Accounting Partner Program

FreshBooks for Accountants: 7 New and Updated Features for 2025

At FreshBooks, we’re dedicated to continuously improving our software to make it more powerful and user-friendly for accounting professionals. This includes adding and refining new features, guided by user feedback, rigorous testing, and evolving industry standards.

To catch you up on what you might have missed in 2024, we’ve rounded up some of FreshBooks’ latest updates. Each enhancement was designed to improve financial accuracy, provide better client service, and streamline your accounting workflow to help you save time.

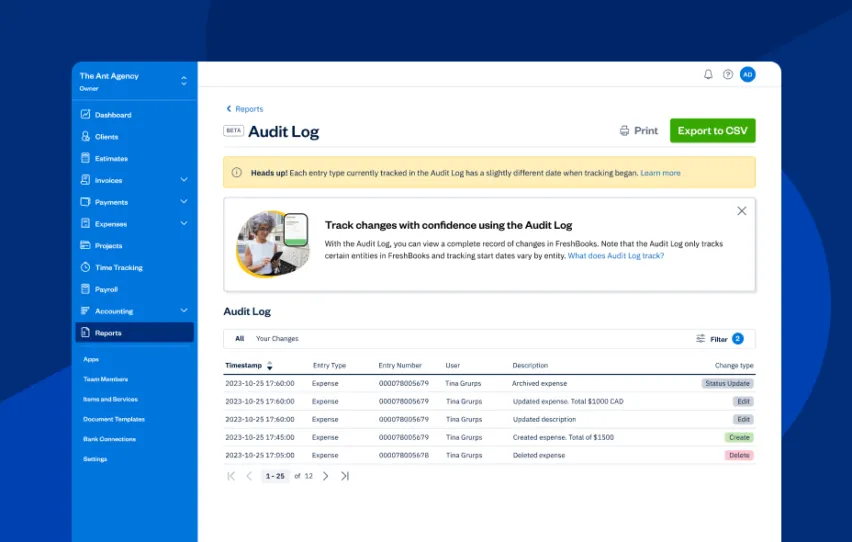

1. New Audit Log Report

The Audit Log report provides a detailed, chronological history of financial transactions, ensuring transparency and strengthening financial management and governance.

Some key features of the FreshBooks Audit Log report:

- It provides transparent, traceable, and reliable documentation of all financial activities.

- It ensures accountability and accuracy in financial reporting.

- It helps meet financial regulation requirements (particularly in Canada, which has specific rules about record-keeping).

- It helps resolve disputes by providing a clear timeline and details, making it easier to determine any issues a client may present.

2. Enhanced General Ledger Report

The updated General Ledger includes:

- An updated compact view that allows you to review more data more quickly.

- A new summary views that show top-line numbers, with the option to switch to a detailed view.

- More comprehensive drill-down functionality that allows you to investigate and deep dive into every number on your report.

- New customization features allow you to organize and view your report data exactly the way you prefer.

3. New FreshBooks Payroll

Launched in 2024, FreshBooks Payroll now includes exciting new enhancements, such as:

- New users signing up for FreshBooks Payroll now have the option to include historical pay runs from previous payroll providers before running their first payroll in FreshBooks.

- Journal entries are automatically written to the chart of accounts when running payroll.

- You can now add 1099 contractors, run contractor payments while paying at least one W-2 employee, and access the Contractor Payment report.

4. Payments Updates

Advanced Payments, also known as a virtual terminal, is an add-on that can be included in a business owner’s subscription. It allows them to proactively charge their customers’ credit cards with the details they’ve provided.

Using Advanced Payments, business owners can quickly process client credit card payments on invoices, over the phone, or in person. For repeat clients, card information can be securely saved for future invoices and recurring payments, streamlining the process.

- Clients can accept payments directly from invoices, with options like credit cards, ACH, Apple Pay, and Google Pay.

- You can use filters to create custom views of transactions and see payment details for any transaction.

- Users can select any declined credit card transaction processed by FreshBooks Payments or Stripe Standard to review the reason.

5. Accountant Hub Improvements

- Set up your accounts and invite your clients. Once you’re in, you have one-click access to your client’s information and bookkeeping.

- Manage everything in one place, from financial reporting and journal entries to a customizable chart of accounts.

- Tailor workflows for each client.

- Get discounts and dedicated, accountant-centric support from real humans.

The improved features to the Accountant Hub include:

- The Accountant Hub includes a welcome video that walks through its key features.

- Clients can access a trial countdown and an onboarding checklist to guide their setup.

- Users can filter clients by status for easier account management.

6. Updated Journal Entries

With journal entry enhancements in FreshBooks, you can:

- See all manually created journal entries in a dedicated journal entries section.

- Create manual journal entries for more complex transactions like depreciation, fixed assets, and loans.

7. Modified Bank Connections

By linking bank accounts to FreshBooks, business owners can also manage cash flow more effectively through comprehensive financial reporting options.

Here’s what the new bank connections modifications can do:

- All bank connections in Bank Reconciliation now display the last imported on-date for posted transactions.

- When creating new Bank Connections with Yodlee, you can now import up to 365 days of transactions with eligible banks.

- Any connected bank accounts via bank connections or bank reconciliations also used for payroll runs will not import expenses automatically to avoid duplicate expenses.

Get Ready to Be (Even) More Efficient

FreshBooks exists to make accounting easier and more streamlined for accountants and their clients. That’s why we’re always dreaming up and integrating enhancements and updates. FreshBooks experts can provide specialized support and tailored recommendations, ensuring a smooth and effective accounting process.

Elevate your practice and deliver exceptional value to your clients by joining the FreshBooks Accounting Partner Program. This program empowers you to grow your advisory practice with innovative, collaborative tools, streamlined workflows, and ongoing education. As a Partner, you’ll enjoy exclusive perks and dedicated support, ensuring you have everything you need to succeed. FreshBooks’ intuitive platform is fully loaded with features that make it easy to streamline your accounting processes and collaborate seamlessly with clients. Take your practice to the next level—become a FreshBooks Accounting Partner today.