Automated Invoicing and Financials Built For You

FreshBooks makes invoicing, expenses, payments, and everything else your business needs, fast and simple. Spend less time in your books and more time on growing your business.

Offer exclusive to this page only: Get 90% Off for 4 Months

Offer terms:

Offer Details:

Monthly Plans

Get 90% off a Lite, Plus, or Premium Plan for 4 months. After the 4-month promotional period, you will be billed at full price for the plan you have selected.

Yearly Plans

Total yearly price is billed at time of purchase. Get the 90% promotional discount + 10% yearly discount on a Lite, Plus, or Premium plan for 4 months. After the 4-month promotional period, the 10% yearly discount will continue for the remaining period of your yearly plan.

Promotional offers for both monthly and yearly plans are for a limited period. New customers only. Cannot be combined with other offers. No free trial period is included when availing of this promotional discount. FreshBooks reserves the right to change this offer at any time.

Offer terms:

Offer exclusive to this page only: Get 90% Off for 4 Months

Save Yourself More Time, Dollars, and Tax Time Stress

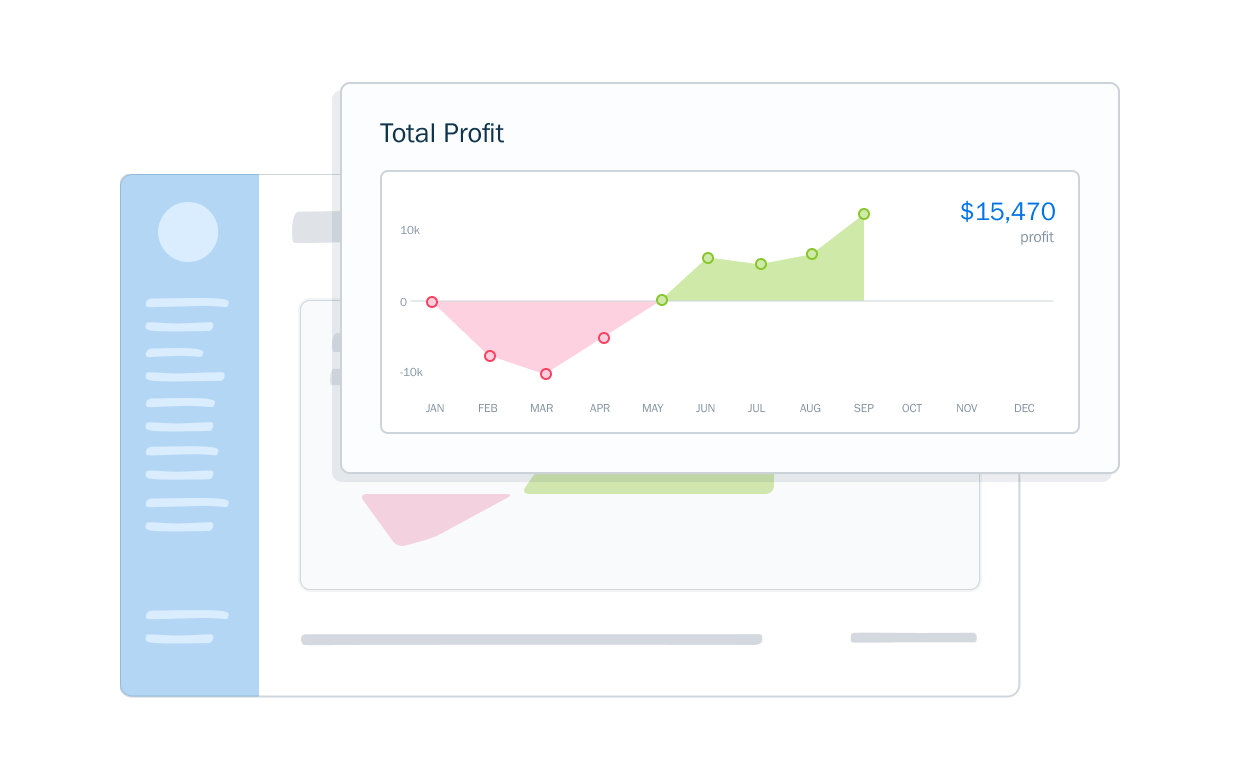

Take Back 11 Hrs a Week

Get so much more time to land clients, stay connected to projects, and grow your business.

Save up to $580 a Month

Untracked billable time adds up, and FreshBooks ensures you don’t miss a minute.

Track 365 Days of Tax Info

Tracking income and expenses year-round means quick and painless filing come tax time.

Easy-to-Use Accounting & Bookkeeping Features

What Our Customers Love Most About FreshBooks

“For me, FreshBooks’ value is not in the time that its saves, it’s in the value that it has added.”

JASMINE HOLMES

JASMINE DESIGNS

MELBOURNE, AUS

“Before using FreshBooks, I would make invoices on a Word doc and send to customers via emails. It was a manual process and required a lot of work. Every week, I would spend at least 5 to 6 hours on accounting. It was too time-consuming. After switching over to FreshBooks, the whole process became automatic, and I was able to focus more on my billable work.”

AHMED OMER

WEB DIGITAL

AUKLAND, NZ

“I love the FreshBooks invoicing; it’s easy to use, and the phone app makes life a lot easier.”

MICHAEL NAIRN

AUSTRALIA

VIA TRUSTPILOT

Award-Winning Customer Support

- Help From Start to Finish: Our Support team is highly knowledgeable and never transfers you to another department.

- 4.8/5.0 Star Reviews: Yup, that’s our Support team approval rating across 120,000+ reviews

- Global Support: We’ve got over 100 Support staff working across North America, and Europe

Frequently Asked Questions

Choose a plan specifically built for small business owners. But which one is right for small businesses? How do you know which accounting software features are right for your small business to save you time and get you paid faster?

FreshBooks plans are as follows:

- Lite Plan

- Plus Plan

- Premium Plan

- Select Plan

If you use an existing accounting software, switching is really easy. Just take a look at this case study about how a massive influencer agency switched to FreshBooks: Why This Scaling Digital Marketing Agency Made the Switch to FreshBooks—Twice

Cloud accounting software means an accounting software program is located on a secure server that makes it available to use on any computer or mobile device that connects to the internet.

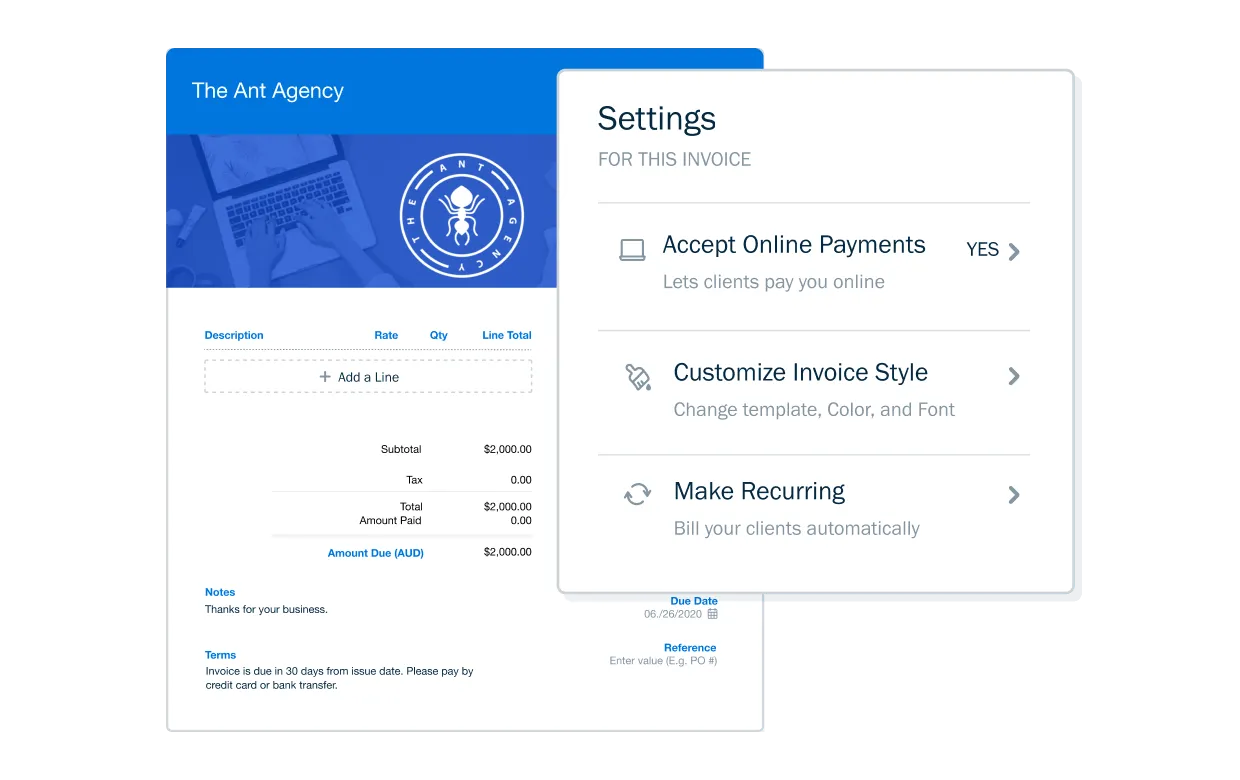

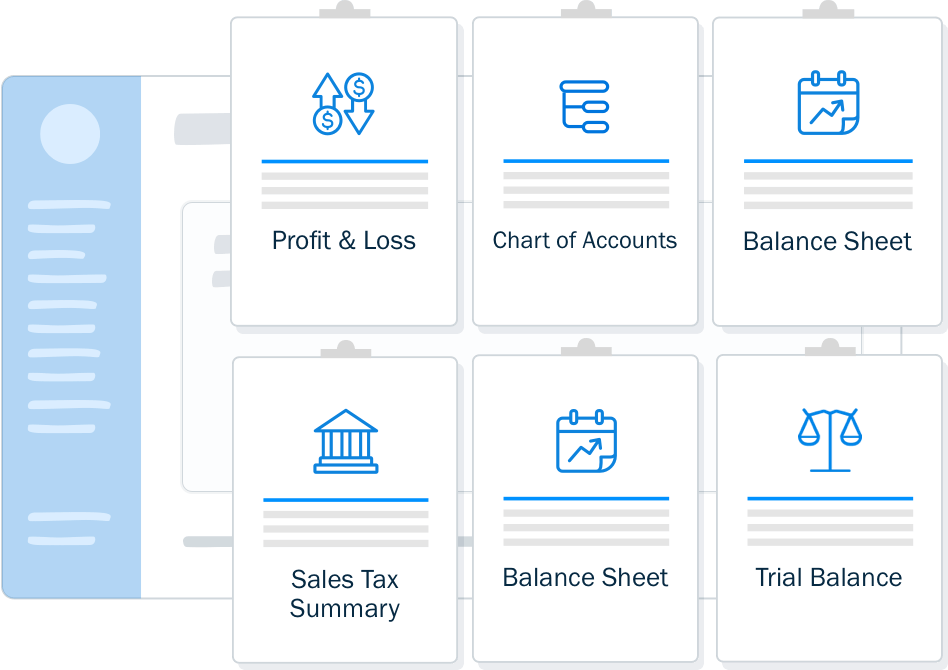

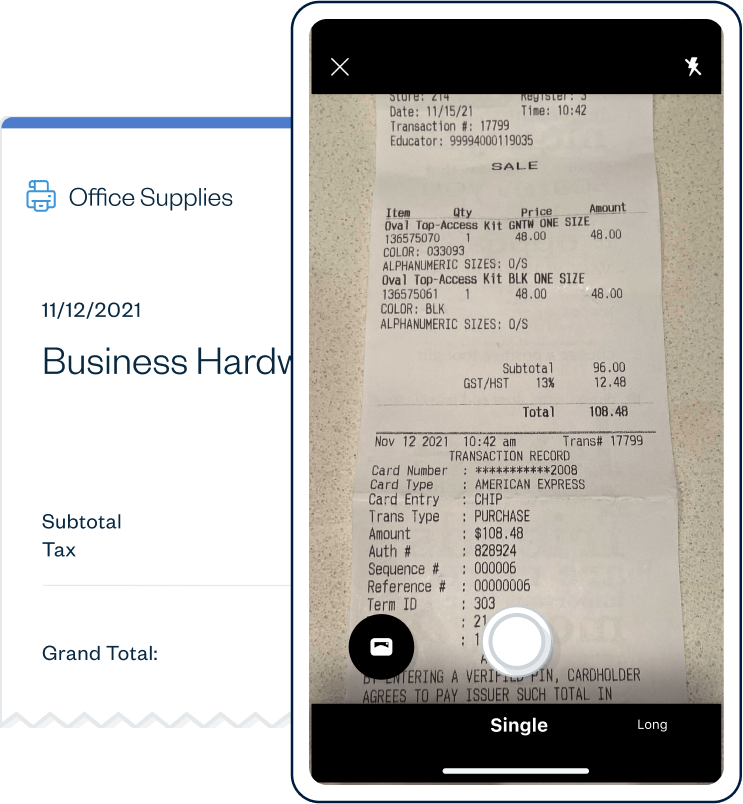

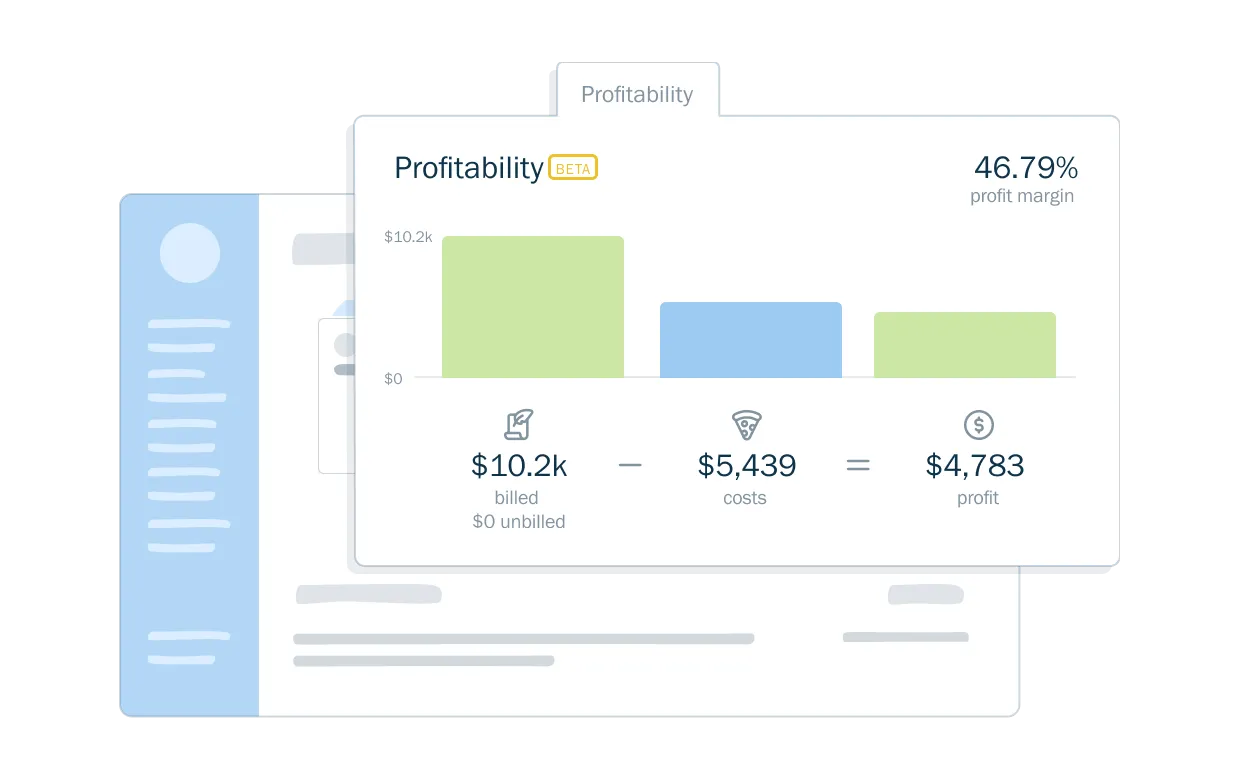

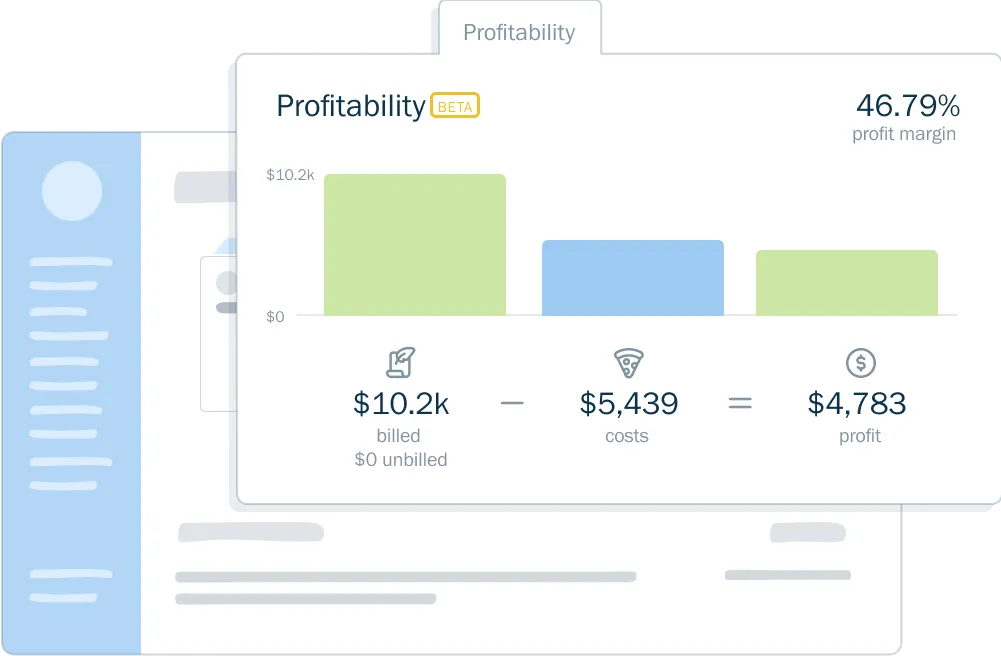

FreshBooks cloud accounting software includes all features like invoicing features, expense tracking, time tracking, online payments, industry-standard double-entry accounting, balance sheets, mileage tracking, project profitability, bank reconciliation, client retainers, and more.

All features are built to be easy to use for small business owners and their teams, clients, and accountants.

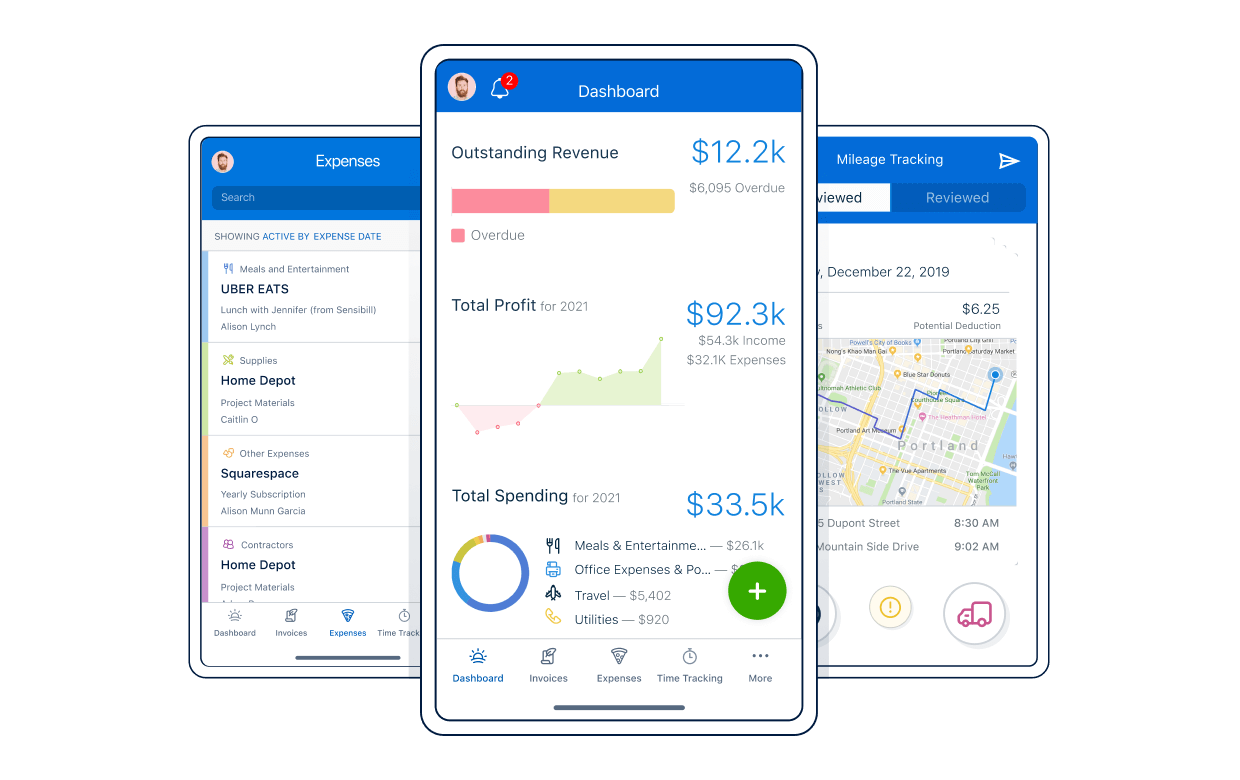

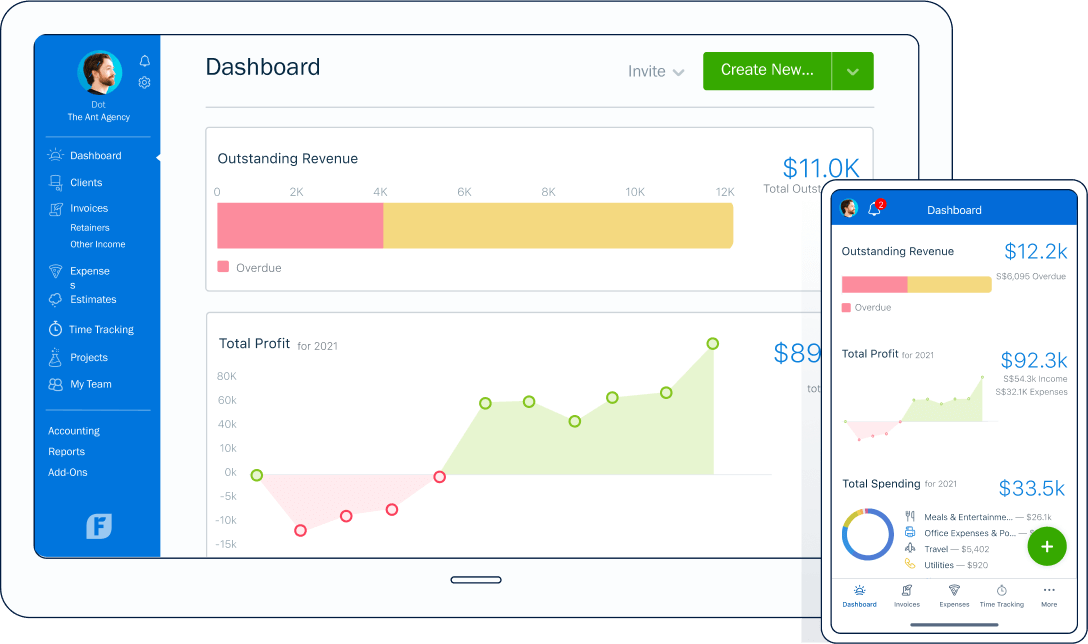

FreshBooks has an Android app (Android 4.2 or higher) as well as a mobile mileage tracking app.

Your information is synced across all devices from your desktop computer or laptop to the mobile app, so you can always access your data wherever you are, on whichever device you’d prefer.

FreshBooks also works in any web browser on all your devices (desktop computer, laptop, tablet, or phone).

You can also do much more than just bill clients on the go with mobile access.

Small businesses can run their business, create invoices, set up recurring invoices, log expenses, track financial data, get paid online, track revenue streams, connect bank accounts, and easily create new customers in their account…all on the mobile app. However, Some features (like reporting) are only available from your desktop.

Here’s some info about how the FreshBooks mobile helps business owners:

It really depends on you as a business owner. While FreshBooks is super-easy to use, when it comes to using all the tools available to you as a business owner, your accountant should definitely be at the top of your toolbox.

Not only does FreshBooks allow business owners to add their accountant to their FreshBooks account, but FreshBooks also has an Accountant Partner Program that pairs business owners with accountants. This ensures that businesses are matched with accountants that suit their specific needs.

Learn all about the Accountant Partner Program here.

Want to hear what it’s like to be part of the Accountant Partner Program? Here’s a great article: How FreshBooks’ Accounting Partner Program Helps CMA Lindsay Support Clients

If you’ve had a business for years, you’ve likely solved bookkeeping problems, tackled financial statements, managed tax payments, and even have a bit of an understanding of your financial health…to some extent. Still, if not, or you’re just starting here’s what you need to know.

Keeping tight books year-round will save you more time and effort than not doing a good job of it and waiting until tax time.

There’s no question that best-in-class accounting software like FreshBooks is essential to running a business these days. Beyond that, if you have a more complex business with lots of moving parts and growth, you likely don’t have time to take care of your books. Here are a few articles that can help:

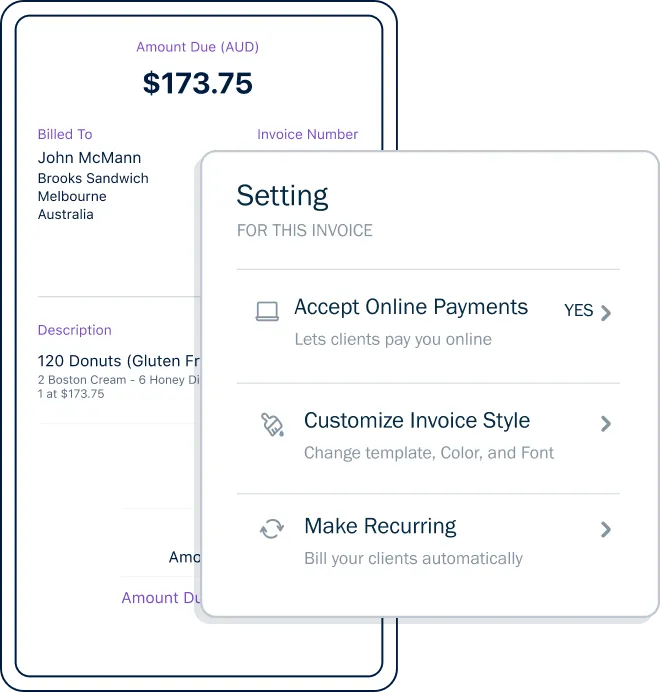

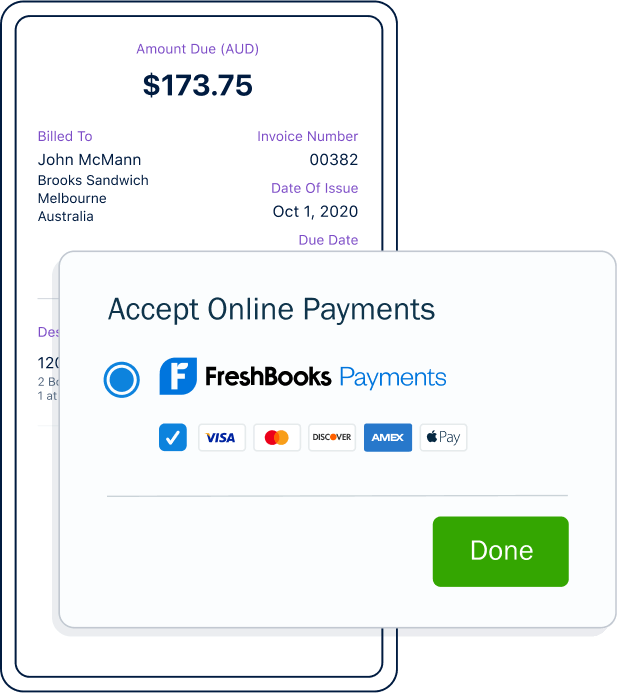

Clients receiving an invoice with line items for subscription-based products or services will find it easy to save their credit card, banking, or other payment details on the FreshBooks invoice software, so they’re automatically billed each time an invoice comes due. Imagine doing this without invoicing software—dealing with paper invoices and receipts and having to keep track of phone and address records separately.

Automatic invoicing in FreshBooks with Recurring Payments makes it simple for clients to pay and for you to accept payments for products or services rendered. Recurring Payments works together with Recurring Templates to automatically bill clients every time an invoice is generated and sent.

Saved payment information can permanently be removed if your clients want to opt-out of Recurring Payments at any time.

Ready to get paid faster? Use your invoice payment terms to get paid faster and save time.

Here’s a great example of the benefits of invoicing with FreshBooks: With FreshBooks, Web Designer Ahmed Saves 6 Billable Hours Every Week.

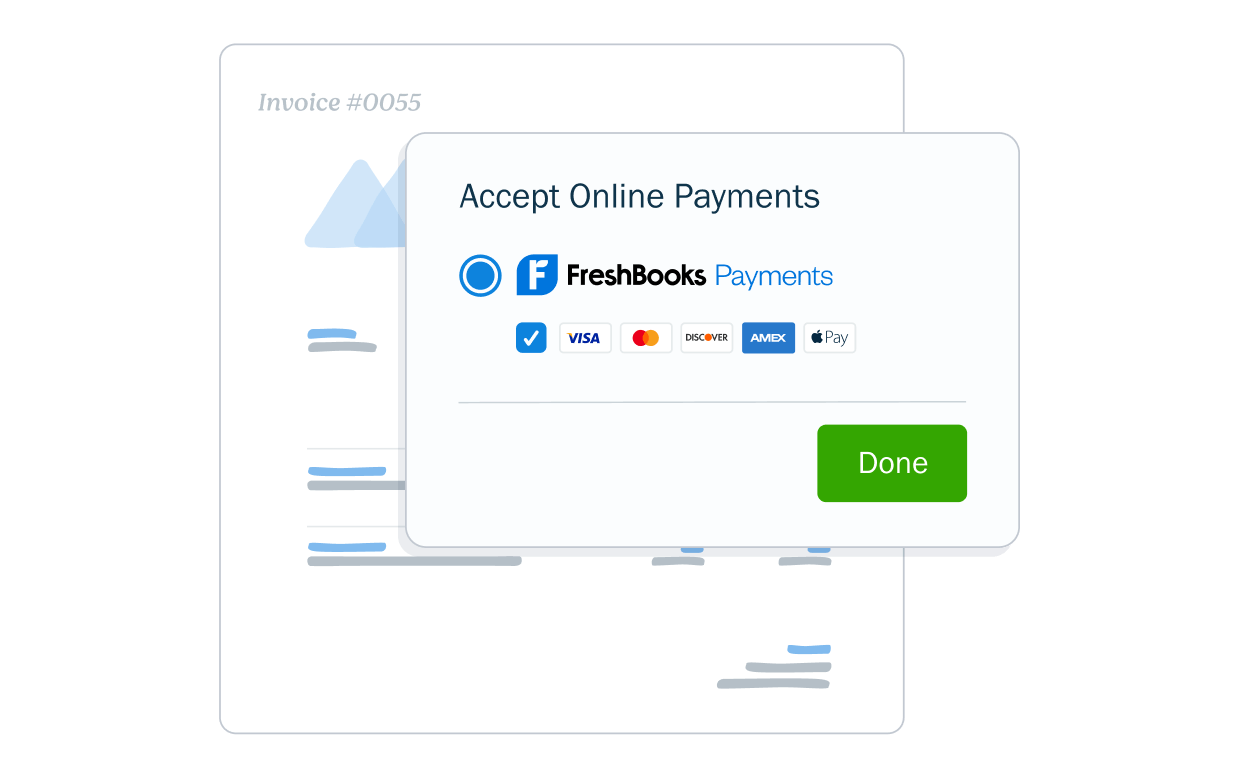

There are several payment options you can choose to accept through FreshBooks.

FreshBooks integrates with a number of payment processors so that you can choose the payment method that works best for you and your business. Whether you want to accept credit card payments, set up bank transfers, or get paid through FreshBooks Payments, you can easily set up the method you prefer. You can also set up different payment methods for different clients, depending on what suits them best.

The payment providers we utilize are WePay, Stripe, and PayPal in order to provide the following payment methods:

- Major credit cards

- Apple Pay

- Google Pay

- PayPal

- FreshBooks Payments

- Stripe

- Bank Transfers

FreshBooks offers small businesses amazing support. Our customer support team has won 11 Stevie Awards, which are international awards given to the world’s absolute best customer support department. While we all think our support team is the best, they have the hardware to prove it.

Support Hours: Monday – Friday

8am – 8pm ET (1pm – 1am GMT)

Toll-Free (North America): 1-866-303-6061

We also have a massive help center that has answers to just about every question we’ve ever been asked by our customers. Check it out here.

FreshBooks protects your personal information. For the security of transactions, we use the Secure Sockets Layer (SSL) protocol, which encrypts any information, such as credit card numbers and billing information, that you send us electronically. The encryption process protects your information by scrambling it before it is sent to us from your computer. In addition, your data is backed up automatically and is accessible from any device, so you can always stay connected and up-to-date.

Want to learn more? Check out this article from our blog: How Secure Is Your Data in the Cloud?