Easily access all the tax info you need directly from your FreshBooks account, to ensure easy collection and filing this tax season.

Federal taxes, tax returns, income taxes. It’s all a headache. And if you own a small business, you may have anxiety when it comes to tax time. You’re not alone – tax filing can be scary. We’ve all been there: Digging through mountains of receipts, triple-checking invoices from half a year ago, losing sleep over whether you chose the right category for your expenses – taxes are no joke. Even if you think you’ve covered all your bases for tax preparation, you’ve lost valuable time looking for information that you could retrieve in a few clicks. And no, we’re not talking about tax software.

To help with your tax preparation, FreshBooks gives you access to all the data you need in 3 thorough Reports. The Profit & Loss Report, General Ledger Report, and Sales Tax Summary Report will save you time and spare you the stress of collecting and verifying everything you need to process your taxes with confidence this tax season before the tax deadline. These reports are like your personal tax professionals, as they’ll help make tax filing, tax returns, and meeting your tax deadline that much easier.

Table of Contents

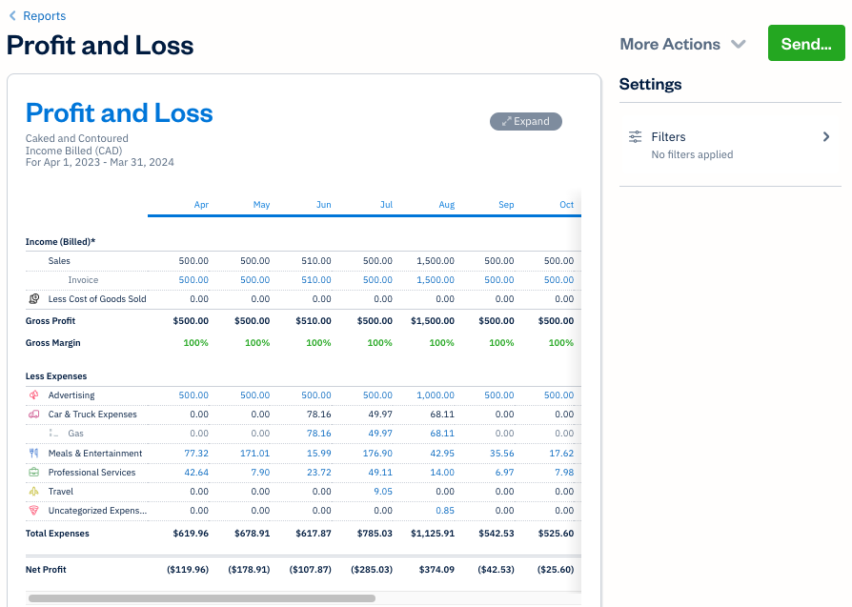

Profit & Loss Report

Your Profit & Loss Report (a.k.a. P&L) shows your total Income and Expenses in a specific period of time to give you a net profit or loss. This is an essential Report come tax time, as the form contains the information you’ll need to report on for your tax returns. Think of it as a snapshot of your business activity over the last year while being incredibly useful for your tax refund.

A P&L statement is important as it’s one of the three types of financial statements prepared by you or your accountant/accounting software to tell the financial story of your company.

The other two are the balance sheet and the cash flow statement. The purpose of the P&L statement is to show company revenues and expenditures over a specified period of time, usually over one fiscal year.

As a business owner, you and your accountant can use this information to understand the profitability of the company/business income, often combining this information with insights from the other two financial statements. These same data reports are the tax preparers to accompany you when tax filing your tax returns, tax refunds, or anything in between.

For example, you may want to calculate a company’s return on equity (ROE) by comparing its net income (as shown on the P&L) to its level of shareholder’s equity (as shown on the balance sheet).

How Do I Access My Profit and Loss Report?

Accessing your profit and loss report in FreshBooks is easy! To run your report:

- Go to the Reports section of your account

- Select Profit & Loss under Accounting Reports

Here’s what it looks like in FreshBooks:

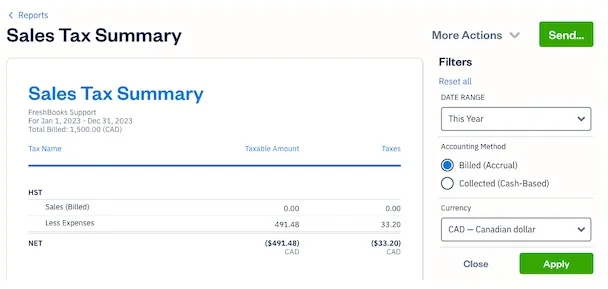

Sales Tax Summary Report

The Sales Tax Summary Report provides a clear breakdown of the sales tax you’ve collected on revenue and the tax you’ve paid on expenses.

If you’re registered to collect sales tax, this report neatly organizes the information needed to file your tax return, making it invaluable for federal tax filing. By tracking collected and paid taxes, the report simplifies record-keeping and ensures everything is in order, making life easier for both you and your accountant.

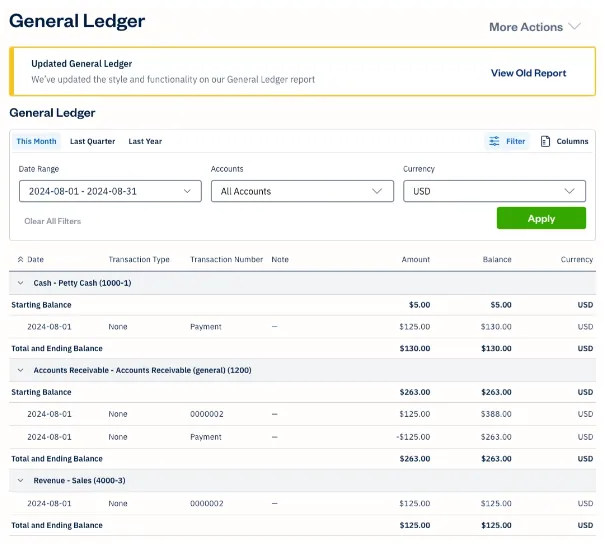

General Ledger Report

The General Ledger report gives you a detailed view of every transaction moving in and out of your accounts on an accrual basis. These transactions are generated from activities in FreshBooks, such as sending invoices, tracking expenses, accepting payments, and logging other income.

A complement to the Trial Balance report, the General Ledger helps verify that all categories and parent accounts are balanced. Plus, you can adjust date range filters to match the report with your bank statements, making reconciliation easier.

This powerful tool ensures everything is categorized correctly, helping you identify potential tax deductions and stay prepared for tax time.

Check out the report below:

NOTE: The updated General Ledger report is currently only available to specific users. Our product team is working on making it available to Plus, Premium, and Select plans soon.

If you want to try the updated General Ledger report, sign up for the waitlist here.

Tax Advice: Other Reports to Consider at Tax Time

The two other Reports worth looking at are the Cash Flow Report and the Invoice Details Report. The Cash Flow Report breaks down exactly how much cash you have on hand, as well as where the money came in from and went to. The Invoice Details Report provides a detailed summary of all the invoices you created and sent over a period of time to keep track of your fees.

Tax Preparer: Need Help Getting Started?

Having all of this information at your fingertips will help make your tax filing more manageable. If you have interest in learning more about FreshBooks reports, contact our team of Support Rockstars, ready and able to help you out on your journey to become a tax expert.

How a Relationship Coach Uses FreshBooks to Make Tax Time a Breeze (VIDEO)

This post was updated in January 2025.

Written by FreshBooks

Posted on April 7, 2021

A Beginner’s Guide to Financial Statements

A Beginner’s Guide to Financial Statements Why the Cloud Is Your Ally at Tax Time—and Beyond

Why the Cloud Is Your Ally at Tax Time—and Beyond A Roundup of U.S. Tax Season Advice

A Roundup of U.S. Tax Season Advice