Does the thought of incorporating or deciding on a business structure seem daunting and maybe a little unnecessary for your small business?

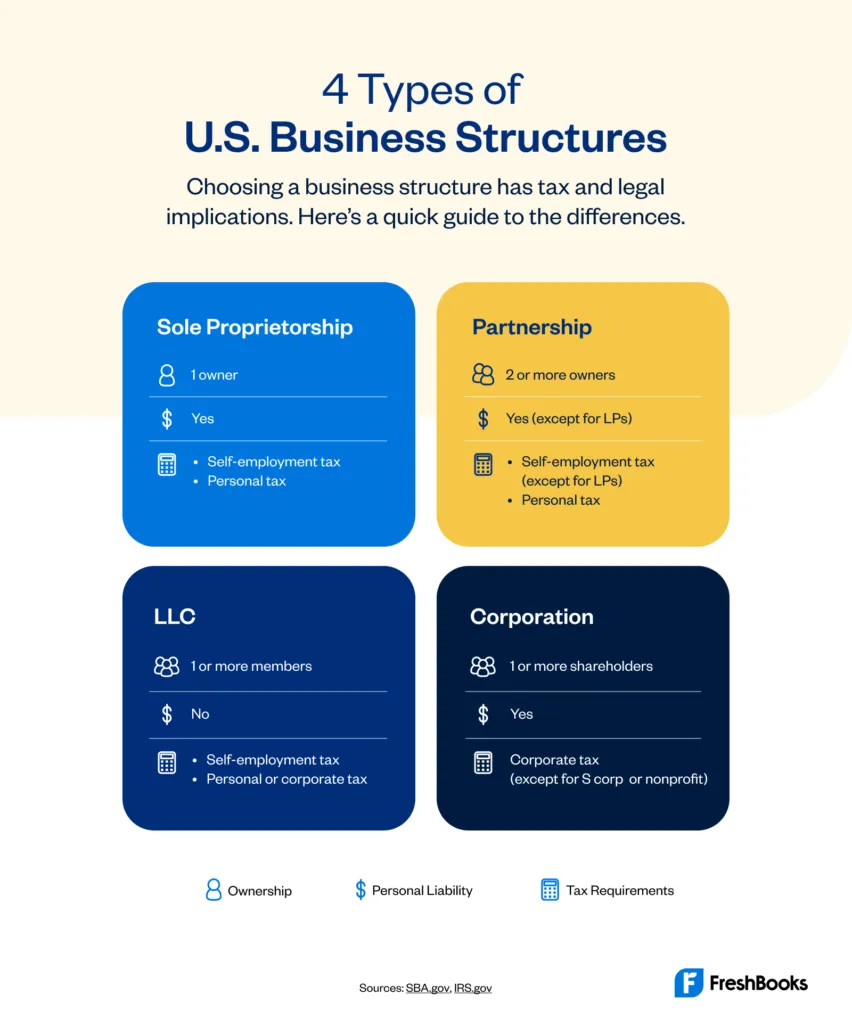

Starting a new business is exciting, but choosing the right business structure can feel like a daunting decision. Should you go with a sole proprietorship for its simplicity, a partnership, or something more complex like a limited liability company (LLC) or a corporation? The business structure you choose will impact everything from your personal liability to how you pay income taxes and manage day-to-day operations.

This is one of the first major decisions business owners face when testing their business idea. The structure you select can protect your personal assets, determine your tax consequences, and even affect your ability to raise money. However, the process can be confusing, and it’s essential to consult with attorneys, accountants, or business counselors who can tailor advice to your specific needs.

While this guide provides an overview of common business structures and their pros and cons, remember that every business is unique. From sole proprietors to corporations and beyond, this article will help you start comparing business structures and get a clearer picture of what might work best for your business idea.

Table of Contents

An Overview of Different Business Structures

Choosing the right business structure is one of the most important decisions you’ll make when starting your business. The legal structure you select affects everything—from personal liability to how you pay self-employment taxes and report income to the IRS. Let’s break down the key business structures to help you decide which one might work best for your business idea.

Sole Proprietorship

A sole proprietorship is the simplest business structure and the default for single-owner businesses unless you formally register under a different legal entity. This structure makes tax time straightforward: you report business income and expenses directly on your personal income tax return.

However, as a sole proprietor, your business isn’t legally separate from you. This means you’re personally liable for business debts and obligations—something to keep in mind if your business involves medium or higher risk.

Partnership

For businesses with multiple owners, a partnership might be the right choice. Partnerships are pass-through entities, meaning profits are taxed as personal income rather than at the business level. There are three common types:

- General Partnership (GP): In a general partnership, all partners share profits and unlimited personal liability for debts. While no formal paperwork is required to create a GP, a partnership agreement can help protect your business.

- Limited Partnership (LP): LPs include one general partner with unlimited liability and one or more limited partners who have liability only up to their investment.

- Limited Liability Partnership (LLP): In an LLP, all partners enjoy limited liability protection, shielding personal assets from business obligations. This structure is popular among professional groups like doctors and lawyers.

Limited Liability Company (LLC)

A limited liability company (LLC) offers the liability protection of a corporation with the tax simplicity of a partnership. Members are not personally responsible for the company’s debts, which helps safeguard personal assets.

LLCs are considered pass-through entities, meaning the business itself doesn’t pay income tax. Instead, members report profits and losses on their personal tax returns, which can simplify things when filing with the IRS.

Corporation

Corporations are a great option for businesses looking to raise money or for those with higher risk. Corporations operate as separate legal entities, which means personal liability is limited. There are two primary types:

- C Corporation (C Corp): A C corp is a completely independent legal entity. It files its own taxes, and profits are taxed twice—first at the corporate level and then on personal income when distributed as dividends.

- S Corporation (S Corp): S corps are designed for businesses with 100 shareholders or fewer. Unlike a C corp, an S corp’s income is taxed only once, as it’s passed through to the personal tax returns of its shareholders.

Benefit Corporations and Nonprofits

If your business has a mission to serve the public—like charity, education, or religious work—you might consider a benefit corporation or nonprofit corporation. Nonprofits can apply for tax exemption by filing with the IRS, and they must submit annual benefit reports to maintain their status.

8 Questions to Ask When Choosing a Business Structure

The legal structure that a business owner chooses affects everything from liability protection to tax obligations and the ability to raise money. Your decision depends on factors like your business idea, the number of owners, and your long-term goals. To make the best choice, review common business structures and consult with counselors, attorneys, and accountants who can provide tailored advice.

Here are eight key questions to help you decide which structure is best for your specific business.

1. Are You Concerned About Personal Liability?

If you work in a high-risk field or one that’s susceptible to lawsuits (like medicine, food, tattoo and body piercing, daycare, or dog-sitting), this is a no-brainer. You’ll want a business structure that comes with limited personal liability.

But no matter what your business type, you should seriously consider if there’s a chance your business could be sued, or won’t be able to pay its debts. If you’re operating as a sole proprietorship or general partnership, you have unlimited personal liability, meaning your personal assets are at risk.

Forming a corporation or LLC will provide business owners with liability protection, as each business structure puts some separation between your personal assets and your business. Should your business get sued, these types of businesses can protect your personal assets in many situations.

2. Will You Hire Employees or Contractors?

Hiring employees or contractors increases your exposure to liability, especially if they make mistakes that result in damages. Forming an LLC or corporation can shield your personal assets in these situations.

Without these protections, sole proprietors and general partners may be held personally responsible for employee actions. If you plan to grow your team, consider a structure that safeguards your liability.

3. Do You Like to Keep Things Simple?

Some business structures require more paperwork and compliance than others:

- Corporations (C corps and S corps): Require a board of directors, annual meetings, shareholder decisions, and a separate corporate income tax return.

- LLCs: Require filing an annual report with your state, but generally involve less formalities.

- Sole Proprietorships and General Partnerships: The simplest to manage, with minimal paperwork—but no liability protection.

If you want personal liability protection without the complexity of a corporation, an LLC might be the right choice.

4. Do You Want Pass-Through Taxation?

Some business structures allow profits to pass directly to owners’ personal tax returns, avoiding double taxation:

- Pass-Through Entities: S corps, LLCs, sole proprietorships, and partnerships. These don’t pay corporate taxes; instead, profits are taxed as personal income.

- C Corporations: Pay corporate income tax, and distributions to owners are taxed again as personal income, resulting in double taxation.

If avoiding double taxation is a priority, consider pass-through entities like an LLC or S corp.

5. Are You Looking to Lower Your Self-Employment Taxes?

Self-employment taxes, which cover Medicare and Social Security, are a significant burden for sole proprietors and partners. With a corporation, you can reduce these taxes:

- Pay yourself a salary and only pay FICA tax (not self-employment tax) on that amount.

- Distribute remaining profits as dividends, which aren’t subject to FICA or self-employment taxes.

This strategy can result in significant tax savings for profitable businesses.

6. Are Any of the Business Owners Non-U.S. Residents?

Ownership rules vary by structure. Choose a business structure that works for you:

- S Corporations: Only U.S. residents can be shareholders.

- C Corporations and LLCs: Allow ownership by non-U.S. residents.

If any of your business owners are non-residents, an LLC or C corp may be the better option.

7. Do You Want to Offer Employee Benefits?

Corporations offer the greatest flexibility when it comes to employee benefits, such as:

- health plans

- medical reimbursement programs

- retirement contributions

- life insurance plans

These expenses are tax-deductible for the business, reducing its taxable income. For businesses looking to grow, and attract and retain talent, a corporation may be the best structure

8. Do You Want to Give Employees or Others Stock in Your Company?

If you’re planning to attract investors, reward employees with stock options, or grant equity to partners, forming a corporation is essential.

- Corporations can issue different classes of stock, a feature that appeals to venture capital investors.

- Sole proprietorships, partnerships, and LLCs don’t allow stock issuance, limiting their appeal to larger investors.

Get Professional Advice if You’re Unsure

Having a business idea before forming a business and choosing the way you structure it is exciting, but Choosing a business structure is a critical step that impacts your taxes, liability, and growth opportunities.

Whether you’re looking to limit personal liability, simplify operations, or combine different business structures, consulting with experienced counselors, attorneys, and accountants can prove helpful in navigating the tax consequences and unintended risks of your decision.

By carefully considering these factors and your specific business goals, you can select a structure that aligns with your needs and sets you up for success.

This post was updated in January 2025.

Written by Nellie Akalp, Freelance Contributor

Posted on October 10, 2017

This article was verified by Janet Berry-Johnson, CPA and Freelance Contributor

How Your Business Structure Affects Your U.S. Taxes

How Your Business Structure Affects Your U.S. Taxes 6 Business Milestones to Hit in Your First 5 Years

6 Business Milestones to Hit in Your First 5 Years Doing Business As (DBA): What Is It and Why Is It Needed?

Doing Business As (DBA): What Is It and Why Is It Needed?

![Standing Out From the Crowd [free e-book] cover image](https://www.freshbooks.com/blog/wp-content/uploads/2022/05/Standing-Out-From-the-Crowd_eBook-Blog-Hero-Image-226x150.png)