Best sole trader accounting software

Simplify invoicing and get paid faster with sole trader accounting software

FreshBooks accounting software for sole traders helps you simplify invoicing and get paid faster. Create professional-looking invoices in seconds and accept payments through various options such as credit cards, bank transfers (ACH), PayPal, Venmo, and Apple Pay. When it’s this easy, you’re bound to get paid quickly.

Track income and expenses with ease

Keep track of your income and expenses effortlessly with FreshBooks. With FreshBooks, you can easily monitor your financial performance, categorize expenses, and ensure that your books are accurate and up-to-date. This makes it simple to see where your money is going and helps you make informed decisions.

Automate tax calculations and reports

Automate your tax calculations and reports to save time and reduce errors. One effective strategy for solopreneurs is to prepare and file taxes efficiently by using automated tools. FreshBooks helps sole traders automate tax-related tasks, such as calculating sales tax, deductions, and generating tax reports. This feature simplifies tax season and ensures compliance.

Manage cash flow with real-time insights

Manage your cash flow effectively with real-time insights from FreshBooks. As your business grows, it is crucial to select software that can adapt to evolving needs, ensuring you have the necessary features for future expansion. You’ll always know where your business stands financially with up-to-date information on income, expenses, and outstanding invoices. This clarity helps sole traders make better financial decisions.

Stay organized with seamless bookkeeping

Stay organized with FreshBooks’ seamless bookkeeping tools. FreshBooks makes bookkeeping simple by providing a centralized platform to manage your finances, track transactions, and generate financial reports. This helps sole traders stay on top of their books and maintain a clear financial overview.

FreshBooks Accounting Software Testimonial Videos

All the features you will need for your sole trader accounting software

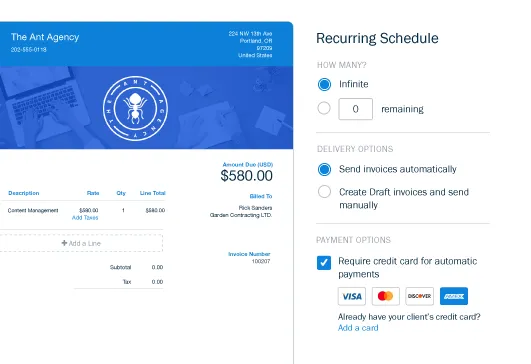

Automate your finances and save time

FreshBooks’ automation features, like recurring invoices, expense tracking, and tax calculations, help sole traders manage their bookkeeping effortlessly. Automating data entry processes can save time, cut costs, and minimize manual data entry errors by integrating data directly from financial sources. This automation saves time and increases efficiency, reducing errors and simplifying financial management. With FreshBooks, sole traders can focus on growing their business instead of getting bogged down in paperwork.

Get paid faster with effortless invoicing

FreshBooks streamlines invoicing and payments for sole traders with automation, online payment options, and automated reminders. These features help sole traders get paid faster, reduce missed payments, and improve cash flow. Effortless invoicing makes financial management stress-free, allowing you to issue or pay invoices from any location with an internet connection, ensuring you receive payments promptly and consistently.

Stay on top of your finances in real time

FreshBooks provides sole traders with real-time updates on income, expenses, and overall financial health. Automating data entry in accounting software streamlines the process by saving time, reducing costs, and minimizing human error. Instant insights eliminate manual tracking, helping sole traders make informed financial decisions with ease. With FreshBooks, you can monitor your finances in real-time, attract new clients, and make timely adjustments to keep your business on track.

Featured In

Free vs. FreshBooks accounting software for sole traders

Free accounting software might seem like a good starting point for sole traders, but it often lacks important features. Things like invoicing, tracking expenses, and creating detailed reports might be limited. This can make it harder to manage your finances as your business grows.

FreshBooks is a better choice for sole traders. It has tools to easily track what you spend, send bills to clients, and make professional invoices automatically.

Beyond just features, FreshBooks also keeps your data safe, offers helpful customer support, and works well with other business tools. Free software often misses out on these important things.

Accounting apps & integrations for sole traders

FreshBooks integrates with 100+ apps to help you take control of your sole trader accounting and customize your FreshBooks experience.

Support that actually supports you 💙

- Help From Start to Finish: Our Support team is highly knowledgeable and never transfers you to another department.

- 4.8/5.0 Star Reviews: Yup, that’s our Support team approval rating across 120,000+ reviews

- Global Support: We’ve got over 100 Support staff working across North America and Europe

Accounting software by industry

Feeling overwhelmed by bookkeeping? FreshBooks offers industry-specific accounting software that simplifies finances and boosts efficiency, letting you focus on what truly matters. Sole proprietors, who represent a significant portion of the workforce, benefit greatly from advancements in technology and online tools that facilitate business management and enhance operational efficiency. Visit our industry pages below to learn how FreshBooks can fulfill all your accounting needs!

Trades and Home Services

Creative Professionals

Specific Professions

Specialized Industries

Online and Digital Services

Resources to support sole traders

How to Invoice as a Sole Trader: Guide and Example

Top Sole Proprietorship Advantages and Disadvantages

12 Legal Requirements for Starting a Small Business

Frequently asked questions

FreshBooks is the best accounting software for sole traders because it offers a user-friendly interface, automation features, and comprehensive tools designed to simplify financial management. It helps with invoicing, expense tracking, tax calculations, and provides real-time insights into your business’s financial health.

As a sole trader, look for accounting software with features like invoicing, expense tracking, automated tax calculations, financial reporting, and bank reconciliation. The software should also offer ease of use, mobile accessibility, and integrations with other business tools.

Yes, cloud-based sole trader accounting software is highly beneficial. It provides accessibility from anywhere, real-time data updates, automated backups, and enhanced security. Cloud-based solutions also facilitate collaboration with accountants and simplify financial management.

Yes, sole trader accounting software like FreshBooks greatly assists with financial reporting. It automates the generation of key financial reports such as profit and loss statements, balance sheets, and cash flow statements, providing sole traders with clear insights into their financial performance.

FreshBooks stands out from other options with its focus on user experience, intuitive design, and powerful automation features tailored for sole traders. Its emphasis on simplifying invoicing, expense tracking, and financial reporting makes it an ideal choice for sole proprietors seeking efficient and easy-to-use accounting software.