Expense report template – free download

What is an expense report?

An expense report is a comprehensive document that tracks your company’s spending for a given time period. Within the report, expenses are sorted into different categories to keep track of employee business expenses, company purchases, and other costs.

Expense reports are essential for organizing and tracking business spending. When employees and other members of the company go on business trips or make purchases on behalf of the business, spending is tracked on the expense report. This record is then used to reimburse employees for travel expenses and other business-related spending.

A detailed monthly expense report is helpful for creating a corporate budget and managing financial record-keeping. It’s also important at tax time, when you can use the expense report to organize your business expenses and claim the relevant business tax deductions.

How do I create an expense report?

You can create an expense report in 6 easy steps:

Download a report template

Download a free expense report template or use a reporting software like FreshBooks to save time on your expense report calculations.

Customize your columns

Most expense report templates come with columns for expense date, name, client, amount, and other details. Customize your columns to suit your business needs.

Fill in expenses

Add the details for any other expenses incurred during the accounting period. Generally, expense reports are filed chronologically, with the most recent expense at the end.

Calculate totals

Calculate the subtotals and totals of each expense category, including taxes. Expense reporting software can automate this process.

Include documentation and receipts

Attach any invoices or receipts to your expense report. This is necessary for all employee spending and is recommended for business owners and any other company members.

Share your report

Review your expense report, confirm that all expenses have the required documentation, and share the report with your accountant and anyone else who needs access.

Download expense report template

A free basic expense report template is a straightforward way to track expenses and simplify your entire expense reporting process. You can download the template and customize the columns to suit your business needs, making it easy to organize all your expenses. Choose from PDF or spreadsheet formats to suit your accounting system.

Expense report format

Expense reports include the following major categories:

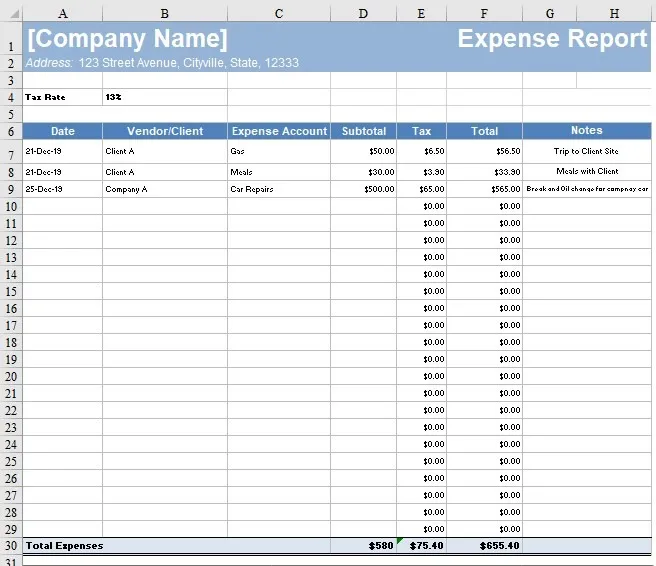

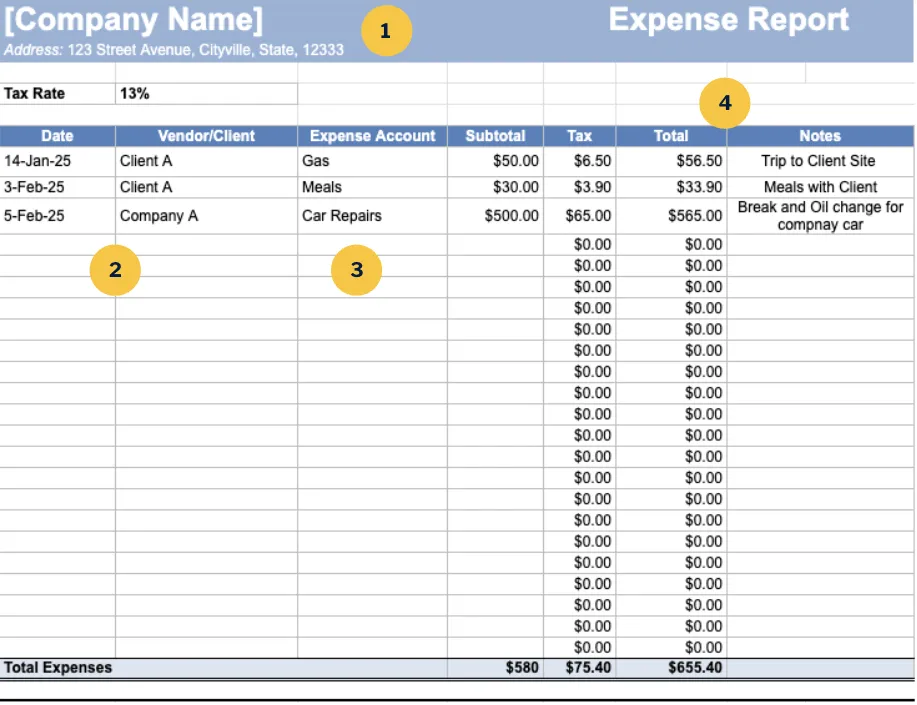

1. Company details

These include your company’s name, address, and contact information, as well as the information of the business owner or employee creating the expense report.

2. Accounting information

Include the number and details of the financial account(s) associated with the expense. This section may also include information on the relevant client file.

3. Expense details

Add the date, name, and amount of the purchase. You’ll also include who purchased the item or service, a receipt for the purchase, and any relevant notes.

4. Totals and notes

Ensure each expense category column displays both subtotals and grand totals. Separate totals should be provided for amounts before and after taxes. For enhanced record-keeping, a notes column can be added to provide further details about each expense.

Additional accounting templates

In addition to your travel expense report template, try even more free downloadable accounting templates from FreshBooks.

Profit and loss statement template

Download a free profit and loss statement template to compare your company’s revenue and expenses during a given time period.

Simple balance sheet templates

A simple balance sheet template provides an easy way to review your assets, liabilities, and shareholder equities over a specified period.

General ledger templates

Use a general ledger template to create an overview of your company’s finances, including assets, liabilities, revenue, expenses, and shareholder equity.

Income statement templates

Also called a profit and loss statement, an income statement provides a snapshot of your revenue and expenses.

Billing statement templates

A free billing statement template helps you create a comprehensive overview of your transactions with a client.

Bank reconciliation templates

Try a bank reconciliation template to help you compare your internal financial statements to your bank records.

Expense report template vs FreshBooks accounting software

Compare the free expense report template and FreshBooks accounting software to find the right fit for your business needs.

Features

Expense report template

FreshBooks accounting software

Mobile Access

Pre-designed Templates

Downloadable Templates

Automated Data Entry

Automated Calculations

Reduced Error Risk

Cloud Data Storage

Limited

Automatic Report Generation

Scalability

Difficult

Automatic Recurring Reports

FreshBooks accounting software offers everything you get in a downloadable template, plus a wide array of other helpful features. In addition to a customizable template, you can automate recurring expenses and instantly perform calculations for quicker, more accurate expense reporting.

While a free template is good for creating your first expense report, accounting software is the best fit for tracking ongoing expenses, reimbursing employees, and managing your business finances.

Sign up for a free FreshBooks trial today

Try It Free for 30 Days. No credit card required.

Cancel anytime.

Helpful resources for your business

The FreshBooks small business resource hub delivers a wide array of helpful articles on expense reports, invoicing, and other information for running a small business. Discover free templates for a variety of financial reports to support you as you grow your business.

Expense Report: What It Is and Why Is It Important?

How to Create an Expense Report: 6 Easy Steps

9 Free Expense Tracker of 2025

What Is Expense Analysis & How to Analyse Business Account

Frequently Asked Questions

An expense report works by organizing and tracking business expenses. Based on this, the company can make expense reimbursements to employees, track spending, and prepare a budget.

Expense reports are an essential tool for business reimbursement, budgeting, and financial planning. Keeping an expense report is necessary for employees who make business purchases and want to be reimbursed for their spending.

Anyone who makes business purchases should use an expense report. This includes employees who want to be reimbursed and small business owners who want to track their company spending.

An expense report should include detailed information on any business or business-related expenses, including who made the expense, the date, amount, client and associated accounts, receipts or invoices, and totals.

Yes, business owners and employees can generally use the same monthly expense report template together. Business owners may also use an additional template to record overall company spending.

An expense report tracks company spending, while an income statement tracks revenue. Expense reports may be used by employees and business owners, while income statements are typically reserved for decision-makers like the business owner.

Although you don’t need FreshBooks accounting software to create an expense report, it does make it faster and easier. FreshBooks allows you to automate repeating expenses, generate reports, perform automatic calculations, and other helpful features.

You should upgrade to a paid accounting subscription when you have to generate multiple expense reports or when you have a large volume of expenses that would be faster and more accurate to track with an automated system.