General ledger template – free download

What is a general ledger?

A general ledger is a company’s main accounting record and is used to keep track of all your business accounts together. It typically includes 4 main categories: assets, liabilities, revenues, and expenses.

Your general ledger provides an overview of your company’s financial situation. In addition to details on all incoming and outgoing business transactions, the general ledger includes dates and categories for each transaction to help you generate accurate financial reports and records.

General ledgers are structured based on the double-entry accounting method, where each transaction has a journal entry on the debit and credit sides. This helps your accountant balance the books and provides a clear system for preparing your financial statements.

How do I create a general ledger?

A general ledger template makes it easy to automate your general ledger process. FreshBooks templates also let you customize your general ledger templates so you can include the categories that best fit your small business.

Determine your ledger categories

Most general ledgers include categories for assets, liabilities, revenues, and expenses. However, you can also include additional categories, such as shareholder’s equity.

Set up double-entry columns

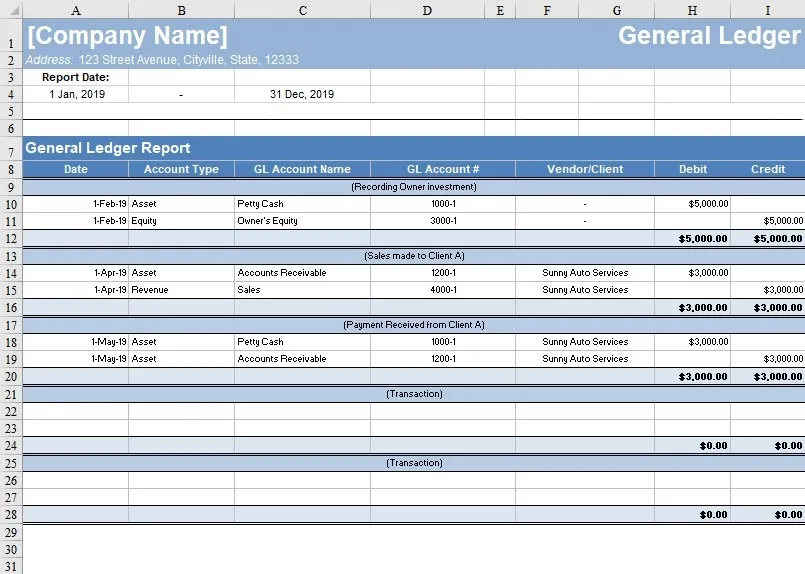

Using the FreshBooks general ledger template, prepare a double-entry table with debit and credit sides for each category.

Add category details

Add details like the account balances, names and numbers, and transaction dates. It’s also helpful to include a space for a brief description of the transaction.

Record transactions

Every time your company makes a transaction, include it in the general ledger. Remember to include repeat transactions and preauthorized payments.

Review your ledger

Make sure your general ledger is up to date with regular reviews. It’s recommended to review at least once a month or more frequently if you perform many transactions.

Download general ledger template

No more spending hours creating accounting spreadsheets—a customizable general ledger template from FreshBooks makes it easy to create and use your own general ledger. Download the template for free as a spreadsheet or PDF, add relevant details, and fill in all your transactions for an effortless workflow.

General ledger format

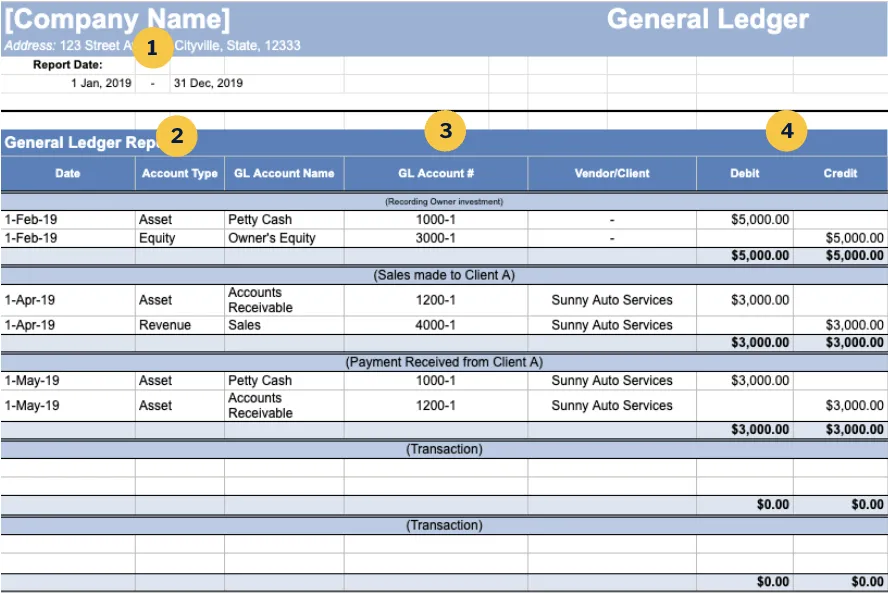

A general ledger is crucial for understanding your business’s financial health, providing a systematic record of every transaction organized into distinct accounts. Download FreshBooks’ free general ledger template to help you effortlessly manage your financial records. Below are the four main sections of this template, along with four simple steps to accurately fill it out and gain valuable insights into your business’s financial performance.

1. Determine the accounting period

Decide on the specific time frame the ledger will cover (e.g., monthly, quarterly, or annually). This establishes the scope of your record-keeping.

2. Understand your chart of accounts

Familiarize yourself with your Chart of Accounts, which lists all your business’s accounts by type: Assets (what you own), Liabilities (what you owe), Revenue (money earned), Expenses (costs incurred), and Equity (owner’s stake). This understanding is key to classifying transactions accurately.

3. Record transactions

For each transaction, identify affected accounts (using their numbers), record the date and vendor/client (if applicable), and apply double-entry bookkeeping (debits = credits). Enter debit/credit amounts in the correct columns (debits increase assets, expenses, and dividends; credits increase liabilities, equity, and revenue) and update each account’s balance.

4. Regularly review and balance

Periodically review your ledger entries for accuracy. At the end of your chosen accounting period, ensure that the total debits equal the total credits. This balanced ledger is essential for generating accurate financial reports.

Additional accounting templates

Discover even more downloadable business accounting system templates to support your small business.

Profit and loss statement template

Also called an Income Statement, a profit and loss statement provides an overview of your company’s revenue and expenses over a given time period.

Expense report template

An expense report tracks all of your company’s spending. This includes major corporate purchases as well as business spending by employees.

Simple balance sheet templates

A simple balance sheet shows your financial data on assets, liabilities, and shareholder equities. It provides an overview of your company’s finances at a specific point in time.

Income statement templates

An income statement shows your company’s revenues and expenses for that financial period.

Billing statement templates

A billing statement is a report that a company sends to its customers that includes a record of all transactions and balances owed during the billing period.

Bank reconciliation templates

A bank reconciliation helps you compare your company’s financial statements to your bank statements to ensure all transactions and asset accounts are accurate and accounted for.

General ledger template vs. FreshBooks accounting software

While a general ledger template is great for starting out, FreshBooks’ full-service accounting software offers everything you need for comprehensive invoicing, generating financial statements, and calculating taxes.

Features

General ledger template

FreshBooks accounting software

Mobile Access

Pre-designed Templates

Downloadable Templates

Automated Data Entry

Automated Calculations

Reduced Error Risk

Cloud Data Storage

Limited

Automatic Report Generation

Scalability

Difficult

Automatic Recurring Reports

FreshBooks accounting software offers a wide array of features, including customizable invoicing, online payments, tax calculations, and more. In addition to creating a general ledger, FreshBooks accounting software makes it easy to automatically record and track payments and import them into your ledger to save you time and money.

Sign up for a free FreshBooks trial today

Try It Free for 30 Days. No credit card required.

Cancel anytime.

Helpful resources for your business

FreshBooks offers a wide array of articles to help you grow your business. Browse our small business resource hub to discover articles on reports, invoicing, and other essential financial statements here. You can also explore general accounting articles to learn more about how FreshBooks accounting software can support your small business.

General Ledger: Definition, Importance, and How It Works

What Is a General Ledger Report?

What Is a Ledger in Accounting?

Chart Of Accounts: Definition, Types And How it Works

Frequently Asked Questions

A general ledger typically includes assets, liabilities, revenues, expenses, and equities. It’s also helpful to include details for each transaction, such as the date and a brief description.

A general ledger is essential for providing a clear overview of your company’s financial position. It also helps you prepare important financial statements and provides information for your decision-making and business strategy creation.

A good general ledger template should include clear sections for categories like assets, liabilities, revenues, expenses, and equities. It should also provide space for names, dates, and details. Your general ledger template should also be customizable so you can tailor it to your small business needs.

You can balance your general ledger by comparing the debit and credit sections of each account. Each transaction should be recorded on both sides, meaning that your debit and credit sections should have the same total when added up at the end.

Yes, you can automatically generate a general ledger using your accounting software. You’ll still need to input your transactions, but your accounting software can then populate the general ledger account using this information.

FreshBooks offers a variety of different plans for accounting services, so you can find the plan that fits your price point. Using accounting software like FreshBooks helps you save time on your accounting, making it a helpful investment for your business.