Best vacation rental accounting software

Automate guest invoicing and payment collection

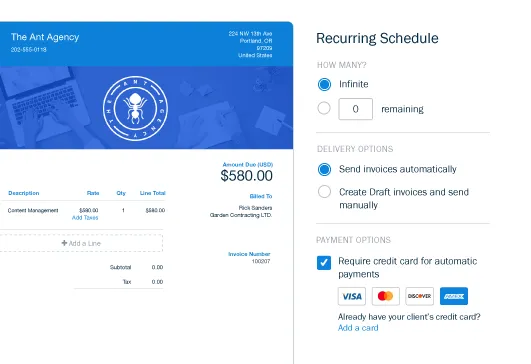

FreshBooks helps automate guest invoicing and payment collection for property owners , ensuring you get paid faster. You can create professional-looking invoices in seconds and let your client pay with credit cards or bank transfers (ACH). Linking to bank accounts can facilitate faster payments, making it even easier to get paid quickly!

Track rental income and property expenses effortlessly

FreshBooks allows you to track rental income and property management expenses effortlessly. Keep your books accurate and up-to-date with automation while managing and analyzing financial data. Prepare detailed financial reports and track income and expenses—you’ll know how your business is performing 24/7 and you’ll always be ready for tax time.

Simplify tax preparation with automated reports

Simplify tax preparation with FreshBooks’ automated reports. Spend less time on manual data entry and more time running your business. Improve accuracy when your bookkeeping software automatically records income and expenses, tracks time, sends payment reminders, and keeps your books tax time ready.

Manage multiple properties with real-time financial insights

Property managers can manage multiple properties using property management software like FreshBooks and gain real-time financial insights. Capture important project information from the first pitch to delivery. Set and stick to proposed budgets, bill for the work you did, and deliver profitable projects for your business.

Streamline bookkeeping with seamless bank reconciliation

FreshBooks streamlines bookkeeping with seamless bank reconciliation. This helps ensure that your financial records are accurate and up-to-date, saving you time and reducing errors.

FreshBooks Accounting Software Testimonial Videos

All the features you will need for your vacation rental accounting software

Automate your vacation rental finances & save time

FreshBooks’ automation features, such as recurring invoices, expense tracking, and tax calculations, help vacation rental businesses streamline their bookkeeping. This automation emphasizes time savings, reduces errors, and provides efficient financial management, allowing owners to focus on growing their rental business.

Get paid faster with seamless invoicing

FreshBooks simplifies invoicing and payments for vacation rentals with automation, online payment options, and automated reminders. These features ensure timely payments, minimize missed transactions, and enhance cash flow for a stress-free financial experience.

Monitor your rental income in real time

FreshBooks provides vacation rental owners with real-time updates on income, expenses, and overall financial health. These instant insights eliminate manual tracking, helping rental businesses make informed financial decisions with ease.

Featured In

Free vs. FreshBooks accounting software for vacation rental

Free accounting software might seem like a good deal for vacation rental owners, but it often misses important tools. Things like invoicing, tracking expenses, and creating detailed reports might be limited. This can make managing your finances harder as your business grows.

FreshBooks is designed for vacation rentals. It helps you easily track what you earn and spend, create invoices, and get paid faster. FreshBooks also keeps your data safe and connects with other business apps, which free software usually doesn’t do.

For a reasonable cost, the right accounting software like FreshBooks gives you the tools to manage your money and grow your business confidently.

Accounting apps & integrations for vacation rental owners

FreshBooks can integrate with 100+ apps to help you take control of your vacation rental business’s accounting and customize your FreshBooks experience.

Support that actually supports you 💙

- Help From Start to Finish: Our Support team is highly knowledgeable and never transfers you to another department.

- 4.8/5.0 Star Reviews: Yup, that’s our Support team approval rating across 120,000+ reviews

- Global Support: We’ve got over 100 Support staff working across North America and Europe

Accounting software by industry

Feeling overwhelmed by bookkeeping? FreshBooks offers industry-specific accounting software that simplifies finances and boosts efficiency, letting you focus on what truly matters. Visit our industry pages below to learn how FreshBooks can fulfill all your accounting needs!

Trades and Home Services

Creative Professionals

Specific Professions

Specialized Industries

Online and Digital Services

Resources to support vacation rental owners

10 Airbnb Tax Deductions

25 Small Business Tax Deductions (Write Offs) in 2025

How Is Rental Income Taxed? Understand Rates and Deductions

Frequently asked questions

FreshBooks is the best short-term rental management software. It offers features such as automating invoicing and payments, tracking rental income and expenses, simplifying tax preparation, and providing real-time financial insights.

When choosing vacation rental accounting software, look for features like automated invoicing and payments, expense tracking, financial reporting, and tax preparation assistance. FreshBooks offers all these features and more.

Accounting software helps manage rental income and expenses by automating tracking, organizing transactions, and generating financial reports. FreshBooks provides a clear overview of your financial status, making it easier to make informed decisions.

Vacation rental owners can track various tax deductions with accounting software, including mortgage interest, property taxes, utilities, and maintenance expenses. FreshBooks helps you organize these expenses for easy tax preparation.

Yes, you can automate invoicing and payments for your vacation rental business with FreshBooks. This feature saves time and ensures timely payments from guests.

Vacation rental accounting software like FreshBooks generates various reports for financial insights, including income statements, expense reports, and cash flow statements. These reports help you monitor your business’s financial health.