How to Calculate HST for Small Businesses

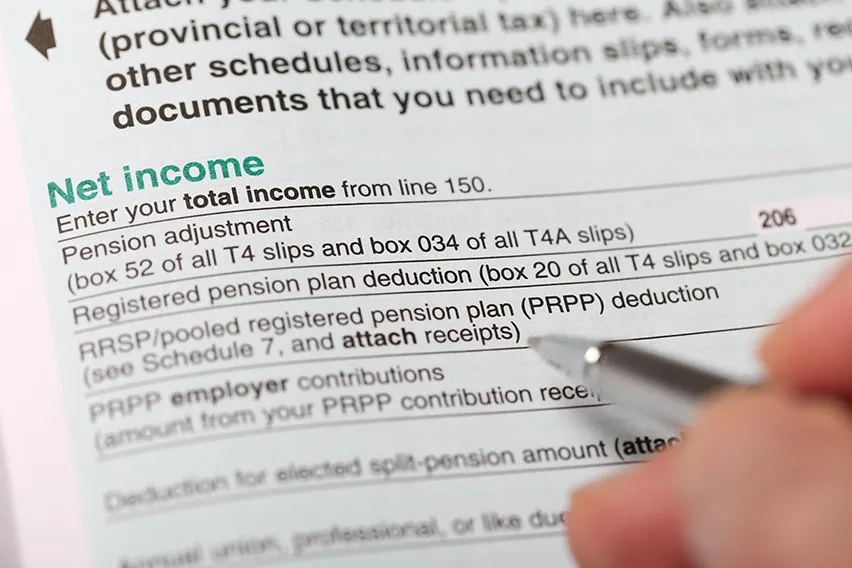

When you’re running a small business, it can be quite confusing to wrap your head around all of the financial information when it comes to taxes.

However, it’s a necessary evil, and understanding what taxes you have to pay is an important part of running a business.

One of the taxes that Canadian business owners have to pay is HST.

But what exactly is a harmonized sales tax HST? We’ll take a closer look at the definition and help you to figure out how to calculate harmonized sales tax for small businesses.

Key Takeaways

- HST, or harmonized sales tax, is a consumption tax paid by local consumers and businesses in Canada.

- HST works by combining the nation’s federal goods and services tax and the other various provincial sales taxes.

- HST is paid by consumers when they come to the point of sale

- To calculate sales tax, you combine the retail price with the HST percentage amount of that product amount

- There are four exceptions for HST. They are exceptions for small suppliers, exempt and zero-rated goods and services, selling goods or services to another province or territory, and selling goods and services outside Canada.

Here’s What We’ll Cover:

What Is Harmonized Sales Tax (HST)?

How to Calculate Harmonized Sales Tax

What Is Harmonized Sales Tax (HST)?

Harmonized sales tax, or HST, is a consumption tax paid by local consumers and businesses in Canada. It combines the nation’s federal goods and services tax and the other provincial sales taxes.

At the current time of writing, five Canadian provinces use the HST. These provinces are:

- Newfoundland & Labrador: Joined in 1997

- New Brunswick: Joined in 1997

- Nova Scotia: Joined in 1997

- Ontario: Joined in 2010

- Prince Edward Island: Joined in 2010

Though some disagree with the idea of a harmonized tax system, some people argue that it improves the competitiveness of Canadian businesses. This is through simplifying their administrative costs, leading to lower prices for consumers. It is argued this may help with things like basic groceries and other such essentials.

How Does HST Work?

The HST is paid by consumers when they come to the point of sale. The seller will collect the tax proceeds by adding the current HST rate to the cost of the goods or services. They would then pass on the collected tax to the tax division of the federal government.

This division is known as the Canada Revenue Agency or the CRA. The CRA then later allocates the provincial portion of the collected tax to the respective province’s form of government.

How to Calculate Harmonized Sales Taxes

In the five provinces that charge full HST rates, you would charge the appropriate percentage of HST on goods and services.

The current HST rates at the time of writing this article are:

- Newfoundland & Labrador: 15%

- New Brunswick: 15%

- Nova Scotia: 15%

- Ontario: 13%

- Prince Edward Island: 15%

To calculate the HST, you’ll take the retail price time as the decimal version of the HST percentage. That number becomes your HST amount. You then add the retail price and HST amount to reach a total.

This formula works for HST on both products and services. You can do it manually or use a sales tax calculator to calculate sales tax and produce the correct amount.

You can obtain the HST extracted amount on a product by using this simplified formula:

Formula to be converted to Image

Alt text – HST Amount Formula

{Retail price – deposit) x HST% = HST amount

For example, let’s say that you are running a boutique clothing store and selling a skirt for $39.99.

If you were selling it in Newfoundland, you would calculate the price as follows:

Skirt: $39.99

HST @ 15%: $6.00

Total Price: $45.99

Whereas if you were selling the same skirt in Ontario, then the price would be:

Skirt: $39.99

HST @ 13%: $5.20

Total Price: $45.19

Are There Any Exceptions?

There are currently four exceptions for this tax ruling. They are:

- Exceptions for Small Suppliers

- Exceptions for Exempt and Zero-Rated Goods and Services

- Selling Goods and Services to Another Province or Territory

- Selling Goods and Services Outside of Canada

Exceptions for Small Suppliers

If your business qualifies as a small supplier, then there are some provinces where you won’t have to add any taxes. But be sure to check if your province runs the exemptions.

To qualify as a small supplier, your total taxable business revenue before expenses must be $30,000 or less in the past financial year.

If this is the case, then you do not have to register to collect and pass out GST or HST. However, you may want to do it anyway so that you can recover GST HST on expenses paid through your input tax credits.

Exceptions for Exempt and Zero-Rated Goods and Services

There are some forms of goods and services that are exempt or zero-rated. This means that you do not charge HST on the customer invoice. Follow this government link to see what goods and services are considered exempt or zero-rated.

Selling Goods and Services to Another Province or Territory

If you are selling your goods and services to a province or territory outside of your own, then you will charge GST or HST. British Columbia and some other provinces and territories use PST and Québec sales tax differs, so be sure to know your tax rates. The GST calculator is also a handy tool for deciphering taxes.

The destination is determined by the place the goods change hands legally. If someone sends a courier to pick something up, the goods are determined to have changed hands at your dock, even if you are shipping to another province.

So, for example, let’s say you are in Labrador, where the rate is 15% but are selling to Ontario. In this case, you will then charge Labrador’s HST rate of 15%, not Ontario’s 13%.

Selling Goods and Services Outside of Canada

You do not need to charge GST or HST on anything shipped from Canada to another country. However, you may have to pay export or excise taxes if you sell products such as cigarettes and alcohol. Products like these are subject to excise taxes from your provincial and federal governments.

Conclusion

Understanding what taxes you do and don’t have to pay is vital to running your small business.

The harmonized sales tax is a relatively easy form of tax to figure out. As long as you have your percentages correct, then there should be no major issues.

If you struggle to keep up with your numbers, consider utilizing accounting software such as FreshBooks. Our accounting solution is here to support you and your small business.

Click here to try FreshBooks for free.

Are you looking for more business advice on everything from starting a new business to new business practices? Then check out the FreshBooks Resource Hub.

FAQs on Calculating HST

When Did HST Come Into Effect?

HST was introduced to Canada in 1997. Before HST took effect, Canadian sales taxes were divided into two separate categories. This was the federal sales tax, or GST, and the provincial sales tax, or PST.

Each province had its own provincial sales tax rates, resulting in significant differences in the sales taxes across Canada. The idea behind HST was to streamline the tax system by combining them into a single consistent tax across all provinces.

How do you calculate quick-method HST?

When using the special quick method, you still charge the HST at the applicable rate on your taxable supplies and services. To calculate the amount of net tax to remit, you multiply the amount of your GST/HST-included supplies for the reporting period by the remittance rate or rates that apply in your situation.

Is HST always 13 percent?

No. The HST rate is only 13% in Ontario. The rate for HST is 15% in Newfoundland & Labrador, New Brunswick, Nova Scotia, and Prince Edward Island.

How do you calculate backward HST?

To calculate sales tax backward, follow this formula. The price before HST is equal to the total price with tax minus the retail sales tax. The sales tax rate equals the sales tax percentage divided by 100. Take the total price with tax and divide it by 1 + the sale tax rate. That result equals the original price before tax was applied, meaning the remainder is the HST amount. You can use a sales tax calculator to quickly get the correct amount.

For example, if the total paid for a shirt in Ontario is $33.89:

The total price = $33.89

The Ontario HST rate divided by 100 = 0.13

$33.89 divided by 1.13 = $29.99

Meaning the retail price was $29.99 and the 13% HST is equal to $3.90.

Are GST and HST the same number?

Goods and services tax (GST) and harmonized sales tax (HST) are value-added taxes the federal government levied. The GST applies nationally. The HST includes the provincial portion of the sales tax but is administered by the Canada Revenue Agency (CRA) and is applied under the same legislation as the GST.

Reviewed by

Kristen Slavin is a CPA with 16 years of experience, specializing in accounting, bookkeeping, and tax services for small businesses. A member of the CPA Association of BC, she also holds a Master’s Degree in Business Administration from Simon Fraser University. In her spare time, Kristen enjoys camping, hiking, and road tripping with her husband and two children. In 2022 Kristen founded K10 Accounting. The firm offers bookkeeping and accounting services for business and personal needs, as well as ERP consulting and audit assistance.

RELATED ARTICLES

What are Pro Forma Financial Statements?

What are Pro Forma Financial Statements? What Is a Weighted Decision Matrix & How Do You Use It?

What Is a Weighted Decision Matrix & How Do You Use It? Profitability Ratios: Definition & Types

Profitability Ratios: Definition & Types What is the Cost Principle? Definition & Meaning

What is the Cost Principle? Definition & Meaning How to Calculate Net Income: Examples & Formula

How to Calculate Net Income: Examples & Formula