Need Help Finding an Accountant for a Small Business? Here’s Everything You Need to Know

Updated on October 25, 2025 | 13 min. read

Get the right financial help for your business, right when you need it.

As a small business owner, your business’s financial health plays a key role in its growth and success. From navigating complex tax laws and preparing financial statements to managing business expenses and planning for tax season, finding an accountant for a small business can feel overwhelming. But hiring the right accountant—whether an independent accountant, a certified public accountant (CPA), or an enrolled agent—can make all the difference.

So, how do you find a reputable accountant who fits your needs? Should you go with an accounting firm, online accounting services, or a local small business accountant in your community? And what should you look for in a prospective accountant to ensure they’re equipped to handle your tax preparation, bookkeeping services, and overall financial management?

In this blog, we’ll break it all down—how to identify the right accounting professional for your growing business, match their skills to your business processes, and ask the right questions to ensure they align with your financial goals.

When Should You Hire an Accountant?

Managing your business’s financial health is no small task, and many small business owners find themselves asking: “When is the right time to hire an accountant?” Whether it’s keeping up with financial statements, navigating tax laws, or ensuring accurate bookkeeping, there’s a point when professional accounting services can make all the difference.

If you’re juggling tax preparation, payroll taxes, and cash flow management—or spending more time on financial records than running your business—it may be time to bring in a small business accountant. Here are some common signs it’s time to hire an accounting professional:

- Tax season feels overwhelming. Filing taxes, planning tax strategies, and managing your tax burden requires expertise. A tax professional can ensure your business stays compliant with tax regulations while helping you maximize tax deductions and savings.

- You’re growing and making complex business decisions. Expanding your small business often requires insights into financial data, business valuation, and tax planning. An accountant can provide the financial analysis needed to support your goals.

- Your books are messy or outdated. Accurate bookkeeping is the backbone of financial management. If your financial documents are incomplete or disorganized, hiring a good accountant or bookkeeper can restore order.

- You’re spending too much time on finances. If bookkeeping, payroll taxes, or preparing financial reports eats into time better spent on growing your business, it’s time to consider outsourcing.

- You’re facing legal or compliance issues. Tax laws and accounting regulations can be tricky to navigate. Legal and accounting advisors or a certified public accountant (CPA) can help ensure your business remains compliant.

Recognizing these signs can help you make smarter business decisions and maintain your business’s financial health.

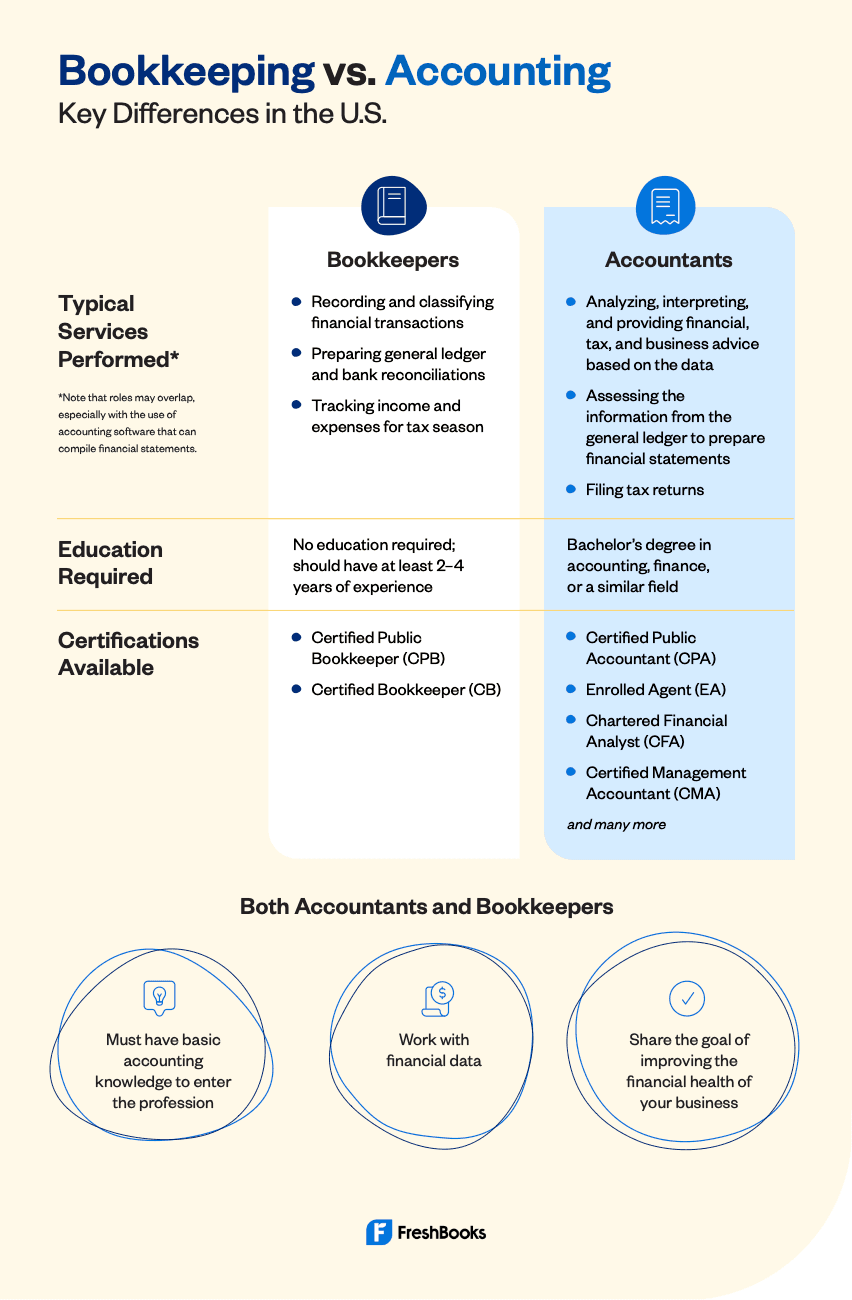

Bookkeepers vs. Accountants vs. CPAs

Not all financial professionals are the same, so it’s essential to know what kind of help your business needs. Depending on your business finances and processes, you might need a bookkeeper, an accountant, or a certified public accountant (CPA). Here’s a quick comparison of these roles:

Bookkeeper

Bookkeepers manage the day-to-day financial data of your business. They handle tasks like:

- Recording transactions using accounting software (e.g., FreshBooks or QuickBooks).

- Tracking accounts payable, accounts receivable, and business expenses.

- Reconciling financial records with bank statements.

- Preparing preliminary financial reports for tax time or cash flow analysis.

They provide the foundation for accurate financial statements and help you stay organized for tax preparation.

Accountant

Accountants take bookkeeping to the next level by analyzing financial data and providing insights into your business’s financial health. Their responsibilities include:

- Preparing detailed financial statements.

- Offering accounting advice to support financial planning and business decisions.

- Filing tax returns and assisting with tax strategy and planning.

- Managing payroll taxes and business taxes.

A small business accountant is perfect for growing businesses looking for insights into their financial goals and strategies.

Certified Public Accountant (CPA)

CPAs are accountants with advanced training, a bachelor’s degree in accounting, and certification. They specialize in complex financial and regulatory tasks, such as:

- Auditing financial statements for legal compliance.

- Representing businesses before the Internal Revenue Service (IRS).

- Providing high-level financial analysis and tax planning.

While hiring a CPA can be more expensive, they’re invaluable for businesses needing advanced financial services or support with tax regulations.

Which Should You Choose?

So, do you need a bookkeeper, an accountant, or a CPA? It depends on your business’s financial needs. For day-to-day financial management, a bookkeeper or accountant offering bookkeeping services is a great start. If you’re tackling more complex financial planning, tax services, or business valuation, an experienced accountant or CPA may be the better fit.

And don’t forget: Many accounting professionals offer bundled services. Some accountants partner with bookkeepers to provide seamless support, while others specialize in online accounting services that streamline processes like tax preparation, financial reports, and bookkeeping.

The key is to find a reputable accountant or bookkeeper who fits your business goals and understands your accounting software (like FreshBooks 🤩) and business needs.

Specialists vs. Generalists

When hiring an accountant for your business, one question many business owners face is: should you choose a specialist or a generalist? Both types of accounting professionals can bring value, but understanding the differences can help you make the best decision for your business’s financial health.

The principles of accounting, including preparing financial statements, managing payroll taxes, and offering tax savings strategies, are generally consistent across industries. A qualified accountant with a strong accounting degree can handle most small business accounting needs. However, specialists often bring unique insights tailored to specific industries.

For example:

- Legal Practices: Law firms often face unique tax laws and compliance requirements. A small business accountant or accounting firm specializing in legal practices can help navigate these challenges.

- E-Commerce Businesses: Online businesses deal with complex sales tax regulations. Specialists can provide tax strategy advice, recommend accounting software, and streamline processes for managing tax returns.

- Construction and Trades: An accountant experienced in this industry can assist with project-based financial analysis and business valuation.

While specialists may charge more than generalists, the added expertise can provide significant value, especially in complex industries. Think of it like choosing between a general practitioner and a medical specialist—both are valuable, but the right choice depends on your specific needs.

Communicating With Your Small Business Accountant

Effective communication is the foundation of a successful relationship with your accountant. Many small business owners struggle to get on the same page with their financial advisors, but good communication is essential for making informed business decisions and maintaining your business’ financial health.

Find an Accountant Who Listens

Whether you hire a generalist or a specialist, your accountant should take the time to understand your unique business processes and goals. Look for someone who asks about your business plan, financial goals, and tax time challenges. A good accountant listens first and offers tailored accounting advice based on your needs, not a cookie-cutter approach.

Consider Communication Style

Different accounting professionals have different communication styles. To ensure a smooth working relationship, ask questions like:

- Do they prefer phone calls, emails, or in-app communication through accounting software?

- How often will they check in to discuss your financial data and business’s financial health?

- Are they available for tax season questions or urgent tax preparation needs?

Cloud-based accounting software, such as FreshBooks, can simplify collaboration. Many online accounting services allow accountants and small business owners to share financial records and reports in real time, eliminating the hassle of paper files or email attachments.

Remember, your accountant might be communicating with several people in your company, even your in-house accountant who offers different expertise. Consider your company culture and whether your accounting firm or accounting advisory suits your workplace.

Find Someone You Like

Even if an accountant’s credentials and experience check all the boxes, a good personal fit is just as important. Your accountant is a long-term partner in your business. Understanding your journey is important, whether they’re part of an in-house accounting team or an independent accountant from a local small business community.

“Working with financial advisors—whether it’s an accountant, tax preparer, or bookkeeper—requires a good personality fit,” says Brittany Turner, founder of the accounting firm Countless. “The better the relationship, the more open and transparent the communication, which leads to better outcomes. Accounting and taxes are challenging enough—don’t make it worse by working with someone you don’t enjoy.”

When you find a good accountant who aligns with your company’s culture, values, and goals, they can help you stay motivated, optimize tax savings, and guide your financial management.

Where to Find a Small Business Accountant

Finding the right accountant for your business can feel overwhelming, but there are plenty of resources to help you connect with qualified accountant candidates. From local recommendations to software certifications, here’s how to find the best match for your needs.

Local Listings

If you’re searching for an accounting firm or independent accountant nearby, start with local listings. A simple Google search can provide a list of accountants in your area, along with reviews and ratings from other small business owners. Look for accountants with experience in small business accounting and expertise in preparing tax returns, managing payroll taxes, and offering financial analysis.

Pro tip: Ask other business owners in your local small business community for recommendations. They may have firsthand experience with a reputable accountant or accounting firm that could be a great fit for your business.

Networking Opportunities

Tap into your network to find an accountant who understands your industry and financial goals. Consider:

- Business Networking Groups: These groups are often filled with experienced accountants and financial advisors who can assist with your business’s financial health.

- Online Communities: Many business owners share their experiences and recommendations in online forums and groups. Ask for suggestions and feedback about accounting prospects.

- Industry Events: Conferences and trade shows often have accounting professionals specializing in your industry.

A referral from someone in your field can lead you to an accountant with the exact expertise you need, such as tax strategy or business valuation.

Referrals from Accounting Software Providers

Did you know your accounting software could connect you with a qualified accountant? Many accounting software providers, such as FreshBooks, offer programs that match users with accountants certified in their platform.

For example, when you use cloud-based accounting software like FreshBooks, the support team can connect you with financial advisors, enrolled agents, or accountants trained in the software. These accountants are familiar with small business accounting and understand the unique needs of businesses like yours.

The benefits of using this approach include:

- Seamless collaboration through shared accounting software.

- Access to a broader pool of accounting professionals, as you’re not limited to local candidates.

- A faster onboarding process, since both parties are already aligned on tools and workflows.

Your Current Accounting Software

If you already use accounting software that you love, check if they have an accounting partner program. Many platforms, such as FreshBooks, certify accountants and bookkeepers who specialize in their software.

By hiring an accountant familiar with your existing tools, you’ll save time and avoid compatibility issues. Plus, certified accountants often bring additional expertise in managing financial statements, offering tax planning advice, and ensuring compliance with tax regulations like the Internal Revenue Service’s (IRS) preparer tax identification number (PTIN) requirements.

Using software-certified accountants can also make it easier to scale your accounting services, whether you need basic bookkeeping or help from an in-house accountant to manage more complex financial management tasks.

How Much Does a Business Accountant Cost?

You may be wondering what to expect in terms of cost. There’s no single, flat rate for accounting services, so let’s talk about the variables.

First off, remember that bookkeeping, accounting, and the specialized services that require a CPA are all likely to cost different amounts. Make sure you’re not paying for services you’re not going to use.

In addition to the level of expertise you require, the scope of your needs will have a big impact on cost. Typically, the more work that’s involved the more you’ll pay.

If your business is simple, you can probably find a simple bookkeeping or accounting package to meet your needs. If you have a complex business with several bank accounts, a high volume of transactions, and a lot of moving parts, you’re likely to pay a little more.

Some Advice on Getting What You Pay For

“You get what you pay for” rings true for accounting professionals, but there are two sides to that truth.

First, make sure you know what you’re paying for. If your accountant charges you an hourly rate, you can find yourself worrying about how efficient they are and how much your bill will be this month. More and more, accountants and bookkeepers are charging a flat rate per month, based on the scale of the work and the value they provide. This gives you some stability in your budget and ensures that you’re not paying for downtime.

Second, while some accountants may charge more for their experience or expertise, it can be a great investment for your business. Seeking out the cheapest option can leave you with subpar service and without the support you need.

A few hundred extra dollars invested in accounting could be worth thousands to your business, while also cutting your stress and saving you time. That’s a great return on investment by any measure!

6 Things to Ask Your Prospective Business Accountant

So, you’ve found a few potential accountants and you’ve set up a call or reached out by email. What questions should you ask to help you find the perfect match? Here are 5 questions to ask.

Whether you’re looking for an industry specialist or just someone familiar with a business roughly the same size as yours, this question can help you get a feel for how well your accountant knows their stuff.

2. What Services Do You Offer?

This is a great way to make sure all your bases are covered as simply as possible. I’ve already mentioned bookkeeping and accounting services. You may also need someone to provide tax preparation and planning, advisory, or payroll services. Not all accountants offer all of these, so make sure they can do everything you need them to do.

3. How Do You Price Your Services?

Hourly or flat fees? What’s included at that price? Automated withdrawals or monthly invoices? The goal here isn’t necessarily to find the cheapest option, but you need to know what you’re getting into and how each accountant stacks up.

4. Can I Reach You With Questions When They Come Up?

A variation on this: How do you communicate with your clients? And how often?

There’s nothing more frustrating (for both parties) than mismatched expectations around communication and support. If you need to reach your accountant frequently and they expect to speak only at scheduled monthly meetings, you’re not going to have the kind of support you need. Make sure you’re in alignment here and expect to pay a bit more for more comprehensive support.

5. How Can You Help Me Run My Business Better?

Accountants and bookkeepers can do so much more than put numbers in boxes! This is your chance to see how proactive your accountant is, and if they are ready and willing to partner with you for the good of your business.

6. Which Accounting Software Do You Use?

If you have a preference as to which accounting software you use as a small business owner to do things like invoice, track business expenses, run financial statements, evaluate cash flow, and do your business taxes then talk about it upfront.

Next Steps

Now that you know what you’re looking for, it’s time to go out there and find the right accountant for your small business. Working with the right accountant or bookkeeper can save you time and money, drastically reduce your stress, help you better understand your business financial statements, and help you take your business to the next level.

This post was updated in January 2025.