Best farm accounting software

Track crop and livestock expenses efficiently

Easily monitor all your farming expenses and utilize inventory tracking in one place with FreshBooks. Utilize comprehensive inventory management to track what you spend on crops, livestock, feed, and supplies, so you always know where your money is going.

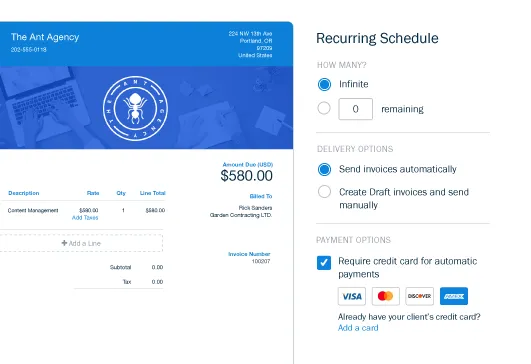

Simplify invoicing for produce and services

You can easily send invoices and create professional-looking invoices for your farm’s produce and services in seconds. Automate invoicing, set up recurring invoices, and get paid faster with online payment options.

Manage payroll and labor costs effectively

Effective farm management, including managing payroll and labor costs, is made easy with FreshBooks. Process payroll and track labor costs, including wages, benefits, and taxes, all within FreshBooks. Ensure accurate payments and simplify your payroll process.

Generate detailed financial reports for compliance

Create detailed financial reports for your farm, including profit and loss statements, balance sheets, and cash flow statements, with in-depth financial analysis to enhance profitability. Stay compliant with tax laws and make informed decisions.

Improve cash flow and farm profitability

Analyze your farm’s financial data to identify trends, evaluate your farm’s financial health, reduce expenses, and increase profitability. Effectively manage your cash flow for a healthier farm business.

FreshBooks Accounting Software Testimonial Videos

All the features you will need for your farm accounting software

Automate your farm’s finances & save time

FreshBooks automates key accounting tasks, like recurring invoices, expense tracking for crops and livestock, and tax calculations, helping you manage your farm finances effortlessly. Save time, reduce errors, and focus on growing your farm operations.

Faster payments and streamlined invoicing for farm sales

FreshBooks streamlines invoicing and payment tracking for farm sales with automated invoicing, online payment options, and sales reconciliation. Improve cash flow and reduce payment delays for your farm.

Gain real-time insights into your farm’s financial performance

FreshBooks provides real-time financial reporting, expense analysis, and profitability tracking, enabling you to make informed financial decisions for your farm. Get instant access to financial data to accurately track income, expenses, and overall farm health.

Featured In

Free vs. FreshBooks farm accounting software

Free accounting software might seem like a good starting point for farm accounting, but it often lacks important features. This can include tools for invoicing, tracking expenses for crops and livestock, managing bank reconciliation, and creating detailed reports. Without these, managing your farm’s finances can become difficult as your business grows.

FreshBooks is a strong alternative for farm accounting. It is designed to meet the specific needs of farm businesses. FreshBooks provides tools to easily track expenses, bill clients, and automatically create professional invoices.

In addition to these features, FreshBooks offers secure storage for your financial data, helpful customer support, and integrates with other business tools. These are important benefits that free software often doesn’t provide.

FreshBooks helps you efficiently manage your finances and supports the growth of your farm business, all at a reasonable cost.

Accounting apps & integrations for farm business

Integrate FreshBooks with 100+ apps to take control of your farm business’s accounting and customize your FreshBooks experience.

Support that actually supports you 💙

- Help From Start to Finish: Our Support team is highly knowledgeable and never transfers you to another department.

- 4.8/5.0 Star Reviews: Yup, that’s our Support team approval rating across 120,000+ reviews

- Global Support: We’ve got over 100 Support staff working across North America and Europe

Accounting software by industry

Feeling overwhelmed by bookkeeping? FreshBooks offers industry-specific accounting software that simplifies finances and boosts efficiency, letting you focus on what truly matters. Visit our industry pages below to learn how FreshBooks can fulfill all your accounting needs!

Trades and Home Services

Creative Professionals

Specific Professions

Specialized Industries

Online and Digital Services

Resources to support farmers

How to Start a Farm: Grow Your Farming Business from the Ground Up

Smart Tips for Owning Multiple Businesses and Making Them Profitable

7 Proven and Budget-Friendly Ideas to Improve Your Small Business

Frequently asked questions

There are two main accounting methods that farmers can use: accrual accounting and cash accounting. The accrual method recognizes revenues and expenses when they are earned or incurred, regardless of when payment is received or made. The cash method recognizes revenues and expenses when cash is received or paid out.

FreshBooks is the best accounting software for farmers because it is easy to use, even for non-accountants. It helps farmers stay organized, automate invoicing, track crop and livestock expenses, and manage payroll.

To file taxes on farm expenses, you will need to report your income and expenses on Schedule F (Form 1040), Profit or Loss From Farming. You can deduct ordinary and necessary expenses that are related to your farming business.

While it is not legally required for farms to have accountants, it can be very beneficial. Accountants can help farmers with bookkeeping, financial planning, tax preparation, and compliance.

A farm balance sheet is a financial statement that reports a farm’s assets, liabilities, and equity at a specific point in time. Assets include things like land, buildings, equipment, livestock, and crops. Liabilities include things like loans, accounts payable, and accrued expenses. Equity is the difference between assets and liabilities.