Start 2026 with huge savings + organized books 🎉 Get 60% off for 3 months. Buy now & save

60% Off for 3 Months Buy now & save

Recent posts

How to Protect Your Small Business From Holiday Fraud (Without Slowing Down Your Workflow)

January 12, 2026

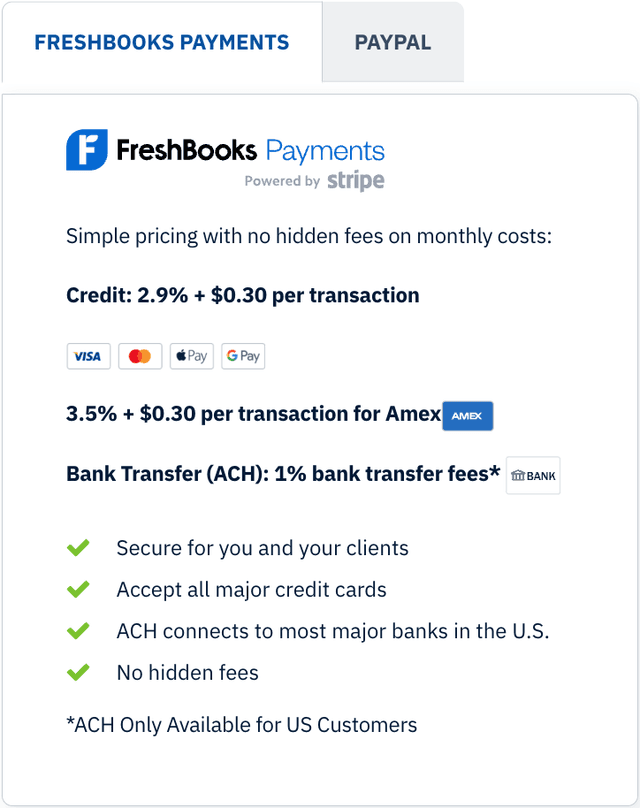

Payments

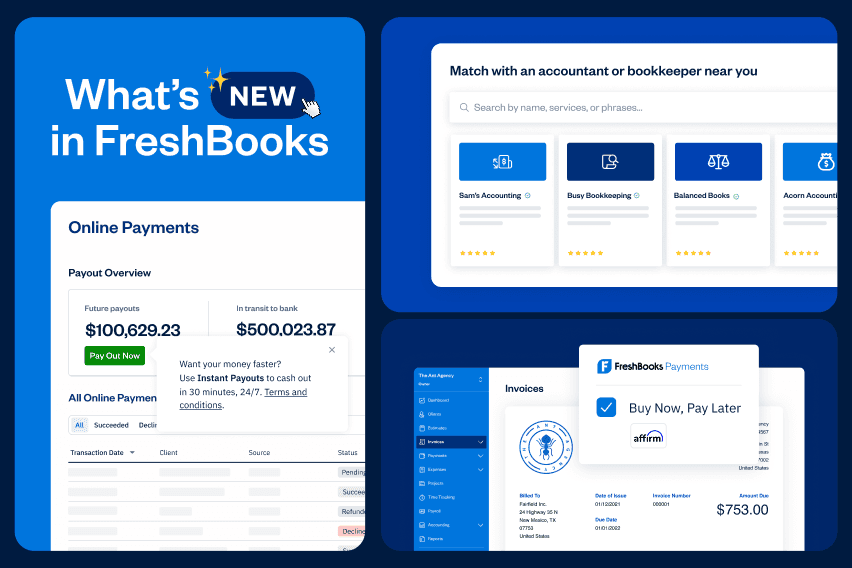

What’s New in FreshBooks: Faster Payouts, Smarter Payroll, and More Ways to Get Paid

December 1, 2025

Feature news

Introducing: Easily Manage Your Bills With Accounts Payable

November 10, 2025

Business Management

How to Write a Business Proposal That Wins New Clients

December 23, 2025

Estimates and Proposals

Explore other resources

Customer Stories

Our blog is here to help! With actionable insights into all aspects of running a small business, FreshBooks helps you thrive.

Why Values-Based Accountant Nicole Believes FreshBooks Truly Cares About Customers

January 7, 2026

How FreshBooks Helps This Creative Agency Prevent Cash Flow Challenges

November 1, 2025

Guides

Our blog is here to help! With actionable insights into all aspects of running a small business, FreshBooks helps you thrive.

2025 Small Business Tax Trends

January 12, 2026

The Business Owner’s Guide to Collaborative Accounting™

January 12, 2026

Sign up for the FreshBooks newsletter