Cost of Goods Sold: What Is It and How To Calculate

Cost of Goods Sold (COGS) is the direct cost of a product to a distributor, manufacturer, or retailer. Sales revenue minus cost of goods sold is a business’s gross profit. The cost of goods sold is considered an expense in accounting. COGS are listed on a financial report. There are two ways to calculate COGS.

Key Takeaways

- COGS refers to the direct costs of goods manufactured or purchased by a business and sold to consumers or other businesses.

- Operating expenses (OPEX) are the day-to-day costs of running your business not included in your COGS.

- By accurately calculating your COGS, you can precisely measure the value of your business.

- You need the precise COGS to write off expenses.

- To calculate COGS, you must take into consideration all expenses directly involved in the manufacture and production of your goods, as well as some overhead expenses.

In this article, we’ll cover:

What Is the Cost of Goods Sold (COGS)?

What Is Included in Cost of Goods Sold?

Importance of Cost of Goods Sold

What Is the Cost of Goods Sold Formula?

Accounting for Cost of Goods Sold

Cost of Goods Sold vs. Operating Expenses

What Is the Cost of Goods Sold (COGS)?

Cost of Goods Sold is also known as “cost of sales” or its acronym “COGS.” COGS refers to the direct costs of goods manufactured or purchased by a business and sold to consumers or other businesses. COGS counts as a business expense and affects how much profit a company makes on its products.

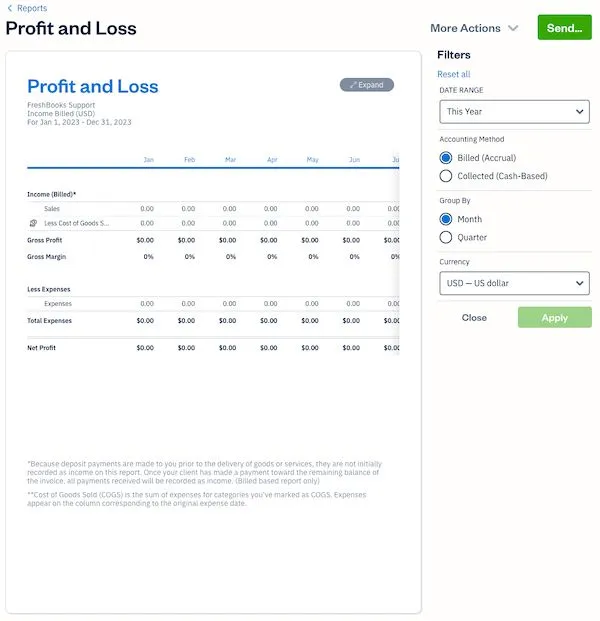

COGS show up on a business’s income statement or profit and loss statement. They are one of the top financial metrics in accounting. They’re used to report income for a specific accounting period, such as a year, quarter, or month. COGS usually show directly beneath “sales” or “income.”

Here’s an example:

COGS and Taxes

Both the Old UK generally accepted accounting principles (GAAP) and the current Financial Reporting Standard (FRS) require COGS for Income Tax filing for most businesses. The terms ‘profit and loss account’ (GAAP) and ‘income statement’ (FRS) should reflect the COGS data.

Companies that make and sell products or buy and resell goods must calculate COGS to write off the expense. The resulting information will have an impact on the business tax position.

Therefore, a business needs to determine the value of its inventory at the beginning and end of every tax year. Its end-of-year value is subtracted from its start-of-year value to find the COGS. The below section deals with calculating the COGS.

What Is Included in Cost of Goods Sold?

The items that make up the costs of goods sold include:

- Cost of items intended for resale

- Cost of raw materials

- Cost of parts used to make a product

- Direct labour costs

- Supplies used in either making or selling the product

- Overhead costs, like utilities for the manufacturing site

- Container costs

Importance of Cost of Goods Sold

COGS is an important metric in your business. It helps you set prices, determine if you need to change suppliers, and identify profit loss margins. But it also helps determine how efficiently you are running your business. Are you able to increase staff wages? Do you need a cheaper location? Can you afford to update tools or renovate your business space? These are all questions where the answer is determined by accurately assessing your COGS.

Poor assessment of your COGS can impact how much tax you’ll pay or overpay. It can also impact your borrowing ability when you are ready to scale up your business. As you can see, calculating your COGS correctly is critical to running your business.

What Is the Cost of Goods Sold Formula?

Method One

You can calculate the cost of goods sold by using the following formula:

(Beginning Inventory + Purchases/Production of the Period) – Ending Inventory = COGS

At the beginning of the year, the beginning inventory is the value of inventory, which is the end of the previous year. Cost of goods is the cost of any items bought or made over the course of the year. Ending inventory is the value of inventory at the end of the year.

This formula shows the cost of products produced and sold over the year.

Method Two

The cost of goods made or bought adjusts according to changes in inventory. For example, if 500 units are made or bought, but inventory rises by 50 units, then the cost of 450 units is the COGS. If inventory decreases by 50 units, the cost of 550 units is the COGS.

Uses of COGS in Other Formulas

The Cost of goods sold helps calculate inventory turnover, which shows how often a business sells and replaces its inventory. It’s a reflection of production level and sell-through. The formula for calculating the inventory turnover ratio is:

COGS / Average Inventory = Inventory Turnover Ratio

The COGS is also used to calculate gross margin.

Accounting for Cost of Goods Sold

The price to make or buy a product for resale can vary during the year. This change needs to be accounted for to meet the reporting requirements of the income statement. There are four methods:

- Specific Identification: This method is generally used for high-dollar products to match the actual costs to the specific items in inventory.

- FIFO: or “first in-first out.” The first goods made or purchased are the first sold.

- Weighted average cost: The average cost per item is calculated by giving a weighted value to items in the data set.

Note: LIFO or ‘last in-first out’ is prohibited by the FRS but is still used in the US, despite its controversy.

FRS allows companies to choose which method they use. Each method has pros and cons. For example, the weighted average can result in a lower stock valuation because it doesn’t account for the ebb of sales and replacement of products, nor does it reflect the efficiency of a business. It is, however, the most difficult to manipulate. FIFO and specific identification track a single item from start to finish. They can be more labour-intensive methods.

For each of the above accounting methods, a certain amount of accounting acumen helps when gathering the information for your income statement. FreshBooks offers COGS tracking as part of its suite of accounting features. It can help you track and categorise your expenses more accurately. Accurate records can give you peace of mind that you are on track come reporting time.

Cost of Goods Sold Example

An e-commerce site sells fine jewellery. To find the COGS, a company must find the value of its inventory at the beginning of the year, which is the value of inventory at the end of the previous year.

Then, the cost to produce its jewellery throughout the year adds to the starting value. These costs could include raw material costs, labour costs, and shipping of jewellery to consumers.

Finally, the business’s inventory value subtracts from the beginning value and costs. This will provide the e-commerce site with the exact cost of goods sold for its business.

Cost of Goods Sold vs. Operating Expenses

The meaning of COGS differs significantly from operating expenses (OPEX). COGS are the expenses associated with the products sold by your business. OPEX refers to the day-to-day cost of running your business not included in your COGS. OEX are the remaining costs after COGS, like your salaries, wages, lease, business travel, utilities, and property tax.

Your operating costs are generally things a business owner has more control over in the sense that not all businesses require a storefront separate from a manufacturing space, business travel or a salaried sales force. COGS include market-driven costs like lumber, metal, plastic, and other supplies that have a cost set by someone else and are, therefore, less under your control.

Conclusion

The costs of goods sold are an integral facet of any business that purchases products for manufacturing or redistribution to the consumer. COGS must accurately reflect the reality of the costs associated with your product so that proportionate pricing can be applied. It is a requirement of your income tax filing.

Your COGS is the primary consideration by bankers and investors. By understanding COGS and the methods of determination, you can make informed decisions about your business. With FreshBooks accounting software, you know you’re on the right track to a tidy and efficient ledger.

FAQs on Cost of Goods Sold

Is cost of goods sold an asset?

COGS is not an asset (what a business owns), nor is it a tax liability (what a business owes). It is an expense. Expenses are part of the cost of doing business. Expenses are one of the five elements of financial statements: assets, liabilities, expenses, equity, and revenue.

How does the cost of goods sold affect profitability?

Cost of goods sold directly impacts profitability. The revenue generated by a business minus its COGS is equal to its gross profit. Higher COGS with disproportionate pricing can leave your business in a deficit position if the prices are too low or alienate consumers if the price is too high.

Are labour costs included in the cost of goods sold?

Some labour costs are included in the COGS but not all. Generally speaking, only the labour costs directly involved in the manufacture of the product are included. In most cases, administrative expenses and marketing costs are not included, though they are an important aspect of the business and sales because they are indirect costs.

Can the cost of goods sold be negative?

In theory, yes. There are very few cases. You would need to have more units sold/inventory sold than goods purchased or not have purchased any goods in an accounting period but also have returns of a product purchased in an earlier period. Then your (beginning inventory) + (purchases) – (ending inventory) would result in a negative. In most cases, it is a clerical error.

Are shipping and transportation costs included in the cost of goods sold?

The inbound freight and transportation costs of your materials should be worked into the cost of the materials. The cost of materials is included in the cost of goods. Outbound freight and transportation costs associated with sales and distribution are not included in COGS because they are not directly associated with manufacturing.

Reviewed by

Levon Kokhlikyan is a Finance Manager and accountant with 18 years of experience in managerial accounting and consolidations. He has a proven track record of success in cost accounting, analyzing financial data, and implementing effective processes. He holds an ACCA accreditation and a bachelor’s degree in social science from Yerevan State University.

RELATED ARTICLES

What Is Unearned Revenue? A Definition and Examples for Small Businesses

What Is Unearned Revenue? A Definition and Examples for Small Businesses W-8BEN-E: Guide for Foreign Entities Doing Business in the U.S.

W-8BEN-E: Guide for Foreign Entities Doing Business in the U.S. Accounting for Sales Tax: What Is Sales Tax and How to Account for It

Accounting for Sales Tax: What Is Sales Tax and How to Account for It Business Deductions for the Self-Employed: 12 Overlooked Tax Deduction Tips

Business Deductions for the Self-Employed: 12 Overlooked Tax Deduction Tips Billable Hours: What Are They and How to Calculate Them

Billable Hours: What Are They and How to Calculate Them Accounts Receivable and Accounts Payable: What’s the Difference?

Accounts Receivable and Accounts Payable: What’s the Difference?