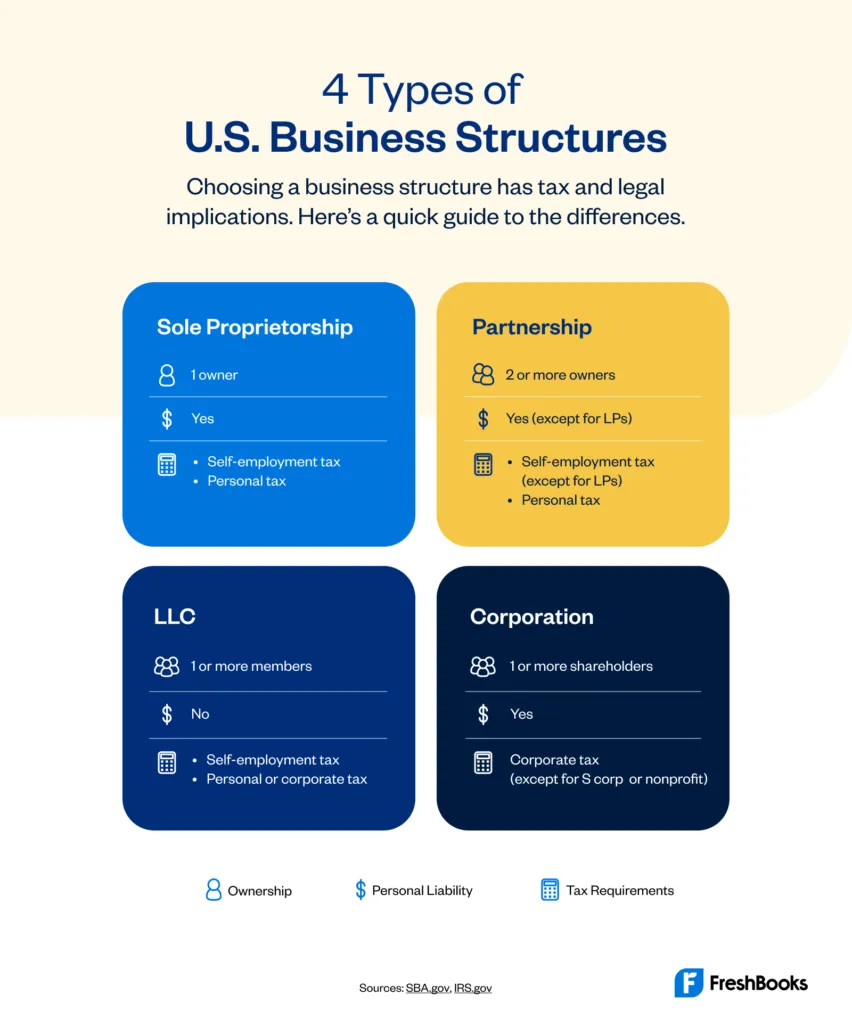

Your business structure impacts how you pay your taxes and how much you owe. Understand the tax implications of 4 common business ownership types.

Taxes may not be the most exciting part of running a business, but understanding how different types of business ownership impact your tax obligations can save you time, money, and headaches. Whether you’re a sole proprietor, part of a partnership agreement, or navigating the nuances of a limited liability company (LLC), your business structure plays a big role in how much you’ll pay in business taxes and how you report your business income.

For federal income tax purposes, the type of business entity you choose determines whether you’ll file taxes as a disregarded entity, pay self-employment tax, or manage corporate profits under an s corporation or c corporation. It also impacts your exposure to personal liability and how your personal tax returns interact with your business income.

From sole proprietorships to limited liability partnerships, every business owner should know the pros and cons of these common forms of business ownership. Whether you’re aiming to raise funds, ensure you’re eliminating double taxation, or just want to make sense of special rules for taxable income, this guide is here to help.

This is general information tailored to U.S. federal government regulations for the 2024 tax year. For specific advice about your personal taxes, business debts, or the intricacies of transferring ownership, always consult a qualified tax professional to ensure compliance with the law and maximize your benefits.

Table of Contents

What to Consider When Choosing a Business Structure

When selecting a business structure, it’s important to think about several factors that will affect not just how much you pay taxes, but how you manage your business, your personal finances, and your long-term goals. Key considerations include:

1. Personal liability and risk:

- Are you willing to assume personal liability for business debts? Sole proprietorships and partnerships expose you to unlimited liability, meaning you could be held personally liable for the business’s debts.

- LLCs, corporations, and limited partnerships provide varying levels of limited liability, meaning your personal assets are generally protected.

2. Tax implications:

- Will your business income be taxed as part of your personal tax return (as with a sole proprietorship or LLC) or will your business file a separate tax return, as with a corporation?

- If you’re an LLC or corporation, consider if you want to elect to be treated as an S corporation to avoid double taxation.

3. Management and control:

- How much control do you want over the business? In a sole proprietorship, you have complete control. However, decisions are often shared in a partnership, and control can be distributed among shareholders in a corporation.

4. Future growth and funding:

- If you anticipate raising funds or selling shares to investors, you’ll need a more formal structure like a corporation. If you plan to stay small and self-funded, an LLC or sole proprietorship may be a better fit.

- By evaluating these factors, you can determine which business ownership structure best aligns with your goals and resources.

Sole Proprietorship

A sole proprietorship is the simplest business structure and the default status for an unincorporated business owned by only one person. If you’ve started a new business but haven’t officially registered it as a distinct legal entity with your state, you’re likely operating as a sole proprietor.

How a Sole Proprietorship Status Affects Taxes

For federal income tax purposes, a sole proprietorship isn’t separate from its owner. As a sole proprietor, you report all business income, losses, and expenses directly on your personal income tax return. This means you don’t need to file a separate tax return for your business.

Using Schedule C attached to Form 1040, you’ll report your business’s revenues and deductible expenses. The resulting taxable income is subject to federal income taxes and self-employment taxes. The latter includes contributions to Social Security and Medicare taxes, which add up to a rate of 15.3% on your net earnings. Be sure to check the IRS’s 2024 updates for any changes to the income ceiling for Social Security taxes.

Who Should Form a Sole Proprietorship?

A sole proprietorship is a great choice if you:

- want complete control over your business without additional paperwork

- are comfortable with unlimited liability (you can be held personally liable for business debts)

- are a solo entrepreneur testing the waters of entrepreneurship

- have relatively modest profits and want a simple setup for income and business taxes

Partnership

A general partnership is the default business structure for a new business owned by two or more people who haven’t registered another legal entity. In a general partnership, all partners share unlimited liability, meaning their personal resources can be used to cover business debts.

Alternatively, limited partnerships (LPs) and limited liability partnerships (LLPs) offer some limited liability protection, depending on the role of each partner.

How Partnership Status Affects Taxes

Unlike a sole proprietorship, a partnership is required to file its own tax return using Form 1065. However, the partnership itself doesn’t pay federal income taxes. Instead, it’s treated as a pass-through entity, meaning profits and losses are passed directly to the partners based on the terms of the partnership agreement.

Each partner receives a Schedule K-1 outlining their share of the partnership income, deductions, and credits. Partners must report this information on their personal tax returns and pay both income taxes and self-employment taxes on their portion of the profits.

Who Should Form a Partnership?

A general partnership might be the right fit if:

- you’re working with multiple owners who want to keep things straightforward

- you and your other partners are comfortable with the risks of unlimited liability

- your business is in its early stages or functions as a side hustle with modest net earnings

- you want flexibility in dividing responsibilities and profits among limited partners and general partners

LLC (Limited Liability Company)

One of the biggest challenges of operating as a sole proprietorship or general partnership is the lack of separation between the business entity and the owner(s). In these business structures, owners are held personally liable for business debts or lawsuits, putting their personal assets at risk.

Enter the limited liability company (LLC)—a legal entity that helps business owners mitigate personal liability. With an LLC, your personal resources are generally protected, even if the business faces financial trouble or legal action.

The LLC structure is appealing because it provides flexibility with fewer corporate formalities than a corporation while offering varying levels of limited liability protection. It’s an excellent option for many entrepreneurs who want to protect their assets while minimizing administrative burdens.

How LLC Status Affects Taxes

For federal income tax purposes, an LLC is treated as a pass-through entity, meaning the business income or loss flows directly to the owner(s). The specific tax filing requirements depend on whether the LLC has only one person (a single-member LLC) or multiple owners (a multi-member LLC).

- Single-member LLCs (SMLLCs): Considered a disregarded entity, they report their business income and expenses on Schedule C of Form 1040, similar to a sole proprietorship.

- Multi-member LLCs: File a partnership tax return (Form 1065), and each member receives a Schedule K-1 detailing their share of the partnership income, deductions, and credits for their personal tax returns.

Regardless of whether the LLC elects to keep profits in the business or distribute them to members, those profits are subject to income tax. If members actively work in the business, they also pay self-employment taxes (including Medicare taxes and Social Security).

Who Should Form an LLC?

A Limited Liability Company may be the right business structure for you if:

- you value separating personal and business assets to reduce risk

- you want a simpler alternative to corporations with fewer corporate formalities

- you’re an entrepreneur anticipating initial losses and want to report them on your personal tax return

Corporation

A corporation is a distinct legal entity that, like an LLC, separates the business ownership from the owners, reducing personal liability. A corporation can enter contracts, hold assets, incur debts, and sue or be sued independently of its shareholders.

However, a key difference is that corporations pay their own business taxes. This means the company files a separate tax return and pays corporate income tax on its taxable income. Unlike an LLC, profits aren’t automatically passed through to the owners.

How Corporation Status Affects Taxes

One potential drawback of a corporation is double taxation. This means:

- The corporation pays taxes on its corporate profits.

- When shareholders receive distributions, they report those earnings on their personal income tax returns.

To avoid this, a corporation can elect S corporation status.

Should You Elect S Corporation Status?

Both LLCs and corporations can choose to be taxed as S corporations. An S corporation allows business income to “pass-through” to the owners, avoiding double taxation.

One of the biggest advantages of an S corporation is the ability to split the business’s income into 2 categories:

- Salary: Subject to FICA taxes (Social Security and Medicare taxes).

- Distributions: Not subject to FICA or self-employment taxes.

For example, if your LLC or corporation earns $80,000 in profits, you might allocate $50,000 as salary and $30,000 as distributions, reducing your FICA tax liability. However, the IRS requires you to pay yourself a “reasonable salary” for your role in the business, so you can’t underpay on salary to maximize distributions.

When to Keep C Corporation Status

If your goal is to keep profits inside the business, remaining a C corporation may be a better choice. A C corp allows you to take advantage of lower corporate tax rates and defer personal taxes until profits are distributed. Additionally, a C corp can help businesses raise funds by selling stock or reinvesting profits for growth.

Who Should Form a Corporation?

A corporation might be the ideal business structure if:

- you want to limit your personal liability for business debts

- you’re comfortable with additional corporate formalities and reporting requirements

- you plan to keep profits in the business to leverage lower corporate income tax rates

- you aim to raise capital by issuing stock

- you’re looking to reduce self-employment taxes by electing S corporation status

The Pros and Cons of Each Business Entity

If you’re still unsure which business structure is best for you, here’s a quick breakdown of the pros and cons for each.

Sole Proprietorship

Pros:

- easy setup with minimal paperwork

- full control over business decisions

- pass-through taxation—business income is reported on your personal tax return

Cons:

- unlimited liability, meaning personal assets are at risk

- harder to raise funds or obtain business loans

- no separation between personal and business finances

Partnership

Pros:

- simple structure with shared responsibility

- income flows through to individual tax returns (no double taxation)

- partners can pool resources and expertise

Cons:

- unlimited liability for general partners, exposing personal assets to risk

- can be difficult to resolve disputes without a clear partnership agreement

- profit-sharing may not always align with effort or contribution

LLC (Limited Liability Company)

Pros:

- limited liability protection, safeguarding personal assets

- flexibility in management and structure

- pass-through taxation—profits and losses reported on owners’ personal tax returns

Cons:

- can be more expensive to set up and maintain than a sole proprietorship

- self-employment taxes may apply to business income

- additional paperwork and filing requirements, depending on state laws

Corporation

Pros:

- limited liability for shareholders, protecting personal assets

- ability to raise capital by issuing stock

- potential tax advantages if you retain earnings within the company (C corp)

Cons:

- more complex and expensive to set up and maintain

- subject to double taxation unless an S corp election is made

- corporate formalities and regulations can be burdensome

There’s No One-Size-Fits-All Business Entity

When it comes to choosing the right business structure, there’s no one-size-fits-all solution. Each business owner needs to weigh their priorities, including tax implications, personal liability, and administrative responsibilities, before deciding.

The federal government treats each type of business entity differently, especially when it comes to how you pay taxes and report income. For instance, a sole proprietorship offers simplicity but exposes your personal assets to risk, while a limited liability company (LLC) or limited partnership provides varying degrees of liability protection. Meanwhile, corporations—whether standard C corporations or close corporations—must comply with additional regulations, including requirements on how corporations report their finances.

When making your choice, consider the following key factors:

- Liability protection: How comfortable are you with your personal assets being at risk? For those looking for protection, entities like LLCs or benefit corporations offer a shield against most liabilities.

- Tax treatment: Does your business income qualify for pass-through taxation (as with sole proprietorships, partnerships, and S corps), or do you prefer the advantages of reinvesting profits in a C corporation?

- Ownership structure: Are you operating as an unincorporated business with a single owner, or do you need a formal partnership agreement to manage roles and responsibilities among general partners or limited partners?

- Growth plans: If you’re a small business looking to attract investors or issue stock, a corporation might suit your needs better than a sole proprietorship or partnership.

Seek Professional Advice

Navigating these choices can feel overwhelming, and that’s where seeking professional advice can make a difference. A tax professional or business attorney can help you assess your financial situation, understand complex regulations, and ensure compliance with the federal government’s requirements. They’ll also help you evaluate whether an entity like an LLC should be treated differently for tax purposes (for instance, if the LLC elects S corp status).

Think Long-Term

As a business owner, it’s critical to align your business structure with your long-term goals. Do you want the flexibility of a sole proprietorship to start small, or are you building toward a larger operation that may eventually transition into a close corporation or a benefit corporation? Do you foresee needing the simplicity of pass-through taxation, or do you plan to reinvest profits and take advantage of corporate tax rates?

Choosing the right business entity is about more than just taxes—it’s about your vision for your business, how you want to manage liability, and how much control you’d like to retain. Whether you’re starting a small business or planning to grow into something bigger, the right structure will set you on the path to success.

This post was updated in January 2025.

Written by Nellie Akalp, Freelance Contributor

Posted on August 29, 2017

This article was verified by Janet Berry-Johnson, CPA and Freelance Contributor

![Your Accountant Matters: How to Find the Right One for Your Business [free e-book] cover image](https://www.freshbooks.com/blog/wp-content/uploads/2022/03/Blog_Post_Image-226x150.jpg)