Generate financial reports for smart decision-making

Simplify tax preparation for your rental business

Manage multiple properties in one place

All the features you will need for your rental property accounting software

Free vs. FreshBooks accounting software for rental property

Free accounting software might seem attractive for rental property management, but it often lacks essential features like detailed financial reporting, expense categorization, and the ability to manage multiple properties efficiently. This can create difficulties as your rental business expands.

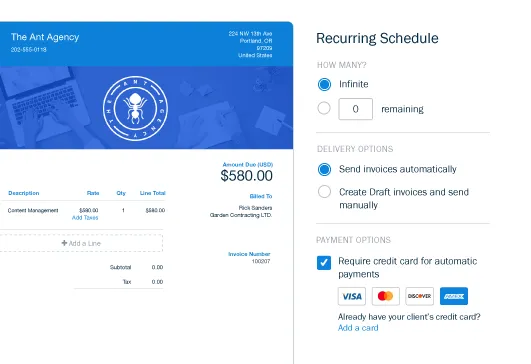

FreshBooks offers a robust solution tailored for rental property needs. It simplifies financial management by providing tools to track income and expenses, automate rent collection, and generate insightful financial reports.

Unlike free software, FreshBooks also ensures secure data storage, provides reliable customer support, and integrates smoothly with other business applications.

Support that actually supports you 💙

- Help From Start to Finish: Our Support team is highly knowledgeable and never transfers you to another department.

- 4.8/5.0 Star Reviews: Yup, that’s our Support team approval rating across 120,000+ reviews

- Global Support: We’ve got over 100 Support staff working across North America and Europe

Accounting software by industry

Feeling overwhelmed by bookkeeping? FreshBooks offers industry-specific accounting software that simplifies finances and boosts efficiency, allowing you to focus on what truly matters. Visit our industry pages below to learn how FreshBooks can fulfill all your accounting needs!

Trades and Home Services

Creative Professionals

Specific Professions

Specialized Industries

Online and Digital Services

Resources to support landlords

How Is Rental Income Taxed? Understand Rates and Deductions

10 Rental Property Tax Deductions

Top 11 Landlord Tax Deductions

Frequently asked questions

Rental property management software like FreshBooks is the best to keep track of rental properties. It offers features like income and expense tracking, automated invoicing, and financial reporting, which simplify rental property accounting.

The best accounting method for rental property is accrual accounting. This method recognizes income and expenses when they’re earned or incurred, providing a more accurate view of your property’s financial status.

Rental property accounting software should include features like income and expense tracking, automated rent collection, financial reporting, tax preparation assistance, and the ability to manage multiple properties.

Rental property accounting software helps with tax preparation by organizing financial data, tracking deductible expenses, and generating reports. This simplifies the process of filing taxes and ensures accuracy.

Yes, FreshBooks automates rent collection. It offers features like automated invoices, online payment options, and reminders to help landlords collect rent efficiently and on time.

Accounting software improves cash flow for landlords by automating invoicing and rent collection, reducing late payments, and providing real-time insights into income and expenses. This helps landlords manage their finances effectively.