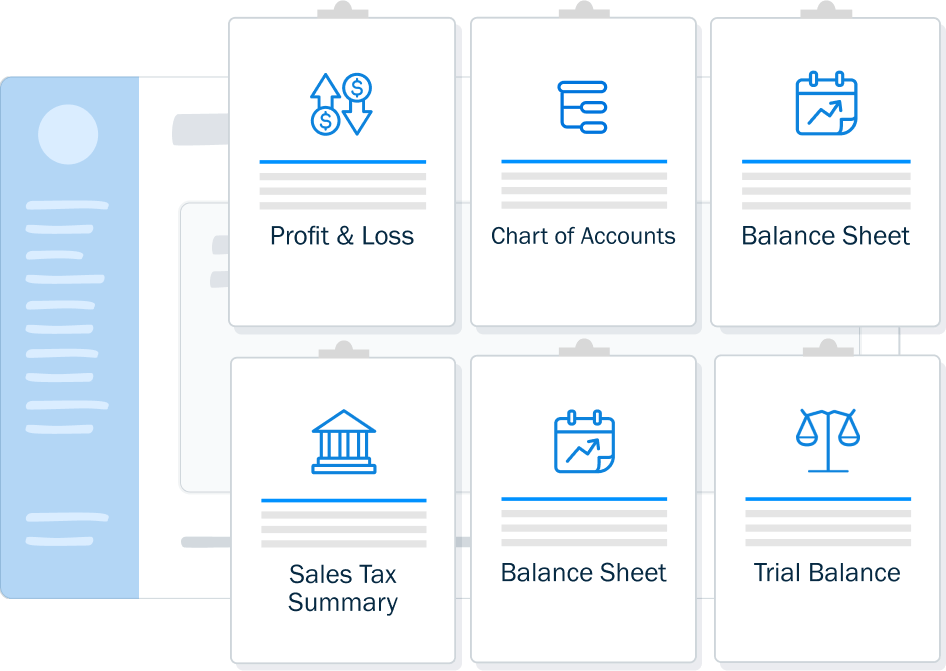

- Business Health Reports

- Double-Entry Accounting Reports

- Special Access for Your Accountant

- VAT Return Filing for HMRC Making Tax Digital

- iOS and Android Apps

- Mobile Mileage Tracking

- Plus, lots more time-saving automation

Offer only eligible for Barclaycard customers.

Dive Into Our Easy-to-Use Features Below

Easy-to-Use Accounting & Bookkeeping Features

Getting Started Takes Mere Seconds

Wave goodbye to spreadsheets that give you headaches, software that’s hard to use, and customer service that gives you the runaround. Switching to FreshBooks is a cinch.

Offer only eligible for Barclaycard customers.

Compare FreshBooks to Other Options

Wondering how FreshBooks stacks up? The short answer is FreshBooks has everything you need to run your business better, while being ridiculously easy to use. The long answer? Check out these comparisons for a full breakdown.

QBO vs FreshBooks | Xero vs FreshBooks

Sage vs FreshBooks | FreeAgent vs FreshBooks

Offer only eligible for Barclaycard customers.

Customer Reviews Tell Why 30+ Million

People Have Used FreshBooks

“I think having FreshBooks makes us look even more professional. Of course, we are professionals, but it reinforces our offering by giving our customers that security, professionalism, and ease of use.”

MARC HARBOURNE

CO-OWNER OF F.B. & SONS

“I learned a long time ago that in this business I could waste my life checking how much time I’ve spent with a client. Time Tracking allows us to record and charge for this time accurately and fairly for both parties.”

DAVE CROMIE

FOUNDER OF SEADOG IT

“When I started the partnership, I knew FreshBooks would be our tool of choice. We also use it for time tracking, invoicing, and expenses, specifically when we want to pass those expenses through to clients.”

GRAHAM PUGH

CO-OWNER OF PROPEL CLEAN ENERGY PARTNERS

Award-Winning Customer Service

- Help From Start to Finish: Our Support team is highly knowledgeable and never transfers you to another department.

- 4.8/5.0 Star Reviews: Yup, that’s our Support team approval rating across 120,000+ reviews

- Global Support: We’ve got over 100 Support staff working across North America and Europe

Terms and Conditions

The approval of your application depends on your financial circumstances and borrowing history. Terms and conditions apply.

*Offer only eligible for Barclaycard customers.

**Transactions need to be taken before 6pm and will be paid the next business day.

FreshBooks is remunerated by Barclaycard for successful introductions that result in Barclaycard Payment Solutions providing merchant acquiring or gateway solutions to a member