Best Accounting software for photographers

Track client invoices and project payments

Using FreshBooks’ accounting software for photographers, you can easily track client invoices, project payments, and track income. This helps you stay organized and ensures you get paid on time.

Simplify expense tracking for equipment and travel

FreshBooks simplifies expense tracking, which is very helpful for photographers. You can easily track expenses for equipment and travel, keeping all your financial information in one place.

Manage project budgets and profitability

With FreshBooks, you can efficiently manage project budgets and profitability. This feature allows you to see how your projects are performing and helps you make better business decisions.

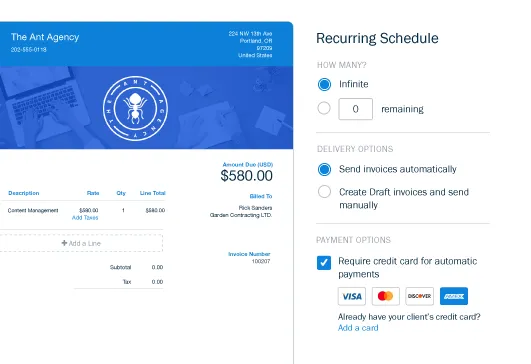

Automate invoicing and payment reminders

FreshBooks automates invoicing and payment reminders, saving you time and effort. This automation helps improve cash flow and reduces the amount of administrative work.

Generate financial reports for business insights

Generate financial reports for business insights with FreshBooks. These reports provide a clear overview of your business’s financial health, enabling you to make informed decisions.

FreshBooks Accounting Software Testimonial Videos

All the features you will need for your photography accounting software

Automate your photography business finances and save time

FreshBooks’ automation features help photographers streamline their financial operations. Features like recurring invoices for retainer clients, expense tracking for gear and travel, and automated reporting save time. This automation minimizes manual data entry, reduces errors, and lets photographers focus on capturing the perfect shot.

Faster payments with effortless client invoicing

FreshBooks simplifies invoicing and payment processing for photographers. It includes online payment options, customizable invoice templates, and automated reminders for outstanding balances. These features ensure timely payments, improve cash flow, and reduce administrative overhead.

Stay on top of your photography business finances in real time

FreshBooks provides real-time financial insights for photographers. This includes project profitability tracking, expense analysis, and revenue reporting. These insights enable photographers to make informed decisions, optimize operations, and improve profitability.

Featured In

Free vs. FreshBooks accounting software for photographers

Free accounting software might seem like a good starting point, but it often lacks essential tools that photographers need to manage their business effectively. These limitations can include difficulties in creating professional invoices, tracking expenses for equipment and travel, and generating detailed financial reports. As a photography business grows, these shortcomings can lead to inefficiencies and lost time.

FreshBooks offers a comprehensive solution tailored for photographers. It simplifies invoicing with customizable templates and automates payment reminders to ensure timely payments. FreshBooks also streamlines expense tracking, helping photographers keep a close eye on their spending on gear and travel expenses.

FreshBooks also ensures secure data storage, dedicated customer support, and seamless integration with other business applications.

Accounting apps & integrations for photography business

FreshBooks integrates with 100+ apps, helping you take control of your photography business’s accounting. This allows you to customize your FreshBooks experience to fit your specific needs.

Support that actually supports you 💙

- Help From Start to Finish: Our Support team is highly knowledgeable and never transfers you to another department.

- 4.8/5.0 Star Reviews: Yup, that’s our Support team approval rating across 120,000+ reviews

- Global Support: We’ve got over 100 Support staff working across North America and Europe

Accounting software by industry

Feeling overwhelmed by bookkeeping? FreshBooks offers industry-specific accounting software that simplifies finances and boosts efficiency, letting you focus on what truly matters. Visit our industry pages below to learn how FreshBooks can fulfill all your accounting needs!

Trades and Home Services

Creative Professionals

Specific Professions

Specialized Industries

Online and Digital Services

Resources to support photography business

Top 12 Tax Deductions for Photographers (2025)

Accounting Basics for Photography Business Owners

How to Start a Photography Business

Frequently asked questions

Accounting software for small photography businesses, like FreshBooks, helps manage finances. It simplifies tasks like invoicing, expense tracking, and financial reporting, making it easier for photographers to stay organized.

Tax write-offs for photographers reduce taxable income. Common deductions include equipment, travel expenses, and home office costs. This helps photographers lower their tax burden.

Photographers may need bookkeepers to manage financial records, track income, and expenses. Bookkeepers handle tasks like tracking income and expenses, preparing financial statements, and ensuring compliance with tax laws.

Photographers pay various taxes, including income tax, self-employment tax, and sales tax. The specific taxes depend on the business structure and location.

Categorizing photography expenses involves sorting costs into groups like equipment, travel, and marketing. This organization helps in tracking spending and preparing tax returns.

Yes, photographers can deduct mileage for business-related travel. This includes trips to client locations, meetings, and other business activities.