Bank reconciliation template – free download

What is a bank reconciliation?

Bank reconciliation is the process of comparing your company’s internal financial records with your bank statements. This allows you to spot discrepancies between your records and your bank account, allowing you to resolve them to ensure your financial records are as accurate and useful as possible. Bank reconciliations are usually done on a monthly basis.

Bank reconciliation is a crucial part of avoiding recordkeeping mistakes and preventing financial fraud. It also helps manage risk, as bank reconciliation ensures accurate statements, helping investors make informed decisions. In general, bank reconciliation provides accountability and confidence in your financial records when compared to your bank account, ensuring all transactions are accurately reported and free of errors.

How do I create a bank reconciliation?

Making a bank reconciliation statement can be a very simple process when you use the right tools. With the FreshBooks bank reconciliation template, you can complete this essential process in just a few easy steps:

Choose your format

First, choose from our various bank reconciliation template formats to find the one that suits your needs.

Download template

Once you’ve chosen your reconciliation template, download it for free from FreshBooks.

Add your business info

Customize your template with your company logo, business name, and other important information.

Account for deposits

Record the initiation and completion of all payments your company has received in the relevant field.

Account for payments

Record the initiation and completion of all payments made from your account in the relevant field.

Check for discrepancies

Finally, double-check the entire report for any errors or discrepancies and amend as needed.

Download bank reconciliation template

The bank reconciliation template from FreshBooks is highly customizable, making it easy to adapt to your specific business needs.

Like our other templates, the bank reconciliation statement template is completely free to download and comes in multiple formats to ensure it’s simple to incorporate into your existing records system.

Bank reconciliation format

What goes on a bank reconciliation document? There are a few key components that the bank reconciliation template should include:

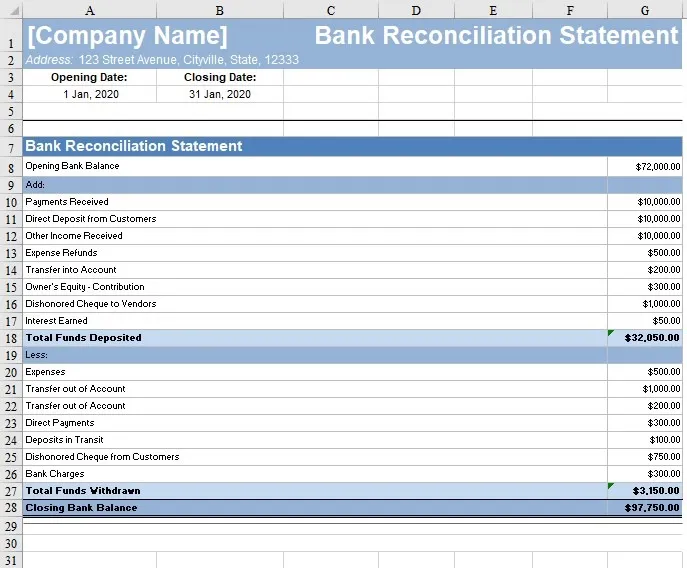

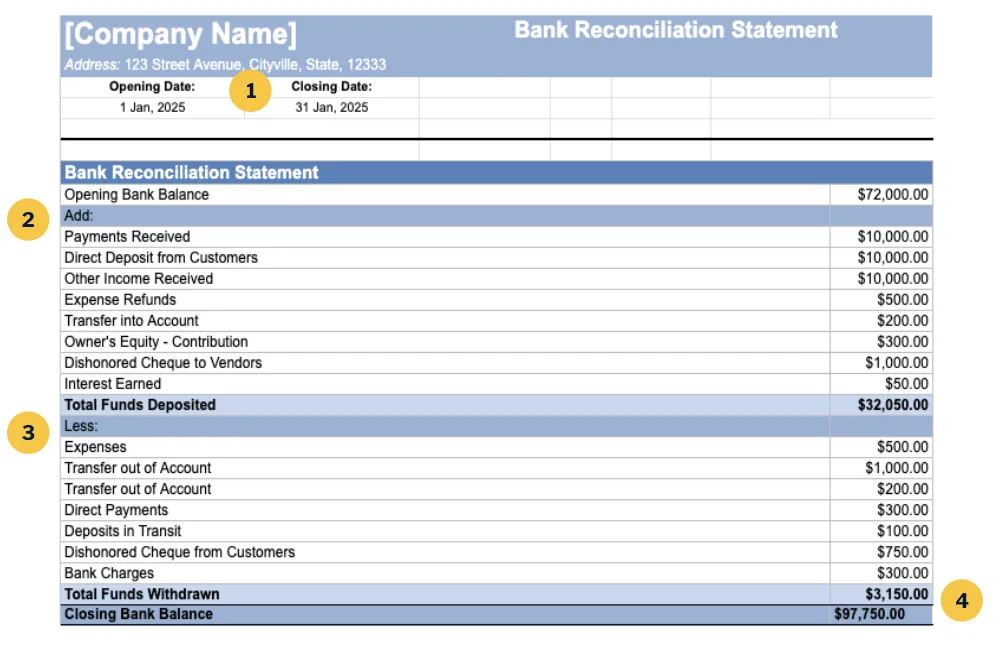

1. Opening and closing date

This section indicates the time period covered by the report by stating the opening and closing dates.

2. Add

The ‘Add’ section lists all transactions that have been deposited to the opening bank balance, such as payments received, direct deposits from customers, and any other income.

3. Less

The “Less” section of a bank reconciliation statement details transactions that decrease the opening bank balance, like expenses, direct payments, and deposits in transit. This section is crucial for finding the adjusted bank balance and ensuring accurate financial records.

4. Closing bank balance

This is your final adjusted cash balance after addressing any discrepancies or errors. The ending cash balance in your books should match the ending balance on the bank statement. If any discrepancies remain, you’ll include an explanation for them here as well.

Additional accounting templates

A bank reconciliation statement is just one part of an effective accounting system. We offer several other useful templates to help you better manage your business finances, including:

Profit and loss statement template

This essential accounting statement notes your expenses, revenues, gains, and losses for a given period.

Expense report template

This statement helps you categorize your business expenses, tracking amounts, reimbursement notes, and other important details.

Simple balance sheet templates

This report details all of your company’s assets, liabilities, and shareholder equity, helping you get a broader view of your financial position.

General ledger templates

This document allows you to manage a double-entry accounting system ongoingly by organizing transactions into sub-ledger accounts.

Income statement templates

Another term for profit and loss statements, these reports help you track your expenses and revenues for a given time period.

Billing statement templates

Your billing statement helps you keep track of all transactions with a certain customer, including payments, fees, and interest.

Bank reconciliation template vs. FreshBooks accounting software

A bank reconciliation template will help you avoid discrepancies, errors, and intentional fraud, but it’s just one piece of the accounting puzzle. FreshBooks accounting software is a comprehensive solution for small business accounting, with countless useful features, including:

Features

Free bank reconciliation template

FreshBooks accounting software

Import Transactions

Manual data entry from bank statements.

Automatic import from connected bank accounts.

Identify Discrepancies

Manual comparison

Automatic flagging of discrepancies and potential issues.

Calculate Ending Balance

Manual formula creation

Automatic calculation of reconciled balance.

Generate Report

Manual formatting, limited customization.

Automatic report generation with customizable details.

Store & Access Records

Local file storage, limited accessibility.

Secure cloud storage, accessible from anywhere.

Recurring Reconciliations

Manual setup and reminders

Automated recurring reconciliations with reminders.

Error Correction

Manual adjustments

Direct adjustments within the software, audit trail.

Scalability

Complex with increasing transactions/accounts.

Seamlessly handles growing transaction volume.

Sign up for a free FreshBooks trial today

Try It Free for 30 Days. No credit card required.

Cancel anytime.

Helpful resources for your business

Looking for more help with your small business accounting? We’ve got you covered with these other helpful resources:

Bank Reconciliation: Definition, Example, and Process

What Should You Be Doing at the End of Every Business Day?

Month End Close Process: Importance, Checklist & Best Practice

Frequently Asked Questions

Our free bank reconciliation template simplifies the process of reconciling your books (accounting records) with your bank statements, making it easier to track and fix discrepancies, avoid errors, and protect yourself from fraud.

A bank reconciliation template includes all bank account transactions (such as deposits and withdrawals) that were recorded in your books over a given period of time. This is then compared to your bank statement to ensure all amounts match.

Reconciling your accounts payable (AP) account involves comparing your general ledger balance with your AP sub-ledger. If the amounts match, the accounts are considered reconciled. If not, you’ll need to examine both ledgers for any errors.

Generally, the process of accounting reconciliation includes gathering and comparing 2 sets of financial records (usually the general ledger and the sub-ledger), identifying discrepancies between them, and investigating those discrepancies to resolve them.

The best file format for your reconciliation template depends on your existing system. If your accounting documents are usually in .doc or .docx format, it’s best to use the same one for reconciliation templates. The same goes for spreadsheet or PDF formats.

FreshBooks accounting software takes the time-saving benefits of our free bank reconciliation templates and amplifies them. It efficiently generates reports, reconciles bank statements automatically, and offers a host of other useful financial reporting features for small businesses.

Yes, FreshBooks accounting software has automated bank reconciliation. This feature saves you time by automating the reconciliation process. Directly approve, change, and import transactions from within your bank account and generate reports instantly with the click of a button.