Best Accounting software for government

Track and manage public fund allocations with fund accounting software

FreshBooks government accounting software helps government agencies meticulously track how public funds are allocated, ensuring transparency and accountability in financial management. By using FreshBooks, agencies can improve efficiency in tracking and managing public fund allocations, enhancing their ability to adapt to evolving demands and streamline workflows.

Simplify grant management and reporting

Local government entities benefit from FreshBooks as it streamlines grant management, making it easier to monitor spending, track deadlines, and generate detailed reports for compliance.

Ensure compliance with government regulations

FreshBooks aids government agencies in adhering to financial management regulations, automating processes to reduce errors, enhance security, and maintain compliance with ever-changing standards.

Generate detailed financial audit reports

FreshBooks simplifies the creation of comprehensive financial audit reports, providing government agencies with the tools to present clear and accurate financial data.

FreshBooks Accounting Software Testimonial Videos

All the features you will need for your government accounting software

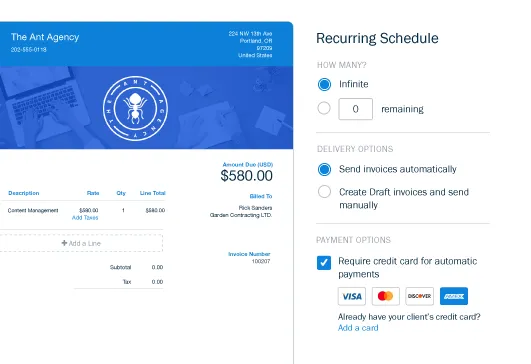

Automate government fund tracking & save time

FreshBooks automates budget tracking and expenses management, giving government entities real-time insights into their finances and helping to improve efficiency by optimizing resource allocation through automation.

Faster financial reporting with accurate fund allocation

FreshBooks’ reporting features are designed to meet the specific needs of government accounting, including detailed fund allocation, grant management, and compliance reporting. These features help to maintain transparency and accountability in financial operations and improve efficiency by enabling faster and more accurate reporting.

Gain real-time insights into public expenditure

FreshBooks provides government entities with real-time financial insights, such as budget vs. actuals, expenditure analysis, and audit trail reporting. These insights, coupled with robust security measures, enable informed financial decisions and improve public fund management.

Featured In

Free vs. FreshBooks government accounting software

While free accounting software might seem cost-effective for government entities, it often lacks essential features for managing public funds. These limitations can hinder transparency and efficiency in financial operations.

FreshBooks offers a robust alternative designed for government accounting needs. It provides tools for meticulous fund tracking, grant management, and compliance reporting, ensuring accountability. FreshBooks also offers secure data storage, helpful customer support, and smooth integrations with other business tools to streamline workflows.

With FreshBooks, government entities can efficiently manage their finances, maintain compliance, and generate accurate reports, all within a user-friendly platform.

Accounting apps & integrations for government agencies

FreshBooks integrates with 100+ apps, allowing you to take control of your government agency’s accounting and customize your FreshBooks experience.

Support that actually supports you 💙

- Help From Start to Finish: Our Support team is highly knowledgeable and never transfers you to another department.

- 4.8/5.0 Star Reviews: Yup, that’s our Support team approval rating across 120,000+ reviews

- Global Support: We’ve got over 100 Support staff working across North America and Europe

Accounting software by industry

Feeling overwhelmed by bookkeeping? FreshBooks offers industry-specific accounting software that simplifies finances and boosts efficiency, letting you focus on what truly matters. Visit our industry pages below to learn how FreshBooks can fulfill all your accounting needs!

Trades and Home Services

Creative Professionals

Specific Professions

Specialized Industries

Online and Digital Services

Resources to support government agencies

Cost Accounting Standards: They’re Policy for Government Contracts

What Is a Tax Rebate? Everything You Need to Know

Tax Incentives: A Guide to Saving Money for U.S. Small Businesses

Frequently asked questions

Government entities use various accounting systems, often including fund accounting to track resources, expenditures, and liabilities, ensuring transparency and compliance.

A government-approved accounting system adheres to specific standards and regulations, such as GAAP or GASB, ensuring accurate financial reporting and accountability.

The three types of governmental accounting are fund accounting, accrual accounting, and modified accrual accounting, each serving specific purposes in public sector financial management.

The line of accounting for the government involves detailed tracking of financial transactions to ensure proper use of funds and compliance with legal requirements.

Government accounting typically uses standards set by the Governmental Accounting Standards Board (GASB) in the U.S.

The U.S. government cost accounting system is designed to track and manage the costs associated with government programs and services.

Generally, GAAP does not fully apply to government accounting; instead, GASB standards are used for state and local governments in the U.S.