Payment Processor: Overview and Top 5 Picks for 2025

Having the capability to accept payments is essential for any business, whether you’re accepting money in cash, online, or through your customer’s mobile devices. A key differentiator can be offering an easy checkout experience.

That’s why using the right payment processor for your business needs is important. It will enable secure and efficient transactions between your customers and your business, while offering a wide variety of payment methods for your clients to choose from. In this article, we’ll explore the pros and cons of some of the top Canadian payment processors, so you can make a better informed decision about which processor to choose.

Key Takeaways

- A payment processor is a company that securely handles electronic transactions for a business, including credit and debit card transactions.

- Payment processing companies work by facilitating communication between merchants and banks to make payments possible through online checkout pages or links, card readers, or even specialized smartphone hardware.

- Fees for payment processing vary depending on your business and its needs.

- A business needs to look for security, customer service, pricing, types of cards handled, fraud protection, and service methods in a payment processor.

- The choice of a payment processor depends on your business and its needs. Research and knowledge will help you choose the best one for you.

Table of Contents

- What is a Payment Processor?

- How Payment Processors Work

- Top 5 Canadian Payment Processors

- Fees to Expect

- How to Choose the Best Payment Processor for Your Business

- Leverage FreshBooks for Efficient Payment Processing

- FAQs on Payment Processors

What is a Payment Processor?

A payment processor is a vendor that manages electronic transactions between customers and businesses, handling the complexities that come with processing payments via credit cards, debit cards, or digital wallets.

In short, payment processors move card data from a website, checkout links, or card terminal to financial institutions in a secure manner, allowing customers to make easy online payments in seconds.

Payment processors also help secure online payments on both ends, using data encryption and firewalls to protect customer data, while ensuring the customer has the funds in their bank accounts or credit card limits to pay for the goods and services they’ve purchased.

How Payment Processors Work

Payment processors do the bulk of the heavy lifting when it comes to online transactions, enabling businesses to accept a variety of payment types quickly and securely, while at the same time making it easier for the exchange of money from the customer to the vendor.

The way many payment processors work is as follows:

1. The Customer Makes a Purchase

A customer decides to purchase goods or services from a company and chooses which payment method they want to use. This could include credit cards, debit card payments, payments through mobile wallets, and other forms of payment. They will present their card or mobile device in person, or click on a payment link and enter their details online to make the purchase.

2. The Payment Processor Facilitates the Exchange

The payment processor receives the transaction details and connects to a payment gateway tool to connect to the client’s bank or credit card company, as well as the business’s bank. This is usually done through physical action, like keying in the credit card number, tapping, or swiping a card.

3. All Information Is Encrypted and Secure

Payment processors use tools to check for fraudulent activity throughout the transaction, and they also employ PCI compliance, as well as tokenization and encryption methods to keep the customer data secure.

4. The Transaction Is Authorized and Authenticated

Authorization of a transaction means that the issuing bank (the customer’s bank) verifies that the customer has sufficient funds to make the transaction. Authentication means the customer’s identity has been sufficiently verified, to the point where fraud is unlikely and the transactions have been made by the cardholder themself.

5. The Business Finalizes the Transaction with the Customer

After the transaction has gone through, and the merchant sees that the client has the funds to pay for the goods and services purchased, they will then complete their end of the transaction with the customer.

6. The Payment Processor Completes the Money Transfer

Once the card network lets the payment processor know the payment request is approved, the payment processor can transfer the funds to the merchant’s bank account.

7. The Seller Receives the Funds

The payment processor logs payment into the merchant’s bank account and allows for the deposit of funds from the customer’s bank or credit card company. Access to the funds can take a few minutes to a few days depending on the payment provider and the banks in question.

8. Chargeback Support Is Provided If Needed

Many payment processors provide additional support to businesses to handle chargebacks and payment disputes. Chargebacks occur when customers are not satisfied with their purchase or believe the purchase was made without their consent and demand their money back. Without proper support, chargebacks can be costly.

Top 5 Canadian Payment Processors

If you’re looking for a new payment processor, these are some of the best options available in Canada. Take a look at each, and decide what fits your business’s needs.

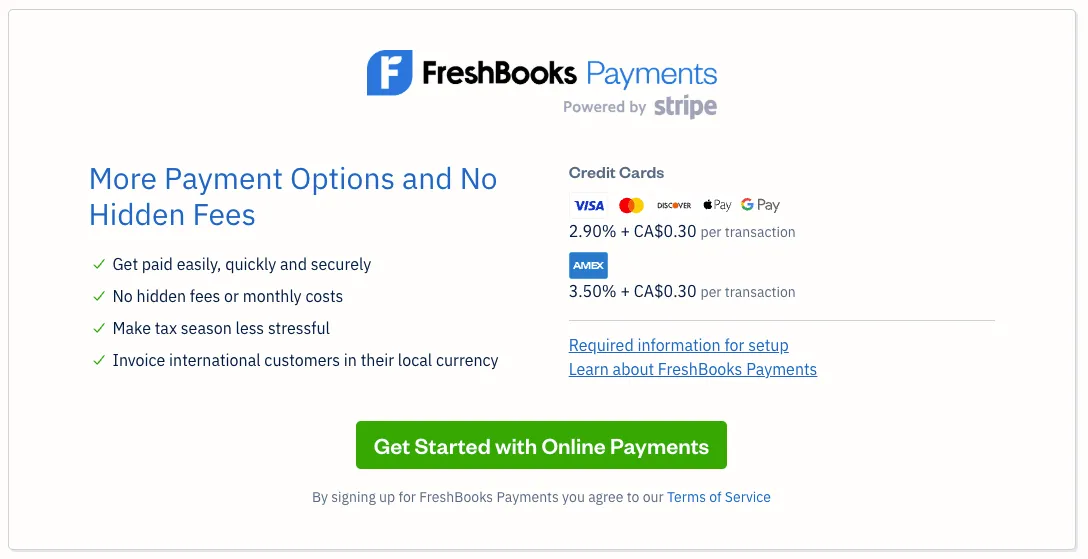

1. FreshBooks Payments

FreshBooks Payments powered by Stripe is the top online payment processor for small and medium-sized businesses, thanks to its seamless integration with FreshBooks accounting software, leading to streamlined financial processing and invoicing capabilities.

Using FreshBooks Payments is cost-effective and time-saving, with benefits suitable for small to medium-sized businesses like freelancers, consultants or agencies, construction companies, and small tech firms.

Using this powerful software allows business owners to focus on running their business, rather than worrying about getting paid. You can accept a variety of payment methods, including credit cards, debit cards, digital wallets like Apple Pay and Google Pay, and more. Try FreshBooks for free.

Features

- Easy integration with the all-in-one FreshBooks suite for simple billing, accounting, and payroll capabilities

- FreshBooks Payments can process international cards with ease

- Excellent customer service, with phone and online help available when you need it

Pricing

- No hidden fees with FreshBooks Payments

- FreshBooks Payments is included in all FreshBooks subscription plans

- Add-ons like Advanced Payments are available for a monthly cost

- Access to lower transaction fees when subscribing to the Select FreshBooks Plan

- A free 1-month trial of FreshBooks is available. Save an additional 10% by paying annually instead of monthly

2. Clearly Payments

Clearly Payments is a Canadian payment processor located in Vancouver. They aim to be Canada’s best possible service provider, with low fees and excellent customer service. Clearly Payments also has an excellent relationship with its customers as evidenced by their rave reviews.

Features

- Can process Canadian and United States payments, with help making cross-border payments with low international transaction fees

- Quick and friendly customer service available by phone or email

Drawbacks

- It can be complex and time-consuming to set up your account and payments

Pricing

- Flat-rated monthly charge with no extra fees taken out throughout the month

- No termination fees

3. Square, Inc.

Square is one of the biggest names in payment processors, especially for small businesses, with its low fees. The biggest issue with Square is its lack of customer support, but if you’re a small merchant, Square is still an excellent provider. Most of the process is easy to get through, and customer support should rarely be needed.

Features

- Simple setup

- Hardware like payment terminals and registers are included in many plans

- A variety of tailored services like Square Restaurant or Square Appointments are available

- Easy third-party app integrations

Drawbacks

- Customer support is hard to obtain, and there’s no phone support

- Accounts are sometimes closed without warning or reasons provided

Pricing

- No signup or cancellation fees for most businesses

- No monthly fees

- Affordable fee structure

- The more transactions processed, the more expensive it is

5. Moneris

Moneris is another Canada-based payment processor. They were founded in 2000 and are based in Toronto. They are best suited for larger businesses with higher fees and a tiered pricing system.

Features

- 24/7 customer service

- A wide range of hardware is available to rent or buy

- All transactions are processed in-house, making it easier to deal with holds or chargebacks

Drawbacks

- High setup fees

- 2- to 4-year-long contracts are required, with high cancellation fees at around $250

Pricing

- Monthly fee for equipment

- Third-party app capabilities cost extra

6. First Data

First Data is best known for selling and reselling hardware terminals. First Data is the largest payment processor in the world and is internationally established.

Because they lack transparency, reviews of First Data tend to be based on contract fine print. Customers have problems with the contracts that they’ve signed, as they miss key points. First Data may be a great option for large businesses, but small businesses are better off with another processor.

Features

- Excellent for international transactions

- Point of Sale (POS) equipment buying and leasing options available

Drawbacks

- High cancellation, monthly PCI, chargeback, and address verification fees

- A lack of transparency surrounding pricing

- Contracts are typically at least 4 years long

Pricing

- Pricing models depend on your business’s needs

- Variable contract terms

Fees to Expect

As a business owner, expenses are always a hot topic. Since payment processors are a service, of course, there are fees to be expected. Each provider has different fees associated with their services, but the most common ones are listed below:

- Start-up fee: The fee charged for getting the software set up with your business

- Transaction fee: The fee is taken each time a transaction takes place

- Interchange fee: A fee exchanged between banks for processing card payments

- Termination fee: Charged when service with a payment processor is canceled

- Disputes and chargebacks: Fees for disputes are charged if a cardholder contests any charges made from their account, and the money is returned to their payment card

Most payment processors will charge some of these fees, but very few charge all of them. One can be a low-volume payment processor with flat rate pricing, others charge a monthly fee with a set number of transactions, and still, others will charge for services like cash advances. Knowing what kinds of fees will be charged makes deciding on a payment processor easier.

How to Choose the Best Payment Processor for Your Business

Finding the right payment processor is about more than just saving your business money in fees. You’ll also want to consider the customer experience, and how well it integrates with your business processes now, and in the future as you grow your company in the future. The following are some of the top factors to keep in mind when choosing your business’s payment processor.

Payment Methods

Payment processors come with different ways to accept payments online. Some offer integration with platforms you may already use, while others have proprietary hardware. Whether you have your business online or need a point-of-sale terminal, payment processors offer a variety of options. Some of the most popular are:

- Online terminals (virtual terminals)

- Traditional credit card terminal

- Connected card reader

- Digital wallets (Google Pay or Apple Pay, for example)

- Full cash drawers and setups

Transparent Pricing

No one enjoys hidden fees. When working towards obtaining a payment processing service, make sure that they are transparent. The more money charged for transactions or monthly fees, the less your business sees.

Customer Service

To keep satisfied customers, you must be a satisfied customer yourself. When choosing a payment processor, be sure to check reviews. You want to be able to contact them in a variety of ways should something go wrong. You also want customer service to be responsive to customer complaints. The worst-case scenario is having a customer’s payment go wrong and being unable to help them. Customer insights in the form of reviews and recommendations can help you choose.

Compliance And Security

When deciding on the right payment processor for your business, it’s imperative to do your due diligence and check that the company meets industry security standards, like PCI DSS rules, and that your customer’s information will be protected through encryption and tokenization.

The top payment processors also give small businesses fraud detection and prevention services using customer verification measures to prevent fraud like identity theft, credit card fraud, and account takeovers.

Flexible And Scalable

Choosing a payment processor that’s flexible, and can grow with you as your business grows will help you avoid having to switch systems in the future. Think about your needs in 5 or 10 years before making your final decision, as you’ll need a processor that can meet your needs, whether you have 5 customers or 5,000.

Leverage FreshBooks for Efficient Payment Processing

Payment processors are a crucial part of any business’s income because they handle all of the technical aspects of taking electronic payments. When selecting a payment processor, business owners might want to look for flexibility, good customer service, a reasonable fee structure, and how easily the service can be added to your accounting system.

FreshBooks Payments is one of the best payment processors Canada has to offer to small and medium-sized businesses, offering seamless integration with accounting and payroll software for better financial organization. Receive payments quickly and securely, while offering your customers flexible payment options including credit card payments, recurring billing, and checkout links.

FAQs on Payment Processors

Which payment gateway is best in Canada?

The best Canadian payment gateway depends on the business. One of the largest payment processors is Moneris, but if your business is smaller, you may want to choose a local processor with a full-service menu of accounting options like FreshBooks. You can try their software and support for free here.

What is the most common payment method in Canada?

Canadians often use credit cards and debit cards that draw funds directly from their bank accounts. The most common credit cards are Visa, Mastercard, AMEX, and Discover.

How much do payment processors make per transaction?

Processing fees for credit card processing range depending on the provider and your chosen plan. Depending on the situation, card, and company, the charges can vary.

How do I start my own payment processing?

If you’re looking for the right payment processing service to allow your business to securely accept card payments, the best way to get started is to find the service that matches your company’s unique needs. Once you find the right processor, you can start taking payments quickly and easily in person and online in just a few business days.

Which is the best payment processor for small businesses in Canada?

FreshBooks Payments is the best option for small businesses in Canada. With payment processing, seamless invoicing, and support for multiple payment options, it’s the software that saves small business owners time and money.

Reviewed by

Kristen Slavin is a CPA with 16 years of experience, specializing in accounting, bookkeeping, and tax services for small businesses. A member of the CPA Association of BC, she also holds a Master’s Degree in Business Administration from Simon Fraser University. In her spare time, Kristen enjoys camping, hiking, and road tripping with her husband and two children. In 2022 Kristen founded K10 Accounting. The firm offers bookkeeping and accounting services for business and personal needs, as well as ERP consulting and audit assistance.

RELATED ARTICLES

What Is Inventory Management? A Guide to Techniques & Methods

What Is Inventory Management? A Guide to Techniques & Methods Credit Vs Debit Card: What’s the Difference?

Credit Vs Debit Card: What’s the Difference? How to Start a Daycare: 12 Simple Steps

How to Start a Daycare: 12 Simple Steps How to Estimate Catering Jobs in Canada: A Pricing Guide for Small Businesses

How to Estimate Catering Jobs in Canada: A Pricing Guide for Small Businesses What to Know for Legally Starting a Business in Canada

What to Know for Legally Starting a Business in Canada