Is incorporating your business the right move? This guide will help you decide by examining the pros and cons of small business incorporation.

This guide covers everything you need to know about incorporating your business, from exploring different business structures—like an LLC or S corporation—to understanding key benefits such as personal liability protection and tax advantages. Incorporation transforms your venture into a separate legal entity, helping to protect personal assets and streamline business finances.

We’ll touch on crucial aspects like articles of incorporation, liability protection, tax savings, and even how to keep your own personal affairs and business finances separate. Whether you’re seeking to raise capital, reduce self-employment taxes, or better protect your personal affairs, we’ve got you covered.

Ready to take the next step? Let’s explore whether incorporating your business is the right move for you and how it can impact your personal and business finances, tax obligations, and long-term growth potential.

Table of Contents

What Does Small Business Incorporation Mean?

When most people start a company, they begin as a sole proprietorship. This is the most common legal entity because it’s the default one: If you don’t register as a different kind of business, you will automatically be a sole proprietor.

While a sole proprietorship may fit your company for a while, it’s usually not a long-term solution. The government doesn’t consider sole proprietorships to be distinct legal entities from their owners. This means your personal assets, such as your home and savings, aren’t protected from business debts or lawsuits. Personal and business finances often mix, creating personal liability. Additionally, sole proprietors miss out on tax advantages and other benefits available to incorporated businesses.

If you want more liability protection, consider a formal business structure. While incorporation isn’t the only option, it’s one way of formally filing your business as a separate entity with your state.

6 Reasons to Incorporate Your Business

Although operating as a sole proprietorship can be simpler, incorporating your small business offers a range of benefits that can help protect your personal and business finances while setting your company up for long-term success. Here’s why small business owners often choose incorporation.

1. Limited Liability Protection

One of the biggest advantages of incorporation is protecting your personal assets. As a sole proprietor, you and your business are legally the same entity, meaning you have unlimited personal liability for business debts. If your business accrues debts or faces legal issues, your personal finances—like your bank account, home, or car—could be at risk. Incorporating your business establishes it as a separate legal entity, ensuring liability protection and peace of mind for business owners.

2. Tax Benefits

Incorporation offers opportunities to optimize taxes, such as:

- Pass-through taxation for S corps and partnerships, avoiding double taxation.

- Potential tax savings on self-employment taxes by electing S corp status.

- Access to deductions for business expenses and corporate profits. You can write off expenses like healthcare, retirement plans, and business activities, reducing your taxable income. And you can pay yourself a reasonable salary and distribute the remaining profits as dividends.

3. More Credibility

An incorporated business looks more professional and trustworthy to potential customers, investors, and lenders. Registering a distinct business name with the state shows that you’ve taken the necessary steps to establish a legitimate, separate business entity.

4. Multiple Owners

When starting a business with others or bringing on new partners, formalizing a business structure ensures clarity and protects everyone’s interests. Options like partnerships, LLCs, or corporations help define ownership, responsibilities, and profit-sharing.

5. Access to Funding

If you’re looking to raise capital, incorporation is a must. Investors are typically unwilling to fund sole proprietorships, as they’re not recognized as distinct entities. A C corporation, in particular, allows you to sell shares or equity, making it easier to attract funding for growth. Banks and other financial institutions may also view incorporated entities as lower-risk, making it easier to secure a business loan.

6. Unlimited Life and Continuity

Sole proprietorships dissolve when the owner passes away or exits the business. By incorporating, you create a legal entity that can exist independently of its owners, allowing the business to continue for generations.

Incorporating your business is a major decision that affects everything from your liability protection to how you pay taxes. Understanding the incorporation process and choosing the right business structure—whether a C corporation, S corporation, or limited liability company (LLC)—is critical to meeting your business needs and goals.

What Are Some Drawbacks to Small Business Incorporation?

While incorporating your small business can offer significant advantages, you may face some challenges:

Increased Administrative Tasks

Incorporating a business comes with ongoing responsibilities like filing articles of incorporation, maintaining accurate business records, and keeping personal and business finances separate. You’ll need to:

- File annual reports.

- Manage multiple tax deadlines, including those for federal income taxes and self-employment taxes.

- Ensure compliance with state requirements, which may include hiring a registered agent.

Initially, these tasks can feel overwhelming, especially for small business owners managing everything themselves.

Higher Costs

Incorporation involves expenses that sole proprietorships or partnerships don’t typically face. These may include:

- State filing fees: Some states have high franchise taxes or fees for maintaining a corporation or limited liability company (LLC).

- Professional services: Many business owners opt to hire a lawyer or certified public accountant (CPA) to handle tax filings, articles of incorporation, or corporate tax planning.

- Payroll services: For businesses with employees, payroll processing adds to operational costs.

Double Taxation (C Corp Only)

A C corp may be subject to double taxation. Here’s how it works:

- Corporate profits are taxed at corporate tax rates.

- Dividends distributed to shareholders are taxed again on the shareholder’s personal tax return.

While other business entities like S corporations and LLCs benefit from pass-through taxation, C corps carry this unique disadvantage.

By considering these drawbacks, small business owners can make informed decisions about whether incorporating aligns with their business goals and financial capabilities.

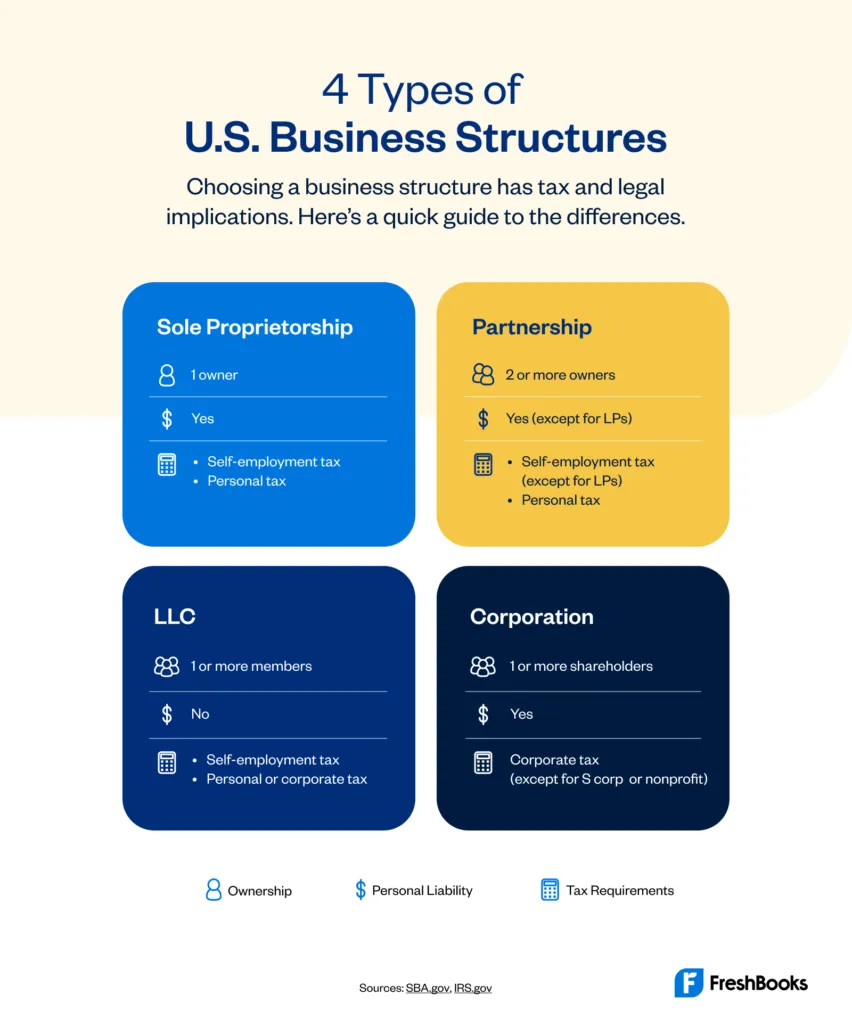

Small Business Incorporation: Business Structure Options

When transitioning from a sole proprietorship to a formal business structure, small businesses have several options to consider. Each structure has unique benefits and drawbacks, depending on your goals, personal liability concerns, and tax preferences.

Partnership

Partnerships are ideal for businesses with two or more owners. You can choose between two main types:

- Limited Partnership (LP):

- Includes at least one general partner who assumes unlimited personal liability for business debts.

- Limited partners enjoy personal liability protection but typically have less control over business decisions.

- Limited Liability Partnership (LLP):

- Offers all partners limited liability protection, shielding their personal assets from business debts or legal claims.

Limited Liability Company (LLC)

A limited liability company (LLC) combines the liability protection of a corporation with the operational flexibility of a partnership. Key features include:

- Personal liability protection for business owners, ensuring your personal assets are safeguarded from business debts.

- Flexibility to choose how the business is taxed—either as a pass-through entity or a corporation.

- Simplified administrative requirements compared to C corporations.

C Corporation (C Corp)

C corps are separate legal entities that offer the strongest personal liability protection but require more complex management. Features include:

- Ability to raise capital by selling stock to shareholders.

- Liability protection for owners’ personal assets against business debts and lawsuits.

- Higher administrative and tax filing requirements, including paying corporate taxes on profits.

- Best suited for businesses planning to raise significant capital or seeking to establish a distinct legal entity for liability protection.

S Corporation (S Corp)

An S corporation blends the liability protection of a C corp with the tax advantages of a pass-through entity. To qualify, businesses must:

- Have fewer than 100 shareholders, all of whom must be U.S. citizens or residents.

- Maintain strict filing and operational requirements, similar to a C corp.

By operating as an S corp, you avoid double taxation since profits and losses pass through to the owners’ personal tax returns. It provides limited liability protection while offering potential savings on self-employment taxes.

When selecting a business structure, consider your business income, liability protection needs, and tax benefits. Each structure has its trade-offs, but choosing the right one is a critical step in the incorporation process and your business’s future success.

How Is an Incorporated Business Taxed?

Understanding how incorporated businesses are taxed starts with comparing it to sole proprietorship taxation. If you operate as a sole proprietor, the Internal Revenue Service (IRS) requires you to report all business income on Schedule C of your personal tax return. This means:

- You pay federal income taxes on your business income.

- You’re responsible for self-employment taxes (currently 15.3%) on that income, which covers Social Security and Medicare contributions.

When you incorporate your business, the way you report and pay taxes changes based on your chosen business structure. Let’s explore how different entities are taxed.

Taxes for Partnerships

Partnerships are pass-through entities, meaning the business itself doesn’t pay taxes. Instead:

- Profits are reported on the partners’ personal tax returns, based on their ownership share.

- The partnership files an information return (Form 1065) annually, detailing the business’s income and expenses.

- Each partner receives a Schedule K-1, showing their share of profits or losses for personal tax reporting.

This structure ensures that income is only taxed once, avoiding the double taxation associated with some other entities.

Taxes for C Corps

C corporations are considered separate legal entities and must file their own tax returns using Form 1120. Key points include:

- Corporate profits are taxed at current corporate tax rates (as outlined by the Internal Revenue Code).

- If profits are distributed as dividends, shareholders report them on their personal tax returns and pay taxes again at the dividend tax rate.

- This process creates double taxation, a notable drawback of the C corp structure.

For example, if you own a marketing agency structured as a C corp, the company pays corporate taxes on its profits. If you distribute those profits to yourself as dividends, you’ll pay additional taxes on your personal tax return.

Taxes for S Corps

S corporations provide tax advantages by avoiding double taxation. Here’s how it works:

- S corps file Form 1120-S but don’t pay corporate income taxes.

- Profits and losses pass through to shareholders and are reported on their personal tax returns.

- Shareholders pay taxes on their share of profits based on ownership percentage.

For example, if you own 40% of an S corp, you’ll report 40% of the company’s profits on your personal tax return. Shareholders who work for the business must pay themselves a reasonable salary, which is subject to income tax. Dividends distributed beyond the salary are typically tax-free as long as they don’t exceed the shareholder’s basis in the company.

One thing to keep in mind is to understand how to pay yourself through your business structure.

Taxes for LLCs

LLCs are known for their flexibility, including options for taxation:

- Single-member LLCs: Treated as sole proprietorships for tax purposes, reporting income on Schedule C.

- Multi-member LLCs: Can elect to be taxed as a partnership, C corp, or S corp, depending on what works best for the business.

For example, an LLC taxed as a partnership allows profits to pass through to the owners, while electing to be taxed as a C corp may offer benefits like retaining profits within the company for growth.

Keep in mind that tax requirements vary by state. Be sure to check your state’s specific rules on franchise taxes, filing deadlines, and other obligations for incorporated businesses.

Can You Incorporate If You’re a One-Person Business?

Absolutely! If you’re running a one-person business, you can choose almost any business structure, except for a partnership (which requires at least two owners).

Here are your options as a single owner:

- Sole Proprietorship: The simplest option, but it doesn’t provide personal asset protection. You’ll be personally responsible for any business debts or liabilities.

- Limited Liability Company (LLC): A popular choice for small business owners because it protects your personal assets while keeping things relatively simple. It also offers flexibility in how you’re taxed—either as a sole proprietorship, S corp, or C corp.

- C Corporation (C Corp): Ideal for businesses looking to raise capital or provide significant liability protection, though it comes with added complexity and potential double taxation on corporation profits.

- S Corporation (S Corp): Provides limited liability and the benefit of pass-through taxation, which means profits are taxed on your personal return rather than at the corporate level.

Each of these business structures has its own tax benefits and tax implications, so it’s worth considering your goals, income level, and how you plan to manage your business activities.

Where Should You Incorporate?

Choosing the right state to incorporate your business is a critical initial business decision. While some may suggest incorporating in states with low fees or no state income tax, this isn’t always the best choice for small business owners.

Here’s why:

- Operating in your home state: If you live and work in a state like California, incorporating in a tax-friendly state like Nevada doesn’t exempt you from paying California’s state income taxes or registering as a foreign business entity. You’d still need to comply with California’s tax and fee requirements while maintaining incorporation fees in Nevada.

- Additional costs: Incorporating in one state while operating in another can result in double costs, including annual fees, franchise taxes, and reporting requirements in both states.

- Ease of compliance: Incorporating in your home state simplifies compliance and reduces paperwork.

While it’s tempting to chase lower costs in other states, incorporating where you live and do business is often the most practical and cost-effective choice. If you’re unsure, consult a CPA or legal expert for tailored advice.

How Do You Incorporate Your Small Business?

Incorporating your business involves several steps, and you have multiple options for completing the process. Here’s a breakdown:

Do-It-Yourself (DIY) Incorporation

This is the least expensive option but requires the most effort. Follow these steps:

- Choose your business name and verify its availability in your state.

- File the required documents, like Articles of Incorporation, with your state’s business filing office.

- Designate a registered agent with a physical address in your state to receive legal documents on your behalf.

- Obtain an Employer Identification Number (EIN) from the IRS to set up a business bank account and manage taxes.

- Comply with ongoing state requirements, such as filing annual reports or paying franchise taxes.

Using an Online Service

Online incorporation services simplify the process by handling filings and ensuring compliance. While pricier than DIY, this option saves time and reduces the risk of errors. Popular platforms often include:

- Filing your state documents.

- Obtaining an EIN.

- Providing a registered agent service.

Hiring a Lawyer

If you have a complex situation—such as forming a company with multiple owners, planning to raise capital, or dealing with significant business assets—hiring a lawyer may be worth the cost. A legal expert can provide tailored advice on business structure selection, liability concerns, and tax benefits.

Additional Considerations

Here are a few other things you should consider with the incorporation process:

- If you’re incorporating as an S corporation, you’ll need to file Form 2553 with the IRS to elect S corp status.

- Ensure compliance with federal and state tax requirements, including registering for state tax accounts if applicable.

Incorporating may seem daunting at first, but the long-term benefits, like protecting your personal and business assets, and enhancing credibility, are well worth it. Whether you choose the DIY route, an online service, or professional help, take the time to research and select the best option for your needs.

Taking the Next Step in Your Business Journey

Incorporating your small business is a big step, but it’s one that can offer substantial benefits—whether it’s protecting your personal assets, gaining access to tax advantages, or enhancing your business’s credibility as a separate legal entity.

For many small business owners, incorporation represents more than just a legal formality. It’s about:

- Ensuring personal asset protection by separating personal and business finances.

- Leveraging tax savings through deductions, pass-through taxation, and reduced self-employment taxes.

- Setting a strong foundation for growth by establishing a clear business name, protecting business assets, and opening opportunities for invesment.

As you consider the steps ahead, remember that your journey doesn’t have to be a solo one. Consulting with an accountant, tax professional, or attorney can help you navigate the incorporation process and ensure your business activities are compliant at both state and federal levels.

Your next step? Decide what aligns with your goals, file those Articles of Incorporation, and start building your incorporated future today.

This post was updated in January 2025.

Written by Erica Gellerman, Freelance Contributor

Posted on July 6, 2020

This article was verified by Janet Berry-Johnson, CPA and Freelance Contributor

Partners to Help You Prepare for Tax Season

Partners to Help You Prepare for Tax Season Top 5 Bookkeeping Mistakes U.S. Entrepreneurs Make, According to Bookkeepers

Top 5 Bookkeeping Mistakes U.S. Entrepreneurs Make, According to Bookkeepers Everything You Need to Know About How to Lower Self-Employment Taxes in the U.S.

Everything You Need to Know About How to Lower Self-Employment Taxes in the U.S.